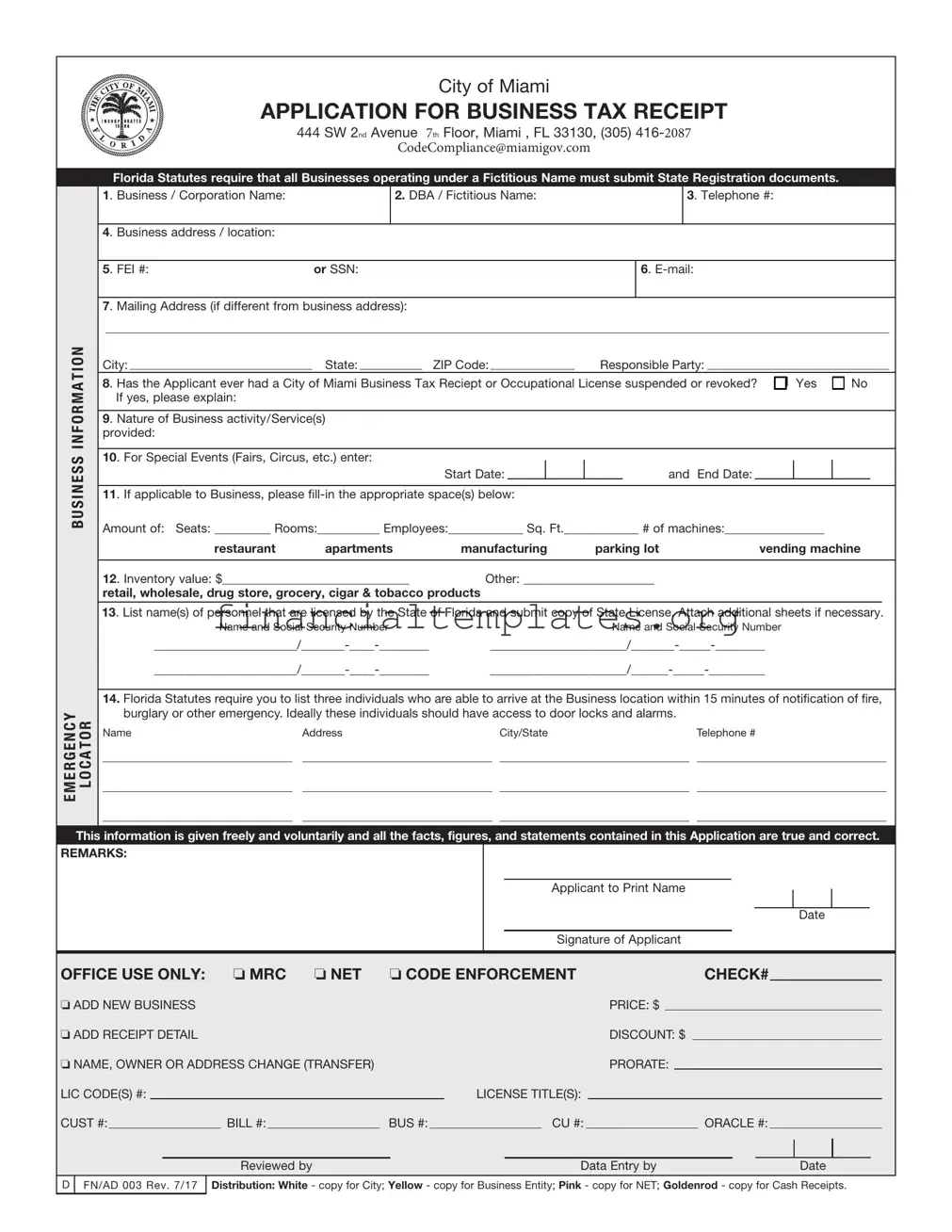

Get Application For Business Tax Receipt Form

When starting or running a business in the City of Miami, one essential step involves obtaining a Business Tax Receipt, a crucial document for legal operation within the city's jurisdiction. Housed at the conveniently located 444 SW 2nd Avenue, the Application For Business Tax Receipt form encompasses a thorough collection of business-related information necessary for compliance with local regulations and tax obligations. This form requires applicants to provide details such as the business or corporation name, any fictitious or "doing business as" (DBA) names, contact information, and the physical address of the business. It also asks for the Federal Employer Identification Number (FEI) or Social Security Number (SSN) and queries about the nature of the business, specifics regarding the size of the operation—like seating capacity or square footage—and any applicable inventory values. Additionally, compliance with Florida Statutes is underscored through the requirement of state registration documents for businesses operating under a fictitious name. Moreover, the form delves into historical compliance, querying about any previous suspensions or revocations of a City of Miami Business Tax Receipt or Occupational License, showcasing the city's dedication to maintaining a regulated and safe business environment. The provision for emergency contact individuals who can swiftly respond underscores the importance of preparedness and safety. Completing and submitting this form not only aligns with statutory requirements but also initiates the integration of the business into Miami's vibrant economic fabric, highlighting the significant step of binding entrepreneurial initiatives with regulatory frameworks and community standards.

Application For Business Tax Receipt Example

City of Miami

APPLICATION FOR BUSINESS TAX RECEIPT

444 SW 2nd Avenue 7th Floor, Miami , FL 33130, (305)

CodeCompliance@miamigov.com

B U S I N E S S I N F O R M A T I O N

E M E R G E N C Y L O C A T O R

Florida Statutes require that all Businesses operating under a Fictitious Name must submit State Registration documents.

1. Business / Corporation Name: |

|

|

2. DBA / Fictitious Name: |

|

|

|

3. Telephone #: |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. Business address / location: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. FEI #: |

or SSN: |

|

|

|

|

|

|

|

6. |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. Mailing Address (if different from business address): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

City: |

|

State: |

|

ZIP Code: |

|

|

Responsible Party: |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

No |

|||||||||||||||||||

8. Has the Applicant ever had a City of Miami Business Tax Reciept or Occupational License suspended or revoked? |

|

r |

r |

|||||||||||||||||||||

|

If yes, please explain: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. Nature of Business activity/Service(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

provided: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. For Special Events (Fairs, Circus, etc.) enter: |

Start Date: |

|

|

|

|

|

and End Date: |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. If applicable to Business, please |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Amount of: Seats: _________ Rooms:__________ Employees:____________ Sq. Ft.____________ # of machines:________________ |

||||||||||||||||||||||||

|

|

restaurant |

apartments |

manufacturing |

parking lot |

vending machine |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. Inventory value: $______________________________ |

Other: _____________________ |

|

|

|

|

|

|

|

|

|||||||||||||||

retail, wholesale, drug store, grocery, cigar & tobacco products |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

13. List name(s) of personnel that are licensed by the State of Florida and submit copy of State License. Attach additional sheets if necessary.

Name and Social Security Number |

Name and Social Security Number |

14.Florida Statutes require you to list three individuals who are able to arrive at the Business location within 15 minutes of notification of fire, burglary or other emergency. Ideally these individuals should have access to door locks and alarms.

Name |

Address |

|

City/State |

Telephone # |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This information is given freely and voluntarily and all the facts, figures, and statements contained in this Application are true and correct.

REMARKS:

Applicant to Print Name

Date

Signature of Applicant

OFFICE USE ONLY: o MRC o NET o CODE ENFORCEMENT |

|

|

|

CHECK# |

|

o ADD NEW BUSINESS |

PRICE: $ |

|

|

|

|

o ADD RECEIPT DETAIL |

DISCOUNT: $ |

|

|

||

o NAME, OWNER OR ADDRESS CHANGE (TRANSFER) |

PRORATE: |

|

|

||

LIC CODE(S) #: |

|

|

|

|

|

|

|

LICENSE TITLE(S): |

|

|

|

|

|

|

|

|

|

||||||

CUST #: |

|

|

BILL #: |

|

BUS #: |

|

|

|

CU #: |

|

ORACLE #: |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reviewed by |

|

|

|

|

|

Data Entry by |

|

|

|

|

Date |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

D |

FN/AD 003 Rev. 7/17 |

Distribution: White - copy for City; Yellow - copy for Business Entity; Pink - copy for NET; Goldenrod - copy for Cash Receipts. |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Document Specifics

| Fact Name | Description |

|---|---|

| Governing Law for Fictitious Name | Florida Statutes require businesses operating under a Fictitious Name to submit State Registration documents. |

| Emergency Locator Requirement | Applicants must list three individuals who can arrive at the business location within 15 minutes of notification for emergencies, such as fire or burglary. |

| Previous License Suspension or Revocation Inquiry | The form asks whether the applicant has ever had a City of Miami Business Tax Receipt or Occupational License suspended or revoked, indicating the city's interest in the applicant's compliance history. |

| Licensed Personnel Documentation | Businesses are required to list names and social security numbers of personnel licensed by the State of Florida, showing the importance of state licensure in certain professions. |

Guide to Writing Application For Business Tax Receipt

Filling out the Application for Business Tax Receipt is a crucial step for any business planning to operate within the City of Miami. This process is not only a legal requirement but also a way to ensure your business is acknowledged and registered under the city's regulations. Completing this form accurately is fundamental to avoid any delays or issues in getting your business up and running. Here’s how you can fill out the form:

- Start by entering the official Business/Corporation Name and, if applicable, the DBA/Fictitious Name under which the business operates.

- Provide the Telephone # and the Business address/location where your business is physically situated.

- Fill in the FEI # or your SSN (Social Security Number), depending on the structure of your business.

- Include a valid E-mail address for business communications.

- If the mailing address differs from the business location, specify this in the Mailing Address section along with City, State, and ZIP Code.

- Answer whether the applicant has ever had a City of Miami Business Tax Receipt or Occupational License suspended or revoked. If yes, provide an explanation.

- Describe the nature of the business activity/service(s) provided.

- For businesses related to special events like fairs or circuses, enter the Start Date and End Date.

- Specify if applicable the number of Seats, Rooms, Employees, Sq. Ft., and number of machines. Also, mention the Inventory value and any other relevant details.

- List the name(s) of personnel who are licensed by the State of Florida, including their Social Security Numbers, and attach a copy of their State License. Use additional sheets if necessary.

- Identify three individuals who can reach the business location within 15 minutes in case of an emergency, providing their Name, Address, City/State, and Telephone #.

- Read the declaration carefully, then print your name, sign the application, and include the date.

After completing the form, double-check all provided information for accuracy. Any misrepresentation can lead to legal complications and delays. Once you’re satisfied, submit the form to the address indicated, along with any required fees and additional documents. Your application will then be processed by the city officials, and you will be contacted regarding the status of your application. Being thorough and precise in your application can significantly streamline the process, bringing you one step closer to legally operating your business in the City of Miami.

Understanding Application For Business Tax Receipt

Frequently Asked Questions About the Application for Business Tax Receipt

- What is a Business Tax Receipt?

A Business Tax Receipt, previously known as the Occupational License, is a certification that is required for the legal operation of businesses within certain jurisdictions. This document is evidence that your business has complied with local regulations and is authorized to offer goods or services within the city limits.

- Is it mandatory to submit State Registration documents for a fictitious name?

Yes, for businesses operating under a fictitious name, Florida Statutes mandate the submission of State Registration documents. A fictitious name, commonly known as a "Doing Business As" (DBA), requires formal registration for the purpose of consumer protection and business transparency.

- Can I apply if my previous Business Tax Receipt was suspended or revoked?

Applicants with a history of suspension or revocation of a City of Miami Business Tax Receipt may still apply. However, it is crucial to provide a detailed explanation regarding the circumstances of the suspension or revocation as part of the application process.

- What information is required regarding the nature of my business?

It is important to clearly articulate the nature of the business activity or services provided. This includes describing the primary operations of your business, the type of goods or services offered, and any special events your business may host, along with their relevant dates.

- How do I determine the amount of inventory value to list?

The inventory value should reflect the current wholesale value of all merchandise or goods intended for sale. This information assists in evaluating the scale of your business for tax and regulatory purposes.

- Do I need to list personnel licensed by the State of Florida?

If your business operation includes personnel that are licensed by the State of Florida, such as professionals in healthcare, real estate, or any other regulated field, their names and corresponding social security numbers must be submitted. This is essential for regulatory compliance verification.

- Who should be listed as emergency contacts?

The individuals listed as emergency contacts should be capable of responding and arriving at the business location within 15 minutes of notification in the event of a fire, burglary, or other emergency situations. Ideally, these individuals should have access to the premises, including door locks and alarms.

- What is the process after submitting the application?

Upon submission, your application will undergo a review for completeness and compliance with local regulations. If approved, the Business Tax Receipt will be issued, which must be prominently displayed at your place of business. The review process also includes checks for zoning, safety, and other local compliance requirements.

- How do I calculate the fees involved?

The fee structure for Business Tax Receipts may vary based on the nature and size of the business. Specifics about fees, potential discounts, and proration can be addressed through direct communication with the City's Code Compliance office or by visiting the office in person. Fees are crucial for processing the application and maintaining the regulatory framework that supports safe and compliant business operations within the city.

Common mistakes

Not providing Fictitious Name Registration: Florida Statutes mandate the submission of State Registration documents for businesses operating under a fictitious name. A common oversight is failing to attach these crucial documents, leading to unnecessary delays in processing the application.

Incorrect or incomplete business information: Details such as the Business/Corporation Name, DBA/Fictitious Name, and contact information must be precisely and fully filled out. This includes accurate addresses, phone numbers, and email details. Misinformation or missing details can lead to confusion and further inquiries, slowing down the approval process.

Omitting details about past suspensions or revocations of a City of Miami Business Tax Receipt or Occupational License: Question 8 specifically inquires about such historical events. Failing to transparently report these can raise concerns during the review of your application, potentially causing delays or refusals.

Inadequate information on business activity/service provided: The nature of the business activity or services offered must be clearly described in the application. Generic or vague descriptions may not satisfy the requirements of the City of Miami, necessitating further clarification and leading to a holdup in the processing of your application.

Documents used along the form

When submitting an Application for Business Tax Receipt, there are several important documents and forms that often need to be included or considered to ensure the application process is complete and compliant with local regulations. These documents serve various purposes, including verifying the identity and qualifications of the business owners, ensuring compliance with zoning laws, and proving financial responsibility.

- Fictitious Name Registration: This document is required for businesses operating under a name different from their legal name. It verifies that the fictitious name has been registered with the state.

- Articles of Incorporation/Organization: For corporations or LLCs, this document establishes the legal existence of the business within the state and outlines its structure and purpose.

- EIN Confirmation Letter (IRS Form SS-4): The Employer Identification Number (EIN) is necessary for tax purposes. This letter from the IRS confirms the business's EIN and is often required to open a business bank account.

- Occupational License/Professional License: Certain businesses and professions must have state or local licenses to operate legally. These licenses demonstrate compliance with industry standards and regulations.

- Zoning Verification Letter: This confirms that the location of the business complies with local zoning laws, which dictate where certain types of businesses can operate.

- Lease Agreement or Proof of Property Ownership: This provides evidence of a lawful place of business, whether through a lease where the business operates or proof of ownership if the business location is owned by the applicant.

- Fire Department Inspection Certificate: Some localities require businesses to pass a fire inspection to ensure compliance with fire safety regulations before opening to the public.

- Environmental Health Inspection Approval: Restaurants, food trucks, and certain other types of businesses may need to show they have passed an inspection by the local health department, focusing on cleanliness and safe food handling practices.

In addition to the Application for a Business Tax Receipt, these documents collectively support a business's eligibility and readiness to operate within a given locale. Each document serves a unique and crucial role in laying the groundwork for a business's compliance, legal structure, and operational readiness. Ensuring all pertinent documentation is in order and submitted along with the business tax receipt application can help expedite the review process and contribute to a smoother start for the business entity.

Similar forms

The "Articles of Incorporation" document shares similarities with the Application For Business Tax Receipt form. Both require detailed information about the business, such as the business name, type, and location. Just like the tax receipt application necessitates disclosure of a DBA (Doing Business As) or fictitious name, the Articles of Incorporation often require the legal name under which the corporation will operate. Furthermore, both documents serve as formal registrations - one for tax purposes and the other for legal recognition of a corporation.

The "Employer Identification Number (EIN) Application" is another document that bears resemblance to the Application For Business Tax Receipt form. Both applications require the business's name, address, and the responsible party’s identification, either through a Social Security Number or a Federal Employer Identification Number. These forms are critical for tax-related identification, with the EIN application being necessary for federal tax reporting and the business tax receipt application for local tax obligations.

Similar to the Application For Business Tax Receipt, the "Sales Tax Permit Application" gathers detailed business information, including business name, location, and the nature of the business activity or service provided. Both are required for businesses to legally operate within their respective scopes - one allowing for the collection of sales tax and the other for the operation of a business within a specific locality.

The "Zoning Permit Application" is akin to the Application For Business Tax Receipt form as it also demands details about the business location and the nature of its activities. Both documents are crucial in ensuring that the business operations comply with local regulations. While the zoning permit focuses on the appropriateness of the business activity in a specific area, the business tax receipt is more concerned with the financial aspect of operating within the city.

"Professional License Applications" share common ground with the Application For Business Tax Receipt through their requirement for detailed information about the individuals involved in the business, often including licensure by the state. Both types of documents verify the qualifications and legitimacy of the business and its personnel to operate within a regulated industry.

The "Food Establishment Permit Application" similarly requires information about the business’s operation specifics, such as seating capacity or square footage, akin to details asked in the Application For Business Tax Receipt form. Both ensure public safety and compliance with health regulations for businesses that prepare and sell food, in addition to managing tax compliance.

"Building Permit Applications" and the Application For Business Tax Receipt form both necessitate specific details about the business premises, including measurements and usage. These applications are integral in ensuring that the business facility meets the local codes and zoning requirements for safety and compliance, aside from tax obligations.

The "Occupational License Application" closely mirrors the Application For Business Tax Receipt in purpose and content. The focus of both forms is to legalize the operation of a business within a specific jurisdiction, requiring similar information such as business name, address, and the nature of the business activity. Both serve as a form of registration with local government entities.

The "Trademark Registration Application" also aligns with aspects of the Application For Business Tax Receipt. While the trademark application is focused on the protection of a business’s brand identity, including names and logos, it does require detailed business information similar to the tax receipt application. This includes the name and location of the business, ensuring that the business identity is legally recognized.

Lastly, the "Vendor License Application" resembles the Application For Business Tax Receipt as both detail the need for specific business information, including the number of vending machines or applicable inventory value. Both forms are essential for businesses that wish to sell goods or services, requiring approval from local authorities to ensure compliance with local business operation standards and tax regulations.

Dos and Don'ts

Filling out the Application For Business Tax Receipt form is an essential step in legitimizing your business in the City of Miami. Proper completion of this document is crucial for ensuring your business operates within the legal framework established by municipal regulations. Below are lists of do's and don'ts to guide you through the process.

Do:- Provide accurate and complete information: Ensure that all details about your business including the official name, DBA (Doing Business As)/Fictitious Name, contact information, and business location are fully and correctly provided.

- Comply with statutory requirements: If your business operates under a Fictitious Name, remember to attach the State Registration documents as required by Florida Statutes. Failure to do so could delay the processing of your application.

- Detail your business activity: Clearly describe the nature of your business activity or services provided. This information helps in classifying your business under the correct tax category.

- Provide a list of licensed professionals: If your business involves professions regulated by the State of Florida, include a complete list of such personnel along with copies of their State Licenses.

- Prepare for emergencies: List three individuals who can be at the business location within 15 minutes in case of emergencies like fire or burglary, as stipulated.

- Sign and date your application: Your signature validates the application, confirming that all provided information is true and correct to the best of your knowledge.

- Omit emergency contact information: Neglecting to provide emergency locators could not only delay your application but also puts your business at a disadvantage during critical situations.

- Provide false information: Knowingly submitting incorrect or misleading information could result in penalties, including the possible denial of your business tax receipt.

- Ignore the need for additional sheets: If the space provided is insufficient, especially when listing licensed personnel or explaining previous license suspensions/revocations, attach additional sheets as necessary.

- Forget to include the payment: The application process includes a fee. Make sure to include your payment to avoid unnecessary delays.

- Assume no follow-up is required: After submitting your application, stay proactive in checking its status. Sometimes, additional information or clarification may be needed.

- Overlook the details for special events: If your business tax receipt is for special events like fairs or circuses, ensure that you clearly specify the start and end dates.

By adhering to these guidelines, you can streamline the process of obtaining a Business Tax Receipt, thereby facilitating a smoother launch or continuation of your business operations within the City of Miami.

Misconceptions

There are several common misconceptions surrounding the Application for Business Tax Receipt form required by cities, such as the City of Miami. Understanding these misconceptions can help business owners navigate the application process more smoothly.

- Misconception 1: All businesses know they need to apply for a Business Tax Receipt. Many business owners, especially those new to entrepreneurship, may not realize that operating any form of business typically requires a Business Tax Receipt. This document is crucial for legal operation.

- Misconception 2: The process is the same in every city. Each city, including Miami, has its own set of requirements and processes for obtaining a Business Tax Receipt. Applicants should always check with local city halls or official city websites for the most accurate and up-to-date information.

- Misconception 3: You only need to submit basic business information. The application for a Business Tax Receipt often requires detailed information beyond just the basic business name and address, including emergency contacts, the nature of the business, and specific licensing details for legally regulated professions.

- Misconception 4: Submitting the application ensures immediate approval. Once submitted, an application must undergo a review process. This might involve inspections or additional documentation, especially for businesses that have public safety implications.

- Misconception 5: Payment is the same for all businesses. The fee structure for a Business Tax Receipt can vary significantly depending on the type of business, location, and even the size of the establishment, such as the number of seats in a restaurant or rooms in a hotel.

- Misconception 6: Once obtained, no further action is required. A Business Tax Receipt often needs to be renewed annually, and businesses may need to update their information if there are any significant changes, such as a change in ownership or business address.

Addressing these misconceptions can help ensure that business owners fully understand the importance and requirements of obtaining a Business Tax Receipt, promoting smoother legal operations and compliance with city regulations.

Key takeaways

When completing the Application For Business Tax Receipt, it is crucial to provide accurate and comprehensive information to ensure compliance with local regulations. The following key takeaways can help applicants navigate the process more efficiently:

- The application must include the official Business/Corporation Name and, if applicable, the Doing Business As (DBA)/Fictitious Name. Remember, operating under a fictitious name requires submitting State Registration documents.

- Contact information is essential. Include a current telephone number, email address, and both the business and mailing addresses if they differ.

- Provide the Federal Employer Identification Number (FEI#) or Social Security Number (SSN) as a form of identification for the business or individual running the business.

- Disclose whether there has been a previous suspension or revocation of a Business Tax Receipt or Occupational License by the City of Miami. An explanation is required if the answer is yes.

- Clearly define the nature of the business activity or services provided. This information helps determine the appropriate tax category and rate for the business.

- For businesses involved in special events, entering the start and end dates of these events is necessary.

- Depending on the nature of the business, it may be required to report operational specifics such as the amount of seats, rooms, employees, square footage, or number of machines.

- The application requires listing inventory value and any other relevant business specifics, like type of business operation, to ensure accurate assessment and taxation.

- Include the names and social security numbers of personnel licensed by the State of Florida, if applicable, ensuring compliance with state regulations.

- Identify three individuals who can arrive at the business location within 15 minutes in case of an emergency, demonstrating preparedness for unforeseen events.

Submitters are reminded to attest that all provided information is true and correct, and must sign and date the application to validate its accuracy. It's advised to keep copies of the application and all associated documentation for future reference.

Popular PDF Documents

IRS 1120-S - The form plays a crucial role in the transparent reporting of an S corporation's financial standings to the IRS and shareholders.

Iowa Tax - The Iowa fuel tax credit, applicable to specific uses of fuel, can be claimed on the IA 1040 form.