Get Application For Sales Tax Rebate Form

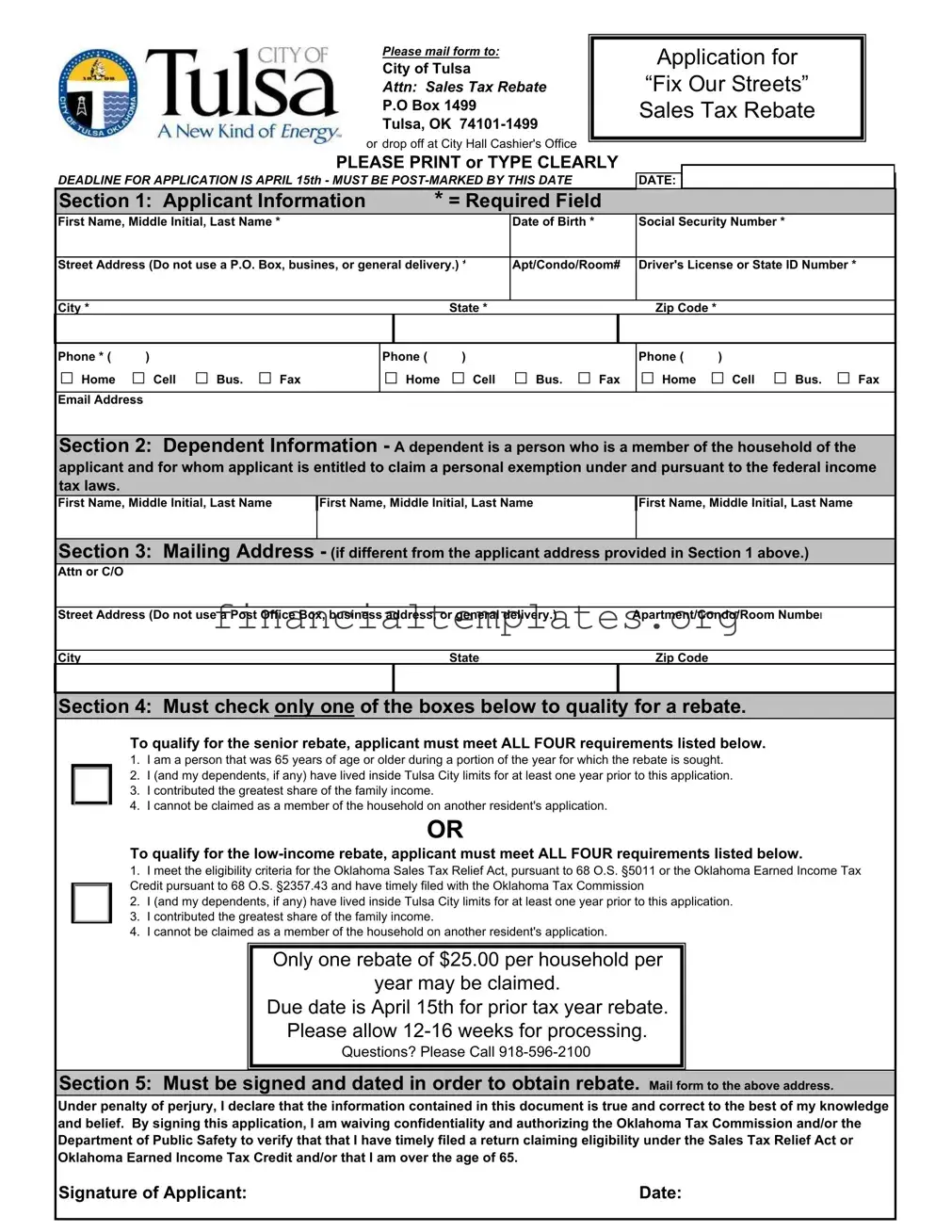

Navigating the process of applying for a sales tax rebate can often feel daunting, but understanding the Application For Sales Tax Rebate form can significantly simplify this task. Aimed primarily at residents of Tulsa, Oklahoma, this form serves as a pathway for eligible citizens to claim a modest rebate under specific conditions, tied to either age or income criteria. The document spells out clear instructions for submission, including mailing details to the City of Tulsa and an emphasis on the importance of using clear, legible handwriting or typing for the information provided. The deadline for submission, crucially set for April 15th, aligns with many federal deadlines, underscoring the need for timely action by applicants. Sections within the form guide applicants through furnishing personal details, information on dependents, and alternate mailing addresses if applicable. Further, it divides eligibility for the rebate into two distinct categories: seniors and individuals or households meeting low-income criteria, each with its own set of requirements to meet. Additionally, the form details the guideline that a single $25.00 rebate is claimable per household annually, integrating checks such as verifying eligibility through the Oklahoma Tax Commission or the Department of Public Safety. Lastly, a commitment to honesty underscores the application process, with a requisite signature under penalty of perjury to affirm the truthfulness of the information provided, culminating in a process that, while bureaucratic, offers tangible assistance to those who qualify.

Application For Sales Tax Rebate Example

PLEASE MAIL FORM TO:

City of Tulsa

ATTN: SALES TAX REBATE

P.O Box 1499

Tulsa, OK

or drop off at City Hall Cashier's Office

PLEASE PRINT or TYPE CLEARLY

DEADLINE FOR APPLICATION IS APRIL 15TH - MUST BE

Section 1: Applicant Information |

* = Required Field |

Application for

“Fix Our Streets” Sales Tax Rebate

DATE:

First Name, Middle Initial, Last Name *

Date of Birth *

Social Security Number *

Street Address (Do not use a P.O. Box, busines, or general delivery.) *

Apt/Condo/Room#

Driver's License or State ID Number *

City * |

|

|

|

State * |

|

|

Zip Code * |

|

|

|

|

|

|

|

|

|

|

|

|

Phone * ( |

) |

□ Bus. □ Fax |

Phone ( ) |

□ Bus. □ Fax |

Phone ( |

) |

□ Bus. □ Fax |

||

□ Home |

□ Cell |

□ Home □ Cell |

□ Home |

□ Cell |

|||||

Email Address

Section 2: Dependent Information - A dependent is a person who is a member of the household of the applicant and for whom applicant is entitled to claim a personal exemption under and pursuant to the federal income tax laws.

First Name, Middle Initial, Last Name |

First Name, Middle Initial, Last Name |

First Name, Middle Initial, Last Name |

Section 3: Mailing Address - (if different from the applicant address provided in Section 1 above.)

Attn or C/O

Street Address (Do not use a Post Office Box, business address, or general delivery.) |

Apartment/Condo/Room Number |

|

|

|

|

City |

State |

Zip Code |

Section 4: Must check only one of the boxes below to quality for a rebate.

□

□

To qualify for the senior rebate, applicant must meet ALL FOUR requirements listed below.

1.I am a person that was 65 years of age or older during a portion of the year for which the rebate is sought.

2.I (and my dependents, if any) have lived inside Tulsa City limits for at least one year prior to this application.

3.I contributed the greatest share of the family income.

4.I cannot be claimed as a member of the household on another resident's application.

OR

To qualify for the

1.I meet the eligibility criteria for the Oklahoma Sales Tax Relief Act, pursuant to 68 O.S. §5011 or the Oklahoma Earned Income Tax Credit pursuant to 68 O.S. §2357.43 and have timely filed with the Oklahoma Tax Commission

2.I (and my dependents, if any) have lived inside Tulsa City limits for at least one year prior to this application.

3.I contributed the greatest share of the family income.

4.I cannot be claimed as a member of the household on another resident's application.

Only one rebate of $25.00 per household per

year may be claimed.

Due date is April 15th for prior tax year rebate.

Please allow

Questions? Please Call

Section 5: Must be signed and dated in order to obtain rebate. Mail form to the above address.

Under penalty of perjury, I declare that the information contained in this document is true and correct to the best of my knowledge and belief. By signing this application, I am waiving confidentiality and authorizing the Oklahoma Tax Commission and/or the Department of Public Safety to verify that that I have timely filed a return claiming eligibility under the Sales Tax Relief Act or Oklahoma Earned Income Tax Credit and/or that I am over the age of 65.

Signature of Applicant: |

Date: |

Document Specifics

| Fact | Detail |

|---|---|

| Form Recipient | The "Application For Sales Tax Rebate" form should be mailed to the City of Tulsa or dropped off at the City Hall Cashier's Office. |

| Application Deadline | The application must be post-marked by April 15th to be considered for the rebate for the prior tax year. |

| Eligibility for Senior Rebate | Applicants must be 65 years or older, live within Tulsa city limits for at least a year, contribute the most to the household income, and not be claimed on another's application. |

| Eligibility for Low-Income Rebate | Applicants must align with the Oklahoma Sales Tax Relief Act or the Oklahoma Earned Income Tax Credit, have lived in Tulsa for a year, be the main contributor to the household income, and not be claimed on another's application. |

| Rebate Amount | Eligible households may claim one rebate of $25.00 per year. |

| Processing Time | Applicants should allow 12-16 weeks for the processing of their rebate application. |

| Contact Information | For questions regarding the application, individuals can call 918-596-2100. |

Guide to Writing Application For Sales Tax Rebate

Applying for a sales tax rebate can offer valuable savings, and the process is straightforward if you follow the steps correctly. The City of Tulsa provides an opportunity for eligible residents to claim a rebate under the "Fix Our Streets" program. Whether you're applying due to age or income level, it's essential to submit your application by the April 15 deadline to qualify for the prior tax year rebate. Here's a guide on how to complete the Application for Sales Tax Rebate form.

- Begin by downloading the form or obtaining a copy from the City of Tulsa's official website or local office.

- In Section 1: Applicant Information, ensure all fields marked with an asterisk (*) are filled out. Include your name, date of birth, social security number, and complete residential address. Note: P.O. Boxes, business, or general delivery addresses are not accepted.

- Next, provide your driver's license or state ID number, along with your city, state, and zip code. Add your phone number, indicating whether it's a business, fax, home, or cell number, and include your email address.

- In Section 2: Dependent Information, list any dependents that are part of your household and eligible under the federal income tax laws. If you have no dependents, you can skip this section.

- For Section 3: Mailing Address, only complete this section if it's different from the address you provided in Section 1. Fill in the recipient's name or attention line if necessary, along with the alternate street address, apartment or condo number, city, state, and zip code.

- In Section 4, you'll need to indicate your eligibility for the sale tax rebate by checking the appropriate box. Review the requirements carefully for either the senior rebate or the low-income rebate, and ensure you meet all the listed criteria before making your selection.

- Once all the information is filled in, proceed to Section 5 to sign and date the application. Your signature attests to the accuracy of the information provided and your compliance with the program's requirements.

- Finally, mail the completed form to the City of Tulsa at the address provided at the top of the form, ensuring it is post-marked by April 15th. You can also choose to drop it off in person at the City Hall Cashier's Office.

After submitting your application, allow 12-16 weeks for processing. If you have any questions or require further assistance, do not hesitate to contact the number provided in the form. Remember, only one rebate of $25.00 per household per year is allowed, so it's crucial to ensure your application is accurate and complete to qualify for this benefit.

Understanding Application For Sales Tax Rebate

-

What is the deadline to submit the Application for Sales Tax Rebate?

The deadline for submitting the Application for Sales Tax Rebate is April 15th. It is crucial that the application is post-marked by this date to be considered valid for the prior tax year's rebate.

-

Where should the Application for Sales Tax Rebate be sent?

The completed form should be mailed to the City of Tulsa at the following address: City of Tulsa, ATTN: SALES TAX REBATE, P.O. Box 1499, Tulsa, OK 74101-1499. Alternatively, it can be dropped off at the City Hall Cashier's Office.

-

What are the key sections that need to be completed in the application form?

The application form consists of important sections including Applicant Information, Dependent Information, and if applicable, a separate Mailing Address. Additionally, applicants must select their qualification category for the rebate and sign the form under penalty of perjury, committing to the accuracy of the information provided.

-

Who is eligible to apply for the sales tax rebate?

Eligibility for the sales tax rebate is divided into two main categories: seniors and low-income residents. Seniors must be 65 years or older, have resided within Tulsa city limits for over a year, be the primary contributor to the household income, and not be claimed on another's application. Low-income individuals must meet specific income criteria defined by Oklahoma laws, have lived in Tulsa for over a year, contribute the majority of household income, and not be claimed by another resident.

-

What is the rebate amount per household?

Eligible households can claim a rebate of $25.00 per year. It is important to note that only one rebate can be claimed per household each year.

-

How long does the processing of the rebate application take?

Applicants should allow 12-16 weeks for the processing of their sales tax rebate application. This timeframe is necessary to verify eligibility and process the rebate accordingly.

-

Can I submit the application electronically?

The instructions specify that the form should be mailed to the provided address or dropped off at the City Hall Cashier's Office. No provision for electronic submission is mentioned, so it is important to follow the provided submission guidelines.

-

If I have questions concerning the form or the rebate, whom do I contact?

For any questions regarding the Application for Sales Tax Rebate, you are encouraged to call 918-596-2100. This number can provide assistance with questions about the form, eligibility, submission deadlines, or processing times.

Common mistakes

When filling out the Application For Sales Tax Rebate form, it's critical to pay attention to detail and follow instructions precisely. Unfortunately, applicants often make mistakes that can delay processing or even result in the denial of the rebate. Below are seven common errors:

Not printing or typing clearly: It's essential that all information on the application is legible. Unclear handwriting can lead to misinterpretation of vital details, causing unnecessary delays in the processing of your application.

Using a P.O. Box or business address: The form specifically demands a physical street address for Section 1 and the mailing address in Section 3 (if different from Section 1). This mistake can lead to confusion or misdelivery of correspondence related to the application.

Failing to include all required fields, marked with an asterisk (*): These fields are crucial for the application to be considered complete. Missing information can result in an incomplete application that cannot be processed until all required information is submitted.

Applying after the deadline: The application must be post-marked by April 15th to be considered for the prior tax year's rebate. Late submissions compromise the ability to qualify for the rebate.

Incorrectly filling out dependent information: This section is imperative for those applying for the rebate with dependents. Each dependent’s full name and relationship to the applicant need to be detailed accurately.

Choosing the wrong eligibility category in Section 4 or not meeting all listed requirements: Applicants must read carefully and check the box that corresponds to their eligibility—either as a senior or based on low-income criteria. Failing to meet or incorrectly identifying eligibility can lead to denial.

Omitting signature and date in Section 5: The application process is incomplete without the applicant’s signature and date, both of which serve as an attestation to the truthfulness and accuracy of the information provided and consent for verification by authorized entities.

Avoiding these errors increases the likelihood of a successful application. Careful attention to each requirement and field will help ensure that the process is smooth and efficient. If there are questions or uncertainties about how to properly complete the form, it's advisable to seek assistance before submission to avoid common pitfalls.

Remember, the goal is to provide all necessary information in a clear, accurate, and timely manner. With correct preparation, applicants can confidently navigate the process and improve their chances of receiving the Sales Tax Rebate. It's in an applicant's best interest to thoroughly review their application for these common mistakes before mailing it to the City of Tulsa or dropping it off at the City Hall Cashier's Office.

Documents used along the form

When submitting an Application for Sales Tax Rebate, it's crucial to provide accurate and complete documentation to ensure a smooth and effective processing experience. Along with the main application, several other forms and documents often play a vital role in supporting your claim. Understanding these additional requirements can help applicants navigate the process more efficiently.

- Proof of Identity: A copy of a valid driver's license or state ID card. This verifies the applicant's identity and matches them to the information provided in the application form.

- Proof of Residence: A utility bill, lease agreement, or mortgage statement. This document should show the applicant's name and address, demonstrating residence within the relevant city limits for the required period.

- Income Documentation: Recent tax returns, W-2 forms, or pay stubs. These documents prove the applicant's income level, helping to establish eligibility for low-income rebates.

- Age Verification: A birth certificate, passport, or other official document that verifies the applicant's date of birth. This is essential for applicants applying for senior rebates.

- Dependent Documentation: For those claiming dependents, documents such as birth certificates or tax return forms showing the dependent status can be necessary for substantiating the claim.

- Oklahoma Sales Tax Relief Act Eligibility Proof: A confirmation letter or official document from the Oklahoma Tax Commission. This serves as evidence that the applicant meets the eligibility criteria as stipulated by state law.

Together, these documents support the application, helping to establish the applicant’s eligibility for a sales tax rebate. It’s important for applicants to gather and submit these documents promptly to avoid delays in processing. Keeping organized and ensuring all documentation is current and accurately reflects the applicant's situation will contribute to a straightforward application process.

Similar forms

The "Application for a Property Tax Credit" form bears a strong resemblance to the "Application for Sales Tax Rebate." Both are designed to alleviate the financial burden on eligible individuals by offering a form of financial return, in these cases, related to taxes. The property tax credit application, like the sales tax rebate form, typically requires personal information, proof of eligibility (such as age or income level), and a declaration that the information provided is accurate under penalty of perjury. These forms also have deadlines and specific mailing instructions to ensure proper processing.

Another similar document is the "Homestead Exemption Application." This form helps homeowners reduce their property taxes by excluding a portion of their home's value from taxation. Like the sales tax rebate form, it asks for personal identification, residency information, and eligibility criteria, including age or disability status. Applicants must often affirm their information's truthfulness, mirroring the sales tax rebate's perjury statement. Both forms are crucial for taxpayers seeking to lower their fiscal responsibilities lawfully and must be filed by prescribed deadlines.

The "Vehicle Registration Tax Credit Form" is akin to the sales tax rebate form in its objective of providing a tax credit, but in this case, related to vehicle registration fees. It requires the applicant's personal data, vehicle information, and a certification of truthfulness, similar to the sales tax rebate application's requirement for accurate and honest information. These forms are tailored to specific tax relief aspects but share the fundamental process of applying for a financial benefit based on eligibility criteria.

"Free Application for Federal Student Aid (FAFSA)" shares procedural similarities with the sales tax rebate form even though they cater to different needs. FAFSA is used to determine eligibility for student financial aid, requiring detailed personal and financial information from applicants. Like the sales tax rebate, there are deadlines and a necessity for accurate, honest information. Both applications play pivotal roles in providing financial relief, albeit in very different contexts: one for educational purposes and the other for tax relief.

Lastly, the "Earned Income Tax Credit (EITC) Claim Form" is quite similar to the sales tax rebate application. Both are tax-related documents that aim to return money to the filer, based on specific eligibility criteria, such as income and residency. The EITC form, like the sales tax rebate application, requires filers to provide personal information, financial details, and sometimes information on dependents. Claimants must sign under penalty of perjury, asserting the veracity of their provided information. These forms are integral to accessing financial benefits available through tax laws.

Dos and Don'ts

Applying for a sales tax rebate can seem daunting. To ensure a smooth process, here are seven essential do's and don'ts when filling out the Application For Sales Tax Rebate form.

- Do make sure to mail your completed form either to the City of Tulsa's given address or drop it off at the City Hall Cashier's Office. Timeliness and choosing the correct submission method are crucial.

- Do print or type clearly throughout the form to avoid any misunderstandings or processing delays. Clear and legible information is key to a successful application.

- Do pay special attention to deadlines. The form must be post-marked by April 15th. Missing this deadline could result in your application being disregarded.

- Do double-check that you are filling out information for all required fields, marked with an asterisk (*). Incomplete forms can lead to unnecessary delays or outright rejection of the application.

- Do not use a P.O. Box, business, or general delivery address for your street address. It's important to provide a residential address to confirm your eligibility based on your living situation.

- Do not check more than one box in section 4 regarding eligibility. You must determine whether you qualify for the senior rebate or the low-income rebate, as checking more than one can confuse the review process.

- Do not forget to sign and date the form. An unsigned form is considered invalid and will prevent the processing of your application. Your signature is also a declaration that the information provided is accurate and true.

Following these guidelines carefully will help ensure that your Application For Sales Tax Rebate is processed efficiently and effectively. Remember, this rebate can offer valuable financial relief, so taking the time to fill out the form correctly is well worth the effort.

Misconceptions

When applying for a Sales Tax Rebate, applicants encounter various misconceptions that can affect their eligibility and the application process. Understanding these common misunderstandings is vital to ensure a smooth and successful application. Here are eight misconceptions about the Application For Sales Tax Rebate form:

All residents of Tulsa are eligible for the rebate. In reality, eligibility is limited to individuals who meet specific criteria based on age or income as outlined in the form. Applicants must either qualify as a senior or meet the low-income requirements as defined by Oklahoma statutes.

The application can be sent to any address or through any means for submission. This is not correct. The form must be mailed directly to the specified address for the City of Tulsa or dropped off at the City Hall Cashier's Office to be considered valid.

Applicants can use a P.O. Box or a business address for their mailing address. The form clearly states that a street address must be provided and specifically advises against using a P.O. Box, business, or general delivery address.

Electronic signatures are accepted. The form requires a physical signature from the applicant, affirming under penalty of perjury that the information provided is true and correct. This suggests that electronic signatures may not be accepted for this particular application.

There is no deadline for the submission. There is indeed a strict deadline. Applications must be post-marked by April 15th for the prior tax year's rebate.

Dependent information is optional. If dependents are present in the household and contribute to the applicant’s eligibility for a rebate, their information is required as part of the application process to accurately assess the claim.

Multiple rebates per household per year are allowed if there are multiple qualifiers. The form clearly states that only one $25.00 rebate may be claimed per household per year, regardless of the number of individuals living at the address who may qualify individually.

Applicants will receive the rebate immediately after applying. The processing time for the rebate can take between 12-16 weeks, dispelling the misconception that the rebate will be received immediately or within a few days after submitting the application.

Understanding these key points can help in accurately completing the Application For Sales Tax Rebate and setting realistic expectations regarding eligibility, the application process, and the timeframe for receiving the rebate.

Key takeaways

When it comes to seeking a bit of financial relief, understanding the nuances of filling out tax-rebate related forms is quintessential. For those eyeing the "Application For Sales Tax Rebate," here are some nuggets of wisdom to ensure process smoothness:

Application Deadline: The punch card for submitting your application is April 15th. This date isn't just for show—your application must be post-marked by this day to qualify. So, mark your calendars and maybe set a reminder (or two).

Mailing Instructions: You have two options for submitting your application: mail it to the provided P.O. box in Tulsa or drop it off in person at the City Hall Cashier's Office. Choice is yours, but remember, timing is everything.

Clear and Legible: Whether you’re old-school and prefer handwriting or you're all about typing things out, clarity is key. Ensure your application is easy to read to avoid delays or issues with processing.

Required Fields Are Not Optional: Pay close attention to fields marked with an asterisk (*). These are not just suggestions; they are mandatory. Incomplete applications are like puzzle pieces lost in a sofa cushion—frustrating and likely to delay the whole process.

Avoid P.O. Boxes for Addresses: If your mailbox is your BFF at a post office, you’ll have to get more personal this time. Use a physical street address for both your residence and the mailing address if they differ.

Qualification Criteria: Whether aiming for the senior rebate or the low-income option, there are specific boxes you need to tick. Every single one of them. Take the time to read through and ensure you meet all four requirements listed for the category that applies to you. No shortcuts here.

One Rebate Per Household: It might be tempting to apply for more if you have multiple eligible members in your household. However, the rule of the land here is one $25.00 rebate per household, per year. Remember, sharing is caring.

The Waiting Game: Patience is a virtue, especially when waiting for your rebate. The processing time can take between 12-16 weeks, so hang tight. It's a good lesson in delayed gratification.

Lastly, don't forget to sign and date your application. It’s the equivalent of saying, "Everything I’ve stated here is true." It might seem like the final step but think of it as the seal on your promise that all the information provided is accurate to the best of your knowledge. Ready to tackle that form now? With this guide, you're more than prepared.

Popular PDF Documents

IRS W-8BEN - Payment for personal services performed in the U.S. by foreign individuals can also necessitate a W-8BEN form.

Apply for Reseller Permit - The requirement for detailed deduction descriptions on Schedule A helps prevent errors and ensures that all deductions are justifiable.

IRS 1040-ES - The 1040-ES includes calculations to help set aside the right amount for taxes quarterly.