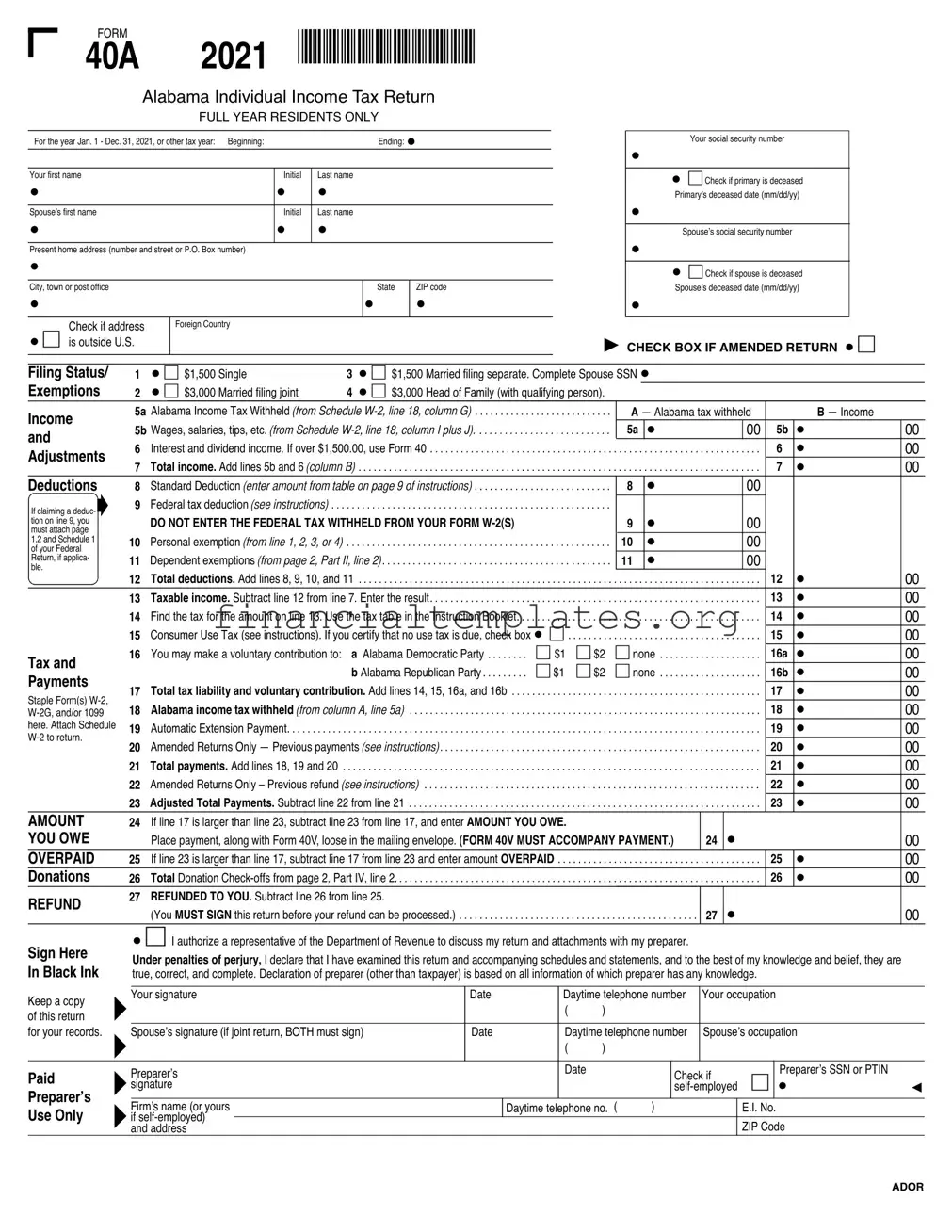

Get Alabama State Tax Return 40A Form

The Alabama State Tax Return 40A form is specially designed for full-year residents to file their individual income tax. This detailed form encompasses various sections that cater to different taxpayer needs, ranging from personal information, filing status options, and income specifics to deductions, tax, and payment computations. It requires declarants to provide their basic details such as names, social security numbers, and addresses. Filing status choices help determine the tax calculation method, while the income section breaks down earnings from wages, salaries, and other sources like interest and dividends. The deductions part guides taxpayers in reducing taxable income through the standard deduction or specific eligible deductions, which ultimately affects the tax liability calculated. Additionally, the form offers options for voluntary contributions to various funds, illustrates how to report Alabama income tax withheld, and clarifies the steps for individuals expecting a refund or those owing additional taxes. With spaces for personal and dependent exemptions, along with guidelines for attaching necessary documentation, the form ensures thorough tax processing. Finally, the Alabama State Tax Return 40A form concludes with a section for declaring total deductions, computing taxable income, and determining the tax due or refundable, highlighting its comprehensive nature in managing state tax obligations for residents.

Alabama State Tax Return 40A Example

FORM |

|

*2100014A* |

40A |

2021 |

ALABAMA INDIVIDUAL INCOME TAX RETURN

FULL YEAR RESIDENTS ONLY

For the year Jan. 1 - Dec. 31, 2021, or other tax year: Beginning: |

|

Ending: |

|

|

Your first name |

|

Initial |

Last name |

|

Spouse’s first name |

|

Initial |

Last name |

|

Present home address (number and street or P.O. Box number) |

|

|

|

|

City, town or post office |

|

|

State |

ZIP code |

Check if address |

Foreign Country |

|

|

|

6 is outside U.S. |

|

|

|

|

Your social security number

6Check if primary is deceased Primary’s deceased date (mm/dd/yy)

Spouse’s social security number

6Check if spouse is deceased Spouse’s deceased date (mm/dd/yy)

V CHECK BOX IF AMENDED RETURN 6

1 |

6 |

$1,500 Single |

3 |

6 |

$1,500 Married filing separate. Complete Spouse SSN |

|

|

|

|||||

2 |

6 |

$3,000 Married filing joint |

4 |

6 |

$3,000 Head of Family (with qualifying person). |

|

|

|

|

||||

5a Alabama Income Tax Withheld (from Schedule |

. . . |

. . . . . |

. . . |

. . . . |

A — Alabama tax withheld |

|

B — Income |

||||||

5b Wages, salaries, tips, etc. (from Schedule |

. . . |

. . . . . |

. . . |

. . . . |

5a |

00 |

5b |

00 |

|||||

6 |

Interest and dividend income. If over $1,500.00, use Form 40 |

. . . |

. . . . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

6 |

00 |

||||

7 |

Total income. Add lines 5b and 6 (column B) . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

7 |

00 |

||

8 |

Standard Deduction (enter amount from table on page 9 of instructions) |

. . . |

. . . . . |

. . . |

. . . . |

8 |

00 |

|

|

||||

9 |

Federal tax deduction (see instructions) . . . |

. . . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . . . |

. . . |

. . . . |

|

|

|

|

|

|

DO NOT ENTER THE FEDERAL TAX WITHHELD FROM YOUR FORM |

|

|

|

|

9 |

00 |

|

|

||||

10 |

Personal exemption (from line 1, 2, 3, or 4) |

. . . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . . . |

. . . |

. . . . |

10 |

00 |

|

|

|

11 |

Dependent exemptions (from page 2, Part II, line 2). |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . . . |

. . . |

. . . . |

11 |

00 |

|

|

|||

12 |

Total deductions. Add lines 8, 9, 10, and 11 . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

12 |

00 |

||

13 |

Taxable income. Subtract line 12 from line 7. Enter the result |

. . . |

. . . . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

13 |

00 |

||||

14 |

Find the tax for the amount on line 13. Use the tax table in the Instruction Booklet. . . . |

. . . |

. . . . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

14 |

00 |

||||

15 |

Consumer Use Tax (see instructions). If you certify that no use tax is due, check box |

6 . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

15 |

00 |

|||||

16 |

You may make a voluntary contribution to: |

a Alabama Democratic Party |

6 |

$1 |

6 |

$2 |

6 none |

. . . |

16a |

00 |

|||

|

|

|

b Alabama Republican Party |

6 |

$1 |

6 |

$2 |

6 none |

. . . |

16b |

00 |

||

17 |

Total tax liability and voluntary contribution. Add lines 14, 15, 16a, and 16b |

. . . |

. . . . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

17 |

00 |

||||

18 |

Alabama income tax withheld (from column A, line 5a) |

. . . |

. . . . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

18 |

00 |

||||

19 |

Automatic Extension Payment |

. . . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

19 |

00 |

|

20 |

Amended Returns Only — Previous payments (see instructions) |

. . . |

. . . . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

20 |

00 |

||||

21 |

Total payments. Add lines 18, 19 and 20 . |

. . . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

. . . . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

21 |

00 |

|

22 |

Amended Returns Only – Previous refund (see instructions) |

. . . |

. . . . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

22 |

00 |

||||

23 |

Adjusted Total Payments. Subtract line 22 from line 21 |

. . . |

. . . . . |

. . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . |

23 |

00 |

||||

24If line 17 is larger than line 23, subtract line 23 from line 17, and enter AMOUNT YOU OWE.

|

Place payment, along with Form 40V, loose in the mailing envelope. (FORM 40V MUST ACCOMPANY PAYMENT.) |

24 |

|

00 |

25 |

If line 23 is larger than line 17, subtract line 17 from line 23 and enter amount OVERPAID |

. . . . . . . . . . . |

25 |

00 |

26 |

Total Donation |

. . . . . . . . . . . |

26 |

00 |

27 |

REFUNDED TO YOU. Subtract line 26 from line 25. |

|

|

|

|

(You MUST SIGN this return before your refund can be processed.) |

27 |

|

00 |

6I authorize a representative of the Department of Revenue to discuss my return and attachments with my preparer.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Your signature |

Date |

Daytime telephone number |

Your occupation |

|

|||

v |

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s signature (if joint return, BOTH must sign) |

Date |

Daytime telephone number |

Spouse’s occupation |

|

|||

v |

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Preparer’s |

|

Date |

|

Check if |

Preparer’s SSN or PTIN |

|

|

|

|

|

|

|

|||

v signature |

|

|

|

6 |

C |

||

Firm’s name (or yours |

|

Daytime telephone no. ( |

) |

|

E.I. No. |

|

|

v if |

|

|

|

|

|

ZIP Code |

|

and address |

|

|

|

|

|

|

|

ADOR

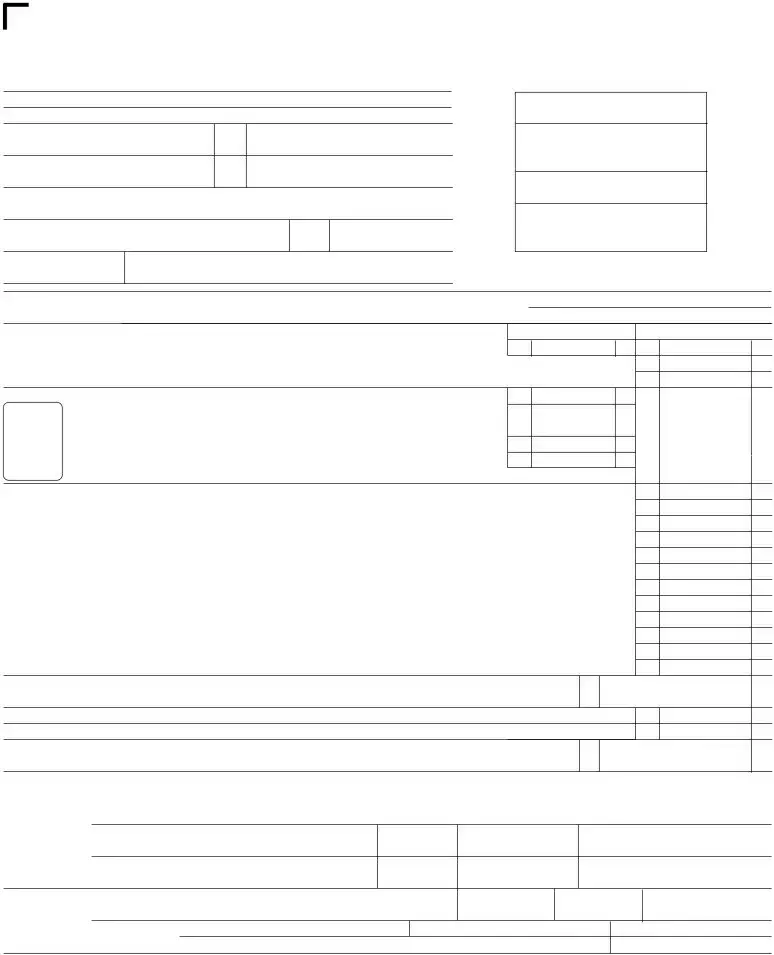

*2100024A*

Form 40A (2021) |

|

|

|

|

Page 2 |

||

|

|

|

|

|

6 Yes |

6 No |

|

PART I |

1 |

Were you (and your spouse, if married filing jointly) a resident of Alabama for the entire year 2021? |

. . . . . . . . . |

. . . . |

|||

|

|

If you checked no, DO NOT COMPLETE THIS FORM. See “Which Form To File” on page 5 of instructions. |

|

|

|

|

|

|

2 |

Did you file an Alabama income tax return for the year 2020? |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . |

. . . . |

6 Yes |

6 No |

|

|

If you checked no, state the reason for not filing. |

|

|

|

|

|

|

3 |

Give name and address of your present employer: |

|

|

|

|

|

General |

|

Yourself |

|

|

|

|

|

|

Your Spouse |

|

|

|

|

|

|

Information |

|

|

|

|

|

|

|

4 |

Your occupation |

Spouse’s occupation |

|

|

|

|

|

|

|

|

|

|

|||

All Taxpayers |

5 |

Enter the Federal Adjusted Gross Income $ |

and Federal Taxable Income $ |

as reported on your |

|

||

Must Complete |

|

2021 Federal Individual Income Tax Return. |

|

|

|

|

|

This Section |

6 |

Do you have income which is reported on your Federal return, but not reported on your Alabama return?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 Yes |

6 No |

|

|||

|

|

If yes, enter source(s) and amount(s) below (other than state income tax refund): |

|

|

|

|

|

|

|

Source |

|

Amount |

$ |

|

|

|

|

Source |

|

Amount |

$ |

|

|

|

|

Source |

|

Amount |

$ |

|

|

PART II

Dependents

Do not include yourself or your spouse

1a |

Dependents: |

|

(2) Dependent’s social security |

(3) Dependent’s |

(4) Did you provide |

|

more than |

||||

(1) First name |

Last name |

number. |

relationship to you. |

||

|

|

|

|

|

dependent's support? |

b Total number of dependents claimed above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2Amount allowed. (Multiply the total number of dependents claimed on line 1b by the amount from the dependent chart below.) Use the following chart to determine the

(See page 10)

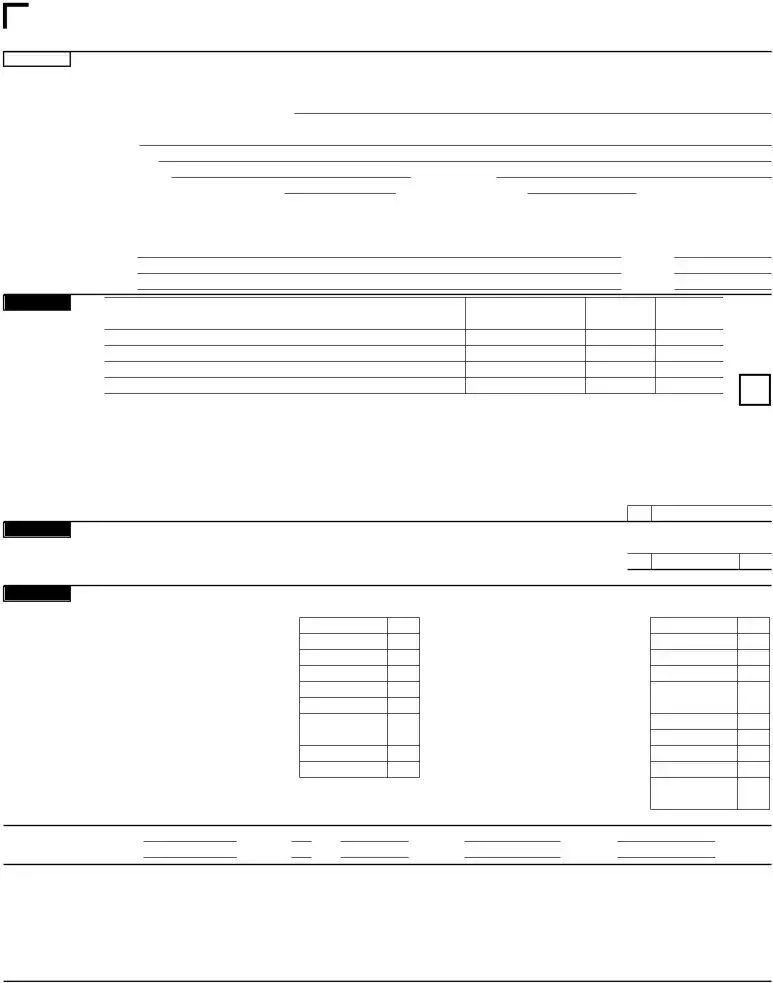

PART III

Federal

Tax Liability

Deduction

PART IV

Donation

Amount on Line 7, Page 1 |

Dependent Exemption |

||

0 |

– 20,000 |

|

1,000 |

20,001 |

– 100,000 |

|

500 |

Over 100,000 |

|

300 |

|

Enter amount here and on page 1, line 11 . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 |

||

1 Enter the Federal Income Tax Liability from worksheet (see instructions) here and on line 9, page 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  1

1

1You may donate all or part of your overpayment. (Enter the amount in the appropriate boxes.)

a |

Senior Services Trust Fund |

1a |

00 |

j Alabama Firefighters Annuity and Benefit Fund |

b Alabama Arts Development Fund |

1b |

00 |

k Alabama Breast & Cervical Cancer Program |

|

c Alabama Nongame Wildlife Fund |

1c |

00 |

l Victims of Violence Assistance |

|

d Child Abuse Trust Fund |

1d |

00 |

m Alabama Military Support Foundation |

|

e |

Alabama Veterans Program |

1e |

00 |

n Alabama Veterinary Medical Foundation |

f Alabama State Historic Preservation Fund |

1f |

00 |

||

g Alabama State Veterans Cemetery at |

|

|

o Cancer Research Institute |

|

|

Spanish Fort Foundation, Incorporated |

1g |

00 |

p Alabama Association of Rescue Squads |

h |

Foster Care Trust Fund |

1h |

00 |

q USS Battleship Commission |

i |

Mental Health |

1i |

00 |

r Children First Trust Fund |

00

00

00

1j |

00 |

1k |

00 |

1l |

00 |

1m |

00 |

1n |

00 |

1o |

00 |

1p |

00 |

1q |

00 |

1r |

00 |

2 Total Donations. Add lines 1a, b, c, d, e, f, g, h, i, j, k, l, m, n, o, p, q, and r. Enter here and on page 1, line 26 |

2 |

00 |

Drivers License Info

DOB |

|

|

Iss date |

Exp date |

(mm/dd/yyyy) |

Your state |

DL# |

(mm/dd/yyyy) |

(mm/dd/yyyy) |

DOB |

|

|

Iss date |

Exp date |

(mm/dd/yyyy) |

Spouse state |

DL# |

(mm/dd/yyyy) |

(mm/dd/yyyy) |

WHERE TO

FILE

FORM 40A

If you are receiving a refund, Form 40A, line 27, mail your return to: Alabama Department of Revenue, P.O. Box 154, Montgomery, AL

If you are not receiving a refund or making a payment, mail your return to: Alabama Department of Revenue, P.O. Box 327469, Montgomery, AL

Mail only your 2021 Form 40A to one of the above addresses. Prior year returns, amended returns, and all other correspondence should be mailed to Alabama Department of Revenue, P.O. Box 327464, Montgomery, AL

ADOR

Document Specifics

| Fact | Detail |

|---|---|

| Form Title | 2004 Form 40A Alabama Individual Income Tax Return |

| Eligibility | Full-year residents only |

| Filing Status Options | Single, Married filing jointly, Married filing separate return, Head of family |

| Income Reporting | Includes wages, salaries, tips, interest, and dividend income |

| Deductions and Exemptions | Standard deduction, federal tax liability, personal and dependent exemptions |

| Voluntary Contributions | Options to contribute to the Alabama Democratic Party, Alabama Republican Party, and others |

Guide to Writing Alabama State Tax Return 40A

Filing the Alabama State Tax Return Form 40A is a critical process for ensuring compliance with state tax obligations. This document is specifically designed for full-year residents of Alabama. The instructions outlined below are crafted to guide taxpayers through the step-by-step process of accurately completing the Form 40A. Following these instructions will help taxpayers avoid common mistakes and ensure their tax return is processed smoothly.

- Start by entering your first name, initial, and, if applicable, your spouse's first name and initial in the designated area.

- Fill in your last name and your present home address, including the number and street or P.O. Box number.

- Provide the city, town, or post office, state, and ZIP code associated with your home address.

- Enter your social security number and, if filing jointly, your spouse's social security number in the allocated fields.

- Select your filing status by checking the appropriate box for single, married filing jointly, married filing separately, or head of family.

- If applicable, complete line 5 with your spouse’s name and social security number.

- List wages, salaries, tips, etc., separately for each employer, including the address and the amount of Alabama tax withheld.

- Report interest and dividend income on line 7. Note: If over $1,500.00, Form 40 is required.

- Calculate your total income by adding lines 6a through 6d and 7, then enter the sum on line 8.

- Enter your standard deduction on line 9 after completing Part III.

- Fill in your federal tax liability on line 10 as directed, ensuring not to enter the federal tax withheld from your Form W-2(s).

- Apply personal and dependent exemptions as appropriate on lines 11 and 12.

- Add lines 9, 10, 11, and 12 to find your total deductions and enter this amount on line 13.

- Subtract line 13 from line 8 to determine your taxable income and record the result on line 14.

- Using the tax table in the instruction booklet, find the tax for the amount on line 14 and enter it on line 15.

- Complete the Consumer Use Tax worksheet on page 9 and enter the result on line 16.

- If you choose to, make a voluntary contribution to the Alabama Democratic Party, Alabama Republican Party, or Neighbors Helping Neighbors and enter the amounts on lines 17a, 17b, and 17c respectively.

- Add lines 15, 16, 17a, 17b, and 17c to find your total tax liability and voluntary contribution, then enter this amount on line 18.

- Sum your Alabama income tax withheld from lines 6a through 6d, column A, and enter on line 19.

- Determine if you owe an additional amount or have overpaid, and fill lines 20 and 21 accordingly.

- If overpaid, decide whether to donate any portion of your refund to the options provided and enter the amounts on line 22.

- Add lines 22a through k to find the total donation amount and enter on line 23.

- Calculate your refund by subtracting line 23 from line 21, enter the amount on line 24.

- Sign and date the return, ensuring both you and your spouse sign if you're filing jointly. Also, include the date and your daytime telephone number.

Before mailing, double-check your return for accuracy, attach all required documents such as W-2s, and verify that your social security number is correct. Remember, filing an accurate and complete return facilitates a smoother and faster processing of your refund.

Understanding Alabama State Tax Return 40A

Who should use the Alabama State Tax Return Form 40A?

Form 40A is designed for full-year residents of Alabama only. If you (and your spouse, if filing jointly) resided in Alabama for the entirety of the tax year in question, you should use this form. If not, this form is not applicable to your situation, and you should refer to the instructions for determining the correct form to file.

What income needs to be reported on Form 40A?

All wages, salaries, tips, and other compensation received during the year should be reported on Form 40A. This includes all income from Alabama sources, as well as potentially income from other states or sources. Additionally, any interest and dividend income up to $1,500 should be reported directly on this form. If your interest and dividend income exceeds $1,500, you must use Form 40 instead.

How do I calculate my deductions on the Alabama Form 40A?

Form 40A provides options for standard deductions, dependent exemptions, and adjustments to income. To calculate your deductions, you'll first calculate your total income, apply any adjustments needed, and then subtract either your standard deduction or itemized deductions if applicable. You will also subtract any personal and dependent exemptions. Specific instructions and rates for these calculations are outlined in the form's instructions.

Are there options for direct donations from my refund on Form 40A?

Yes, Alabama Form 40A includes options to directly donate part or all of your state tax refund to various charitable causes and funds. This includes donations to senior services, arts development, wildlife conservation, child abuse prevention, veterans programs, and more. You can specify the amount you wish to donate to each fund in the designated section on the form.

What if I owe money when completing Form 40A?

If your total tax liability calculated on Form 40A exceeds the amount of Alabama income tax withheld throughout the year, you will owe the difference to the state. The form directs taxpayers to include payment along with Form 40V if a balance is due. Payment options may include check, money order, or potentially credit card payments. Detailed instructions for making a payment are provided in the form's instructions.

How do I ensure my Form 40A is processed quickly?

To ensure quick processing of your Form 40A, double-check all information for accuracy, including your name, address, and social security number(s). Attach all required forms and documentation, including w-2 forms and any applicable schedules. If you're expecting a refund, ensuring your address is correct is particularly crucial. Additionally, reviewing the final checklist provided in the form's instructions can help avoid common filing errors.

Common mistakes

When individuals take on the task of filling out their Alabama State Tax Return 40A form, it's inevitable that mistakes can be made. The process, while thorough, can be confusing. Here are four common errors to watch out for:

Entering incorrect social security numbers: An easy slip-up but with potentially big consequences. Whether it's from rushing or misreading numbers, incorrectly entered social security numbers can delay the processing of your return, or worse, affect your tax obligations and refunds.

Misreporting income: Income must be reported accurately. This includes wages, salaries, tips, and other forms of income like dividends or interest over $1,500 (which requires a different form). Overlooking or underreporting income can lead to discrepancies that might trigger audits or penalties.

Math errors: From simple addition and subtraction to incorrectly calculating deductions or taxable income, math errors are common. They can lead to an incorrect tax liability calculation, potentially resulting in underpayment or overpayment of taxes.

Failing to attach necessary documents: The form requires specific attachments, such as page 2 of Federal Form 1040, W-2s, W-2Gs, and/or 1099s. Forgetting to attach these documents can lead to processing delays or an incomplete assessment of your tax obligations.

While these errors are common, they can often be easily avoided with a careful and methodical approach to filling out the Alabama State Tax Return 40A form. Taking the time to double-check your work can save time, reduce stress, and ensure your tax obligations are met accurately and on time.

Documents used along the form

When completing the Alabama State Tax Return 40A form, filers often need additional forms and documents to ensure accuracy and compliance. These forms complement the main tax return form, helping taxpayers to calculate deductions, report specific types of income, or make amendments to their initial filings. Understanding each of these documents can streamline the process and avoid common filing errors.

- Form 40V: This payment voucher is utilized when taxpayers owe taxes and are making a payment with their return. Ensuring the correct amount is paid and processed efficiently, Form 40V accompanies any physical payments sent to the Alabama Department of Revenue.

- Form W-2: Wage and Tax Statements from employers detail the income earned and taxes withheld during the tax year. This form is crucial for accurately reporting earnings and withholdings on the state tax return.

- Form 1099: Various 1099 forms report different types of income, such as interest (1099-INT), dividends (1099-DIV), and independent contractor earnings (1099-NEC). These forms are essential for reporting income that's not from traditional employment.

- Form 1040: The federal income tax return and its schedules provide detailed information about an individual’s financial situation. Relevant pages from the federal return must be attached to the Alabama State Tax Return to substantiate claims on income and deductions.

- Schedule A (Itemized Deductions): If taxpayers choose to itemize deductions instead of taking the standard deduction, they must fill out this federal schedule to outline specific deductible expenses. While primarily for federal taxes, it influences state tax liability as well.

- Schedule B (Interest and Ordinary Dividends): This form is used for reporting interest and dividend income on the federal return. Taxpayers with substantial amounts of this type of income need to complete Schedule B, which can affect state tax calculations.

- Schedule D (Capital Gains and Losses): Any taxpayer who has capital gains or losses during the tax year must complete Schedule D for their federal return. Information from this schedule may be necessary for the state return, especially if it influences adjusted gross income.

- Form 4868: This is the Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. If a taxpayer files this form with the IRS for a federal extension, they should also mention this when filing their Alabama tax return to avoid penalties for late filing.

In addition to these forms and documents, taxpayers should always check the latest instructions and guidelines from both the Alabama Department of Revenue and the IRS to ensure they are using the correct forms for their specific tax situations. Tailoring the tax filing process to individual needs can help maximize returns or minimize liabilities, ensuring compliance with both state and federal tax laws.

Similar forms

The U.S. Federal Income Tax Return, specifically Form 1040, shares numerous similarities with the Alabama State Tax Return 40A form. Both require the taxpayer's personal information, including their name, social security number, and address. They also provide sections to report income from various sources, such as wages, salaries, tips, dividends, and interest. The forms feature deductions, exemptions, and credits, leading to the calculation of taxable income. Furthermore, they include spaces for voluntary contributions to specified funds or programs and come with instructions for attaching other necessary documentation.

State Tax Return forms from other states, like the California 540 Form or the New York IT-201, also parallel the Alabama State Tax Return 40A. These documents are designed for reporting individual income within their respective states and include sections for personal information, income reporting, deductions, and tax calculations. Despite differences influenced by state-specific tax laws, the structure and purpose align closely, guiding taxpayers through compiling their financial activities within the state for the year.

The 1040EZ, although now retired, offered a simplified structure for filing federal taxes and shares its ease with the Alabama 40A form for straightforward tax situations. Both were designed for taxpayers with simpler financial situations, lacking significant deductions, credits, or types of income outside of wages, salaries, and interest. The intent behind forms like the 1040EZ and the Alabama 40A is to streamline the tax filing process for eligible individuals.

W-2 forms, required attachments for both federal and state tax returns, including the Alabama 40A, contain information on an employee's income and tax withholding. This form serves as a primary document that taxpayers use to report wages and taxes withheld, which directly informs entries in the income sections of their tax returns. Its universal application underscores its role in ensuring accurate income reporting for tax purposes.

Form 1099, encompassing various types such as the 1099-INT for interest or 1099-DIV for dividends, is analogous to parts of the Alabama 40A form that capture income from sources other than wages. These documents are crucial for accurately reporting different types of income on both federal and state tax returns, effectively influencing the computation of taxable income and eventual tax liabilities.

Charitable contribution forms or receipts, while not official tax forms, have a close relationship with sections of the Alabama 40A that allow for voluntary contributions. Taxpayers use these documents to substantiate charitable donations claimed on their tax returns, echoing the process where individuals elect to contribute to state-run programs or efforts directly through their tax forms.

The Federal Schedule A itemized Deductions form intersects with the Alabama 40A form through its function in determining the deductions taxpayers may claim. Although Schedule A is specific to federal returns, it influences the final tax liability by allowing the taxpayer to itemize deductions — including taxes paid to state and local governments, paralleling the deductions section of the Alabama form.

Form 40V Payment Voucher is an integral part of the Alabama 40A package for those owing taxes, similar to the federal payment voucher, Form 1040-V. These documents facilitate the process of submitting payment alongside the return, specifying the amount of tax owed based on the calculations done in the tax forms. By providing structured information to the tax agencies, they ensure accurate processing of payments and correct crediting to taxpayer accounts.

Dos and Don'ts

Filling out the Alabama State Tax Return 40A form is a critical task for residents that, if done correctly, can ensure accuracy and timeliness in processing. It is essential to follow the best practices and avoid common pitfalls during this process. Below are five dos and don'ts to consider:

Things You Should Do:

Ensure that all personal information, including your social security number and address, is accurate and up-to-date. Any mistake in this information can lead to delays or issues in processing your return.

Report all sources of income accurately. The Alabama form 40A requires you to list various types of income, such as wages, salaries, and interest income. Omitting or incorrectly reporting income can result in penalties.

Attach all required documents. This includes your W-2s and, if applicable, 1099 forms. These documents are crucial for verifying the income reported on your tax return.

Review the math on your tax return. Before submitting, double-check your calculations to ensure there are no errors. Mistakes in math can affect your tax liability or refund amount.

Sign and date your return. An unsigned tax return is considered invalid and will not be processed until the omission is rectified.

Things You Shouldn't Do:

Do not overlook the instructions for the specific filing status and exemptions that apply to you. The Alabama tax form includes different sections based on your filing status, such as single, married filing jointly, or head of household. Misreporting your status can lead to inaccuracies in your tax liability calculation.

Avoid estimating income or tax withholdings. Use the exact figures provided in your income documents to fill out your return. Estimates can lead to discrepancies and might trigger audits or revisions.

Do not leave any mandatory fields blank. If a particular section does not apply to you, make sure to fill it with a “0” or “NA,” as indicated in the form instructions. Blank fields can cause confusion and delays in processing.

Resist the temptation to ignore tax deductions or credits you're eligible for. While it can seem complicated to calculate these benefits, they can significantly reduce your tax burden. Thoroughly review the instructions for deductions and credits that might apply to you.

Do not forget to attach a copy of your Federal return if required. Depending on your situation, the Alabama tax form might necessitate attaching documentation from your Federal return to validate your income and tax figures.

Following these guidelines can assist in making the tax return process smoother and help avoid common errors. Always refer to the latest Alabama Department of Revenue instructions or seek professional advice when uncertain.

Misconceptions

Many people have misconceptions about the Alabama State Tax Return 40A form, which is crucial for full-year residents filing their individual income tax returns. By clarifying these misunderstandings, taxpayers can navigate the process more effectively. Here are eight common misconceptions:

Only for Wage Earners: Some believe the Form 40A is exclusively for individuals earning wages, salaries, or tips. This overlooks other sources of income that can be reported, such as interest and dividend income, albeit there is a threshold for using a different form for higher amounts.

Filing Status Benefits: There's a misconception that choosing a particular filing status, such as “Married Filing Jointly,” always results in lower taxes. The best filing status depends on the specific circumstances and income of each spouse.

Standard Deduction Misunderstanding: Many think the standard deduction is fixed regardless of their income. However, the actual amount may vary as it can be calculated as a percentage of adjusted gross income, subject to certain limitations.

Dependent Exemptions: It's often misunderstood that all dependents qualify for a standard exemption amount. In reality, the exemption amount might depend on certain qualifications such as the dependent’s relationship to the filer, and whether the filer provides more than half of the dependent's support.

Voluntary Contributions: Some taxpayers are unaware they can make voluntary contributions to specific funds directly through their tax return. This feature allows taxpayers to support causes they care about efficiently.

Federal Tax Liability: A common error is confusing the federal tax liability with the federal tax withheld. Tax liability refers to the total tax obligation on the federal return, not the amount withheld from paychecks.

Income Sources: There's a misconception that all income sources reported on a federal return must be reported identically on the Form 40A. Certain types of income are taxable at the federal level but not on the state return, and vice versa.

Electronic Filing: Lastly, many still believe paper filing is the only option for Form 40A. While the form itself offers instructions for manual completion and mailing, Alabama residents often have access to electronic filing options that can streamline the process.

Understanding these misconceptions can help ensure that residents of Alabama accurately complete their Form 40A and comply with state tax regulations, potentially avoiding common pitfalls and making the tax return process smoother.

Key takeaways

Filling out and submitting the Alabama State Tax Return 40A form is a process that Alabama full-year residents must complete with care and attention to ensure accuracy and compliance with state tax laws. Here are four key takeaways to consider when handling this form:

- Firstly, ensure that you are eligible to use Form 40A by confirming your resident status. This form is designed exclusively for individuals who were full-year residents of Alabama in the tax year in question.

- Second, carefully review all sections of the form to accurately report income, deductions, and tax liability. Since this form includes various types of income and potential deductions, it's important to thoroughly document your financial activities over the past year to ensure a correct tax return.

- Third, don't overlook the importance of attaching the required documentation. This includes your federal tax return and any applicable W-2, W-2G, or 1099 forms that report Alabama tax withheld. Proper documentation is crucial for verifying the information provided on Form 40A.

- Lastly, consider your payment or refund options carefully. If you owe a balance, ensure that the payment accompanies the form, using Form 40V if necessary. Conversely, if you're due a refund, double-check your address and banking information if opting for direct deposit to avoid any delays.

Understanding these key points can help streamline the tax return process, ensuring that your Alabama State Tax Return 40A is complete, accurate, and submitted on time. Always check for the latest form and guidelines, as tax laws and form requirements can change from year to year.

Popular PDF Documents

Philhealth Online - Serves as a record-keeping instrument for both PhilHealth and its members, aiding in dispute resolution.

Irs Form 1040 Sr Instructions 2023 Printable - Identify how adjustments to your recorded income for tuition and fees can affect your taxable amount, leading to potential savings.

How to Calculate Trust Accounting Income - A key form that breaks down the taxable impact of distributions from trusts or estates to the individual beneficiaries.