Get Alabama First Report Form

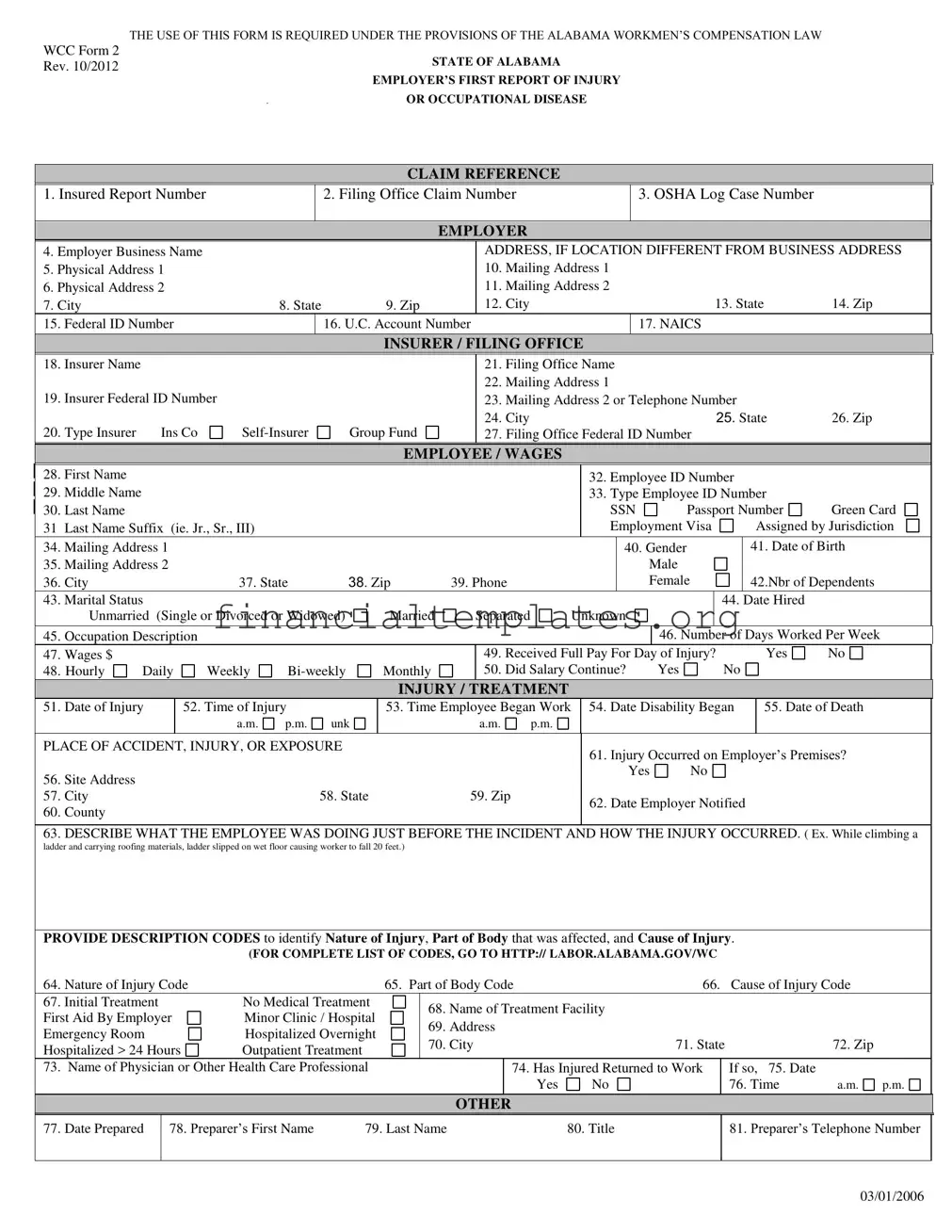

In Alabama, businesses are mandated to adhere to the state's Workers' Compensation Law, a requisite that includes the filling and submission of the Alabama Employer's First Report of Injury or Occupational Disease form. This crucial document, referred to as WCC Form 2, last revised in October 2012, serves as the initial notification of an employee's workplace injury or disease, kickstarting the claims process. It encompasses detailed sections that record specifics about the employer, including business and physical addresses, federal ID, and insurance details. Further, it captures comprehensive employee information such as name, contact details, gender, marital status, occupation, wage details, and the number of dependents. The form also meticulously documents the incident, including the date, time, location, and description of the injury or exposure, supplementing these with codes that categorize the nature of the injury, affected body parts, and the cause. Moreover, it outlines initial treatments administered and tracks whether the employee returned to work post-injury. The completion of this form, which must be prepared by an identified company representative, underscores the importance of a structured approach to reporting workplace injuries or diseases, ensuring that both employer and employee adhere to state law provisions and initiate the compensation process effectively.

Alabama First Report Example

THE USE OF THIS FORM IS REQUIRED UNDER THE PROVISIONS OF THE ALABAMA WORKMEN’S COMPENSATION LAW

WCC Form 2

Rev. 10/2012STATE OF ALABAMA

EMPLOYER’S FIRST REPORT OF INJURY

OR OCCUPATIONAL DISEASE

CLAIM REFERENCE

|

|

1. Insured Report Number |

|

|

2. Filing Office Claim Number |

|

|

|

|

|

3. OSHA Log Case Number |

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. Employer Business Name |

|

|

|

|

|

|

ADDRESS, IF LOCATION DIFFERENT FROM BUSINESS ADDRESS |

|

|||||||||||||||||

|

|

5. Physical Address 1 |

|

|

|

|

|

|

|

|

10. Mailing Address 1 |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

6. Physical Address 2 |

|

|

|

|

|

|

|

|

11. Mailing Address 2 |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

7. City |

|

|

|

|

8. State |

|

9. Zip |

|

12. City |

|

|

|

|

|

|

|

|

13. State |

14. Zip |

|

|||||

|

|

15. Federal ID Number |

|

|

16. U.C. Account Number |

|

|

|

|

|

17. NAICS |

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

INSURER / FILING OFFICE |

|

|

|

|

|

|

|

|

|

|

||||||

|

18. |

Insurer Name |

|

|

|

|

|

|

|

|

|

21. Filing Office Name |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

22. Mailing Address 1 |

|

|

|

|

|

|

|

|

|

|

||||

|

19. |

Insurer Federal ID Number |

|

|

|

|

|

23. Mailing Address 2 or Telephone Number |

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

24. City |

|

|

|

|

|

|

|

|

25. State |

26. Zip |

|

|||

|

20. |

Type Insurer |

Ins Co |

|

Group Fund |

|

27. Filing Office Federal ID Number |

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

EMPLOYEE / WAGES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

28. First Name |

|

|

|

|

|

|

|

|

|

|

|

|

32. Employee ID Number |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

29. Middle Name |

|

|

|

|

|

|

|

|

|

|

|

|

33. Type Employee ID Number |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

30. |

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

SSN |

Passport Number |

Green Card |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

31 |

Last Name Suffix |

(ie. Jr., Sr., III) |

|

|

|

|

|

|

|

|

Employment Visa |

|

Assigned by Jurisdiction |

|

||||||||||||

|

34. |

Mailing Address 1 |

|

|

|

|

|

|

|

|

|

|

|

|

40. Gender |

|

|

|

41. Date of Birth |

|

|||||||

|

35. |

Mailing Address 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Male |

|

|

|

|

|

|

|

|||

|

36. |

City |

|

|

|

37. State |

|

38. Zip |

39. Phone |

|

|

|

|

|

Female |

|

42.Nbr of Dependents |

|

|||||||||

|

43. |

Marital Status |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

44. Date Hired |

|

|

|||||

|

|

|

Unmarried (Single or Divorced or Widowed) |

|

Married |

|

Separated |

|

Unknown |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

45. |

Occupation Description |

|

|

|

|

|

|

|

|

|

|

|

|

|

46. Number of Days Worked Per Week |

|

||||||||||

|

47. |

Wages $ |

|

|

|

|

|

|

|

|

|

49. Received Full Pay For Day of Injury? |

|

Yes |

No |

|

|||||||||||

|

|

48. Hourly |

Daily |

Weekly |

|

Monthly |

|

50. Did Salary Continue? |

|

|

Yes |

|

No |

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

INJURY / TREATMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

51. |

Date of Injury |

|

52. Time of Injury |

|

|

53. Time Employee Began Work |

|

54. Date Disability Began |

|

55. Date of Death |

|

|||||||||||||||

|

|

|

|

|

|

|

a.m. |

p.m. |

unk |

|

|

a.m. |

p.m. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

PLACE OF ACCIDENT, INJURY, OR EXPOSURE |

|

|

|

|

|

|

61. Injury Occurred on Employer’s Premises? |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

56. |

Site Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

57. |

City |

|

|

|

|

|

58. State |

59. Zip |

|

|

62. Date Employer Notified |

|

|

|

|

|||||||||||

|

60. |

County |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

63. DESCRIBE WHAT THE EMPLOYEE WAS DOING JUST BEFORE THE INCIDENT AND HOW THE INJURY OCCURRED. ( Ex. While climbing a

ladder and carrying roofing materials, ladder slipped on wet floor causing worker to fall 20 feet.)

PROVIDE DESCRIPTION CODES to identify Nature of Injury, Part of Body that was affected, and Cause of Injury.

|

(FOR COMPLETE LIST OF CODES, GO TO HTTP:// LABOR.ALABAMA.GOV/WC |

|

|

||||||

64. Nature of Injury Code |

|

65. Part of Body Code |

66. |

|

Cause of Injury Code |

||||

67. Initial Treatment |

No Medical Treatment |

|

68. |

Name of Treatment Facility |

|

|

|||

First Aid By Employer |

Minor Clinic / Hospital |

|

|

|

|||||

|

69. |

Address |

|

|

|

|

|||

Emergency Room |

Hospitalized Overnight |

|

|

|

|

|

|||

|

70. |

City |

71. State |

|

72. Zip |

||||

Hospitalized > 24 Hours |

Outpatient Treatment |

|

|

||||||

|

|

|

|

|

|

|

|

||

73. Name of Physician or Other Health Care Professional |

|

|

|

74. Has Injured Returned to Work |

|

If so, 75. Date |

|

||

|

|

|

|

|

Yes |

No |

|

76. Time |

a.m. p.m. |

|

|

|

|

|

|

|

|

|

|

OTHER

77. Date Prepared

78. Preparer’s First Name |

79. Last Name |

80. Title |

81. Preparer’s Telephone Number

03/01/2006

Document Specifics

| Fact | Detail |

|---|---|

| Governing Law | Alabama Workmen’s Compensation Law |

| Form Revision Date | October 2012 |

| Form Purpose | Employer's First Report of Injury or Occupational Disease |

| Form Reference | WCC Form 2 |

| Employer Information Required | Business Name, Physical and Mailing Address, Federal ID Number, U.C. Account Number, NAICS |

| Employee Information Required | Name, ID Numbers, Mailing Address, Gender, Date of Birth, Number of Dependents, Marital Status, Occupation, Wages |

| Injury/Treatment Information Required | Date and Time of Injury, Injury Occurrence Site, Nature of Injury, Part of Body Affected, Cause of Injury, Initial Treatment |

Guide to Writing Alabama First Report

Once an injury or occupational disease is reported within the Alabama workplace, the Alabama First Report form must be promptly filled out. This form plays a crucial role in ensuring that the rights of the employee are protected and that employers fulfill their obligations under the Alabama Workmen’s Compensation Law. Completing this form accurately is important for the claims process.

- Start by entering the Insured Report Number, Filing Office Claim Number, and OSHA Log Case Number in the sections designated as 1, 2, and 3, respectively.

- In the EMPLOYER section, fill out the business’s name and address information. Include both the physical and mailing addresses, city, state, zip, Federal ID Number, U.C. Account Number, and NAICS in the fields 4 through 17.

- Under the INSURER / FILING OFFICE section, enter the name of the insurer, their federal ID number, and type (Insurer, Ins Co, Self-Insurer, Group Fund). Also add the Filing Office's name, their mailing addresses, city, state, zip, and federal ID number in fields 18 through 27.

- For the EMPLOYEE / WAGES section, provide the employee’s full name, ID number and type, mailing address, gender, date of birth, number of dependents, marital status, and date hired in fields 28 through 44. Specify the employee’s occupation, the number of days worked per week, wages, and whether or not full pay was received for the day of injury, as well as if the salary continued in fields 45 through 50.

- In the INJURY / TREATMENT area, record the date and time of injury, when the employee began work that day, the date disability began and if applicable, the date of death in fields 51 through 55.

- Detail where the accident, injury, or exposure happened, including if it was on the employer’s premises, the site address, city, state, zip, and county in fields 56 through 60. Document the date the employer was notified in field 62.

- Describe what the employee was doing just before the incident, how the injury occurred, and provide description codes for the nature of injury, part of the body affected, and cause of injury in field 63 to 66.

- Fill out the Initial Treatment section with details on the treatment type, name, and address of the treatment facility, city, state, zip, and the name of the physician or health care professional in fields 67 through 73.

- Indicate if the injured has returned to work and if so, provide the date and time in fields 74 through 76.

- Lastly, complete the form with the date it was prepared, and the first name, last name, title, and telephone number of the person preparing the form in fields 77 through 81.

Ensuring all the provided information is accurate and comprehensive is critical in facilitating the claims process. This will support the employee's recovery and return to work, if possible, and helps in managing the responsibilities and liabilities of the employers within the scope of the Alabama Workmen’s Compensation Law.

Understanding Alabama First Report

FAQ: Alabama First Report Form for Workplace Injuries and Diseases

- What is the Alabama First Report form, and when is it required?

The Alabama First Report form, officially known as WCC Form 2, is a document employers must complete following a workplace injury or occupational disease. This form plays a critical role in the Alabama Workmen’s Compensation Law process. It is required whenever an employee suffers a work-related injury or disease that could potentially lead to a claim for workers' compensation benefits. The primary purpose of this form is to document the incident's details and initiate the claims process.

- Who is responsible for completing this form?

It is the employer's responsibility to fill out the Alabama First Report form. Upon learning of a work-related injury or occupational disease, the employer must promptly document the incident using this form. Accuracy and thoroughness in completing the form are crucial, as it provides the basis for the employee's claim for workers' compensation benefits.

- What information is required on the form?

The form demands comprehensive details about the injured or ill employee, the employer, the insurer, and the specifics of the injury or disease. Key sections include:

- Employer and insurance information, like business names and addresses.

- Employee details, including name, address, date of birth, occupation, and wages.

- Specifics of the injury or disease, such as the date, time, and nature of the incident, as well as the initial medical treatment provided.

- Where should the completed form be submitted?

Once filled out, the Alabama First Report form should be submitted to the relevant workers' compensation claims office or the insurer handling workers' compensation claims for the employer. This submission should be done as promptly as possible to ensure a swift response to the employee's needs and to comply with Alabama's workers' compensation law requirements.

- What are the consequences of not completing or submitting the Alabama First Report form?

Failure to complete or submit the Alabama First Report form can have serious ramifications for an employer. It can lead to delays in the injured employee receiving medical treatment and compensation benefits, as well as potential fines or penalties for non-compliance with Alabama's workers' compensation regulations. Prompt and accurate completion and submission of this form are essential to ensure compliance with the law and support for the injured or ill employee.

Common mistakes

Filling out the Alabama First Report of Injury or Occupational Disease form accurately is crucial for both employers and employees to ensure a smooth process in workers' compensation claims. However, several common mistakes can lead to complications or delays. Avoiding these errors can help streamline the claims process.

- Not verifying the accuracy of all identification numbers: Mistakes in crucial numbers like the Insured Report Number, Federal ID Number, or Employee's Social Security Number can lead to significant delays in processing the claim.

- Incorrect employer and insurer information: Employers often overlook the importance of double-checking the business name, addresses, and especially the insurer information, which is critical for correct claim processing.

- Incomplete employee information: Leaving out key details such as the complete name, address, Date of Birth, or incorrectly entering the Employee ID type can cause confusion and unnecessary back-and-forth.

- Failure to accurately describe the job and wages: Details like the occupation description, number of days worked per week, and correct wage information are vital for assessing claims appropriately.

- Overlooking the details of the injury/treatment section: Not providing a detailed description of the incident, neglecting to use the correct codes for nature, part of body affected, and cause of injury, or failing to report initial treatment details can lead to misunderstanding about the severity and cause of the injury.

- Omitting accident location details: It's crucial to accurately state where the accident occurred, including if it was on the employer’s premises, as this can affect the claim's legitimacy.

- Mistakes in dates and times: Incorrect dates for the injury, disability commencement, death (if applicable), or when the employer was notified can heavily impact the claim processing timeline and outcome.

- Inaccurate preparer information: The details of the individual preparing the form, including their contact information, need to be correct to ensure any follow-up can be conducted smoothly.

Avoiding these mistakes not only helps in submitting a robust and accurate claim but also significantly reduces the stress and uncertainty associated with workers' compensation claims. While the filing process may seem complex, careful attention to detail can make a significant difference.

Documents used along the form

When handling workplace injuries in Alabama, the Alabama First Report of Injury or Occupational Disease form is often the starting point for documenting an incident under the Alabama Workmen’s Compensation Law. However, completing this process typically requires additional forms and documents to manage the case effectively. These documents not only support the initial claim but also help in various stages of claim processing, from medical treatment verification to compliance with federal and state regulations.

- WCC Form 3 - Employer’s Supplemental Report: This form provides updates on the employee's work status following the initial injury report. Employers use it to report if there is a change in the employee's return-to-work status, their wages, or if they have stopped working due to the injury.

- OSHA 300 Log of Work-Related Injuries and Illnesses: Although not specific to Alabama, this form is a critical component of federal compliance for recording serious work-related injuries and illnesses. It helps employers keep a running record of such incidents, which can be crucial for both internal tracking and regulatory inspections.

- Notice of Controversion of Right to Compensation: Used by an employer or insurer to dispute a worker’s claim for compensation. This document outlines the reasons for denying a claim, such as lack of evidence that the injury occurred at work or that it qualifies for compensation under workmen’s compensation laws.

- Medical Records Authorization Form: Allows an employer or insurance company to request access to an injured employee's medical records. These records help verify the extent of the injuries claimed and ensure that the treatment provided corresponds with the injuries reported.

Understanding and properly utilizing these documents, alongside the Alabama First Report of Injury or Occupational Disease form, ensures that employers meet their legal obligations and support their employees through the workers’ compensation claim process. Each document serves a purpose in the broader context of managing workplace injuries, from documenting initial injuries to ensuring ongoing compliance and supporting an employee’s return to work.

Similar forms

The Federal Employer's Identification Number (FEIN) on the Alabama First Report form shares similarities with the IRS Form SS-4, Application for Employer Identification Number (EIN). Similar to how the Alabama First Report requires an employer's FEIN for identification, the IRS Form SS-4 is used by employers to apply for an EIN, ensuring their business is registered with the federal government for tax purposes. This critical number facilitates the processing of employee taxes and verification of the employer's identity, showcasing the importance of proper documentation and employer identification in both forms.

The section on the Alabama First Report form asking for details about the employee, such as name, identification number, and address, bears a resemblance to the information required on Form I-9, Employment Eligibility Verification. The purpose of Form I-9 is to document that each new employee is legally authorized to work in the United States. Both forms require detailed personal information to verify identity and employment eligibility, although for different legal purposes—one for workers' compensation claims and the other for employment eligibility verification.

Details regarding wages and salary continuation on the Alabama First Report form parallel the Wage and Tax Statement (W-2 form) used in the United States. While the Alabama form is utilized within the context of reporting an injury and determining compensation benefits, the W-2 form reports an employee's annual wages and the amount of taxes withheld from their paycheck. Both documents are crucial for accurate record-keeping and ensure that employees are fairly compensated, either through their wages or through compensation following a workplace injury.

The injury or occupational disease details required on the Alabama First Report form are analogous to what is found on the Occupational Safety and Health Administration's (OSHA) Form 300, Log of Work-Related Injuries and Illnesses. Both documents necessitate detailed descriptions of the injury or illness, how it occurred, and the severity. These parallels highlight the importance of maintaining precise records on workplace incidents to enhance safety protocols and ensure compliance with regulatory standards.

The requirement to list the nature of the injury, part of body affected, and cause of injury on the Alabama First Report form is reminiscent of the information collected in health insurance claim forms, such as the CMS-1500 used for Medicare and Medicaid. Both sets of documents require specific codes to categorize the nature and cause of injuries or illnesses for processing claims effectively. This coding facilitates a standardized method for health professionals and insurers (or employers in the case of the Alabama form) to communicate about injuries and treatments.

The details of the initial treatment listed in the Alabama First Report form align with the documentation found in patients' medical records. Like medical records, the Alabama form captures first treatment information, treatment facility details, and physician or healthcare professional names. This ensures that there is a record of immediate care provided for the injury, critical for both medical and compensation processes.

The Alabama First Report form's requirement for an insurer or filing office name and identification mirrors the information asked for in health insurance policy forms. These forms identify the insurer responsible for processing claims, similar to how the Alabama document identifies which insurance company or internal office is handling the workers' compensation claim. This identification is essential for streamlining the claims process and ensuring accountability.

The section asking whether the salary continues after the injury on the Alabama First Report form is similar to short-term disability claim forms used by private insurers. These forms often inquire about the employee's ability to work and whether they are receiving their regular salary during their recovery. Both documents recognize the financial impact of injuries on employees and aim to document compensation continuity or the need for benefit initiation during periods of work absence due to injury.

Dos and Don'ts

When filling out the Alabama First Report of Injury or Occupational Disease form, attention to detail and accuracy is crucial for ensuring the submission is accepted and processed efficiently. Below are key dos and don'ts to guide you through this process:

- Do ensure all information is complete and accurate. Missing or incorrect details can delay processing.

- Do use the specific codes provided by the Alabama Department of Labor for describing the nature of injury, part of the body affected, and cause of injury. These codes help standardize reports across different cases.

- Do include the exact date and time of the injury, as accuracy in these details significantly impacts the evaluation of the claim.

- Do verify the employee's personal information, including their full name, address, and social security number, to prevent any identification issues.

- Do describe the incident precisely in the section provided. A clear explanation of what the employee was doing and how the injury occurred is essential for a proper assessment.

- Don't leave any fields blank. If a section does not apply, indicate with "N/A" (not applicable) or "Unknown" if the information is not available.

- Don't estimate or guess information. If you're unsure, it's better to seek out the correct details before submitting the form.

- Don't skip the section regarding the initial treatment received. This information is critical in understanding the severity of the injury and the immediate response.

- Don't forget to sign and date the form. An unsigned form may not be processed.

Misconceptions

When it comes to navigating the complexities of workplace injuries in Alabama, the Employer's First Report of Injury or Occupational Disease form (often just called the Alabama First Report form) is a critical document. However, there are several misconceptions surrounding this form that can lead to confusion for both employers and employees. Let's clear up some of these misunderstandings:

It's only for serious injuries: Some assume the form is only meant for severe injuries. However, it's required for any workplace injury or occupational disease, regardless of the severity. This ensures proper documentation and supports claims processing.

Employees fill out the form: It's a common belief that the injured employees are responsible for filling out the form. In reality, it is the employer's responsibility to complete and submit it to the appropriate agencies, ensuring that the injury is officially reported.

It serves as a claim for compensation: While this form is crucial in the process, filling it out and submitting it does not constitute a claim for workers' compensation benefits. Instead, it starts the documentation process and informs the necessary parties about the injury.

The information required is minimal: Some might think the form only needs basic information. The truth is, it requires detailed information about the employer, the insurer, the employee, and specifics about the injury or disease, including when and how it occurred.

Submission deadlines are flexible: A dangerous assumption is that the deadlines for submitting the form are flexible. The state mandates specific timeframes within which the report must be filed to avoid penalties and ensure timely processing of the injury report.

Only injuries on the employer's premises need reporting: Another misconception is that only injuries occurring on the employer's physical premises require reporting. In fact, the form must be filled out for any work-related injury or disease, regardless of the location it occurred.

No follow-up is required after submission: Some employers might think once the form is submitted, no further action is necessary. However, they may need to provide additional information or documentation as the claim is processed, and they should monitor the claim's progress.

Understanding these key aspects of the Alabama First Report form can help employers manage workplace injuries more effectively and ensure they comply with state laws. By dispelling these misconceptions, both employers and employees can navigate the complexities of reporting workplace injuries with greater clarity and confidence.

Key takeaways

Filling out the Alabama First Report form is a crucial step in the workers' compensation process. This form plays a significant role in ensuring that both employers and employees adhere to the state's regulations and receive the benefits they are entitled to in the event of a workplace injury or occupational disease. Here are nine key takeaways about filling out and using the Alabama First Report form:

- It is mandatory to use this form to report workplace injuries or occupational diseases under the Alabama Workmen’s Compensation Law, highlighting the legal obligation of employers to comply with this requirement.

- Employers are required to provide detailed information, including both the business and the physical address if different, ensuring that all relevant locations are documented.

- The form requires specific identification numbers such as the Insured Report Number, Filing Office Claim Number, and OSHA Log Case Number, which are crucial for tracking and managing the claim.

- Information regarding the insurer or filing office must be filled out. This includes the name of the insurer, their federal ID number, and contact details, which are indispensable for communication and processing of the claim.

- Employee details, including personal information, wages, and employment specifics, must be thoroughly documented. This ensures that the employee's situation is accurately represented and aids in determining their compensation benefits.

- The section detailing the injury or treatment is particularly significant. It must include the date and time of injury, if the injury occurred on the employer’s premises, and the nature of the injury, which are critical for assessing the claim.

- Employers must describe what the employee was doing just before the incident and how the injury occurred. This narrative is essential for understanding the circumstances surrounding the injury.

- Initial treatment information must be provided, including the type of treatment, name and address of the treatment facility, and any attending healthcare professionals, which is vital for confirming the immediate response and medical assessment.

- The form requires information on whether the injured employee has returned to work, which helps in monitoring the recovery and reintegration process.

Proper completion and timely submission of the Alabama First Report form are critical for ensuring that workplace injuries are adequately reported and managed. This facilitates both compliance with state laws and the effective administration of workers' compensation benefits.

Popular PDF Documents

2024 Ev Rebate - Form 8936 differentiates between full electric vehicles and plug-in hybrids for the purpose of credit calculation.

What Is a 8862 Form - A tool for taxpayers to argue their case for regaining the Earned Income Credit on subsequent tax filings.