Get Affidavid Of Heirship Form

When a loved one passes away, the process of legally transferring their assets can seem daunting, especially in the absence of a will. One crucial document that plays a vital role in this scenario is the Affidavit of Heirship. This sworn statement helps in identifying the rightful heirs to the estate of the deceased, facilitating the distribution of assets particularly in cases where the estate falls under a certain monetary threshold and the deployment of a formal probate process isn't mandatory. The affidavit not only outlines the heir's relationship to the deceased and their claim to the estate but also delves into specifics such as the debts and taxes of the estate, ensuring they have been settled accordingly. By providing an inventory of surviving heirs and their entitled proportions, it simplifies the process for financial institutions and other entities in releasing the assets of the deceased. Furthermore, the document carries legal weight as it is signed under oath in the presence of a notary, cementing the claimant's assertions about the estate and the decedent’s heirs. Particularly useful in states with a specified value limit for the decedent’s estate, this affidavit circumvents the lengthy and often expensive probate process, directly addressing the succession and claiming of smaller estates. It also invokes a clause indemnifying the entity releasing the assets from future claims, once the affidavit is accepted. Thus, while the Affidavit of Heirship might seem like a simple piece of paperwork, it serves as an essential bridge for transferring assets smoothly and efficiently to the rightful heirs, ensuring the deceased's wishes are honored and the legal formalities streamlined.

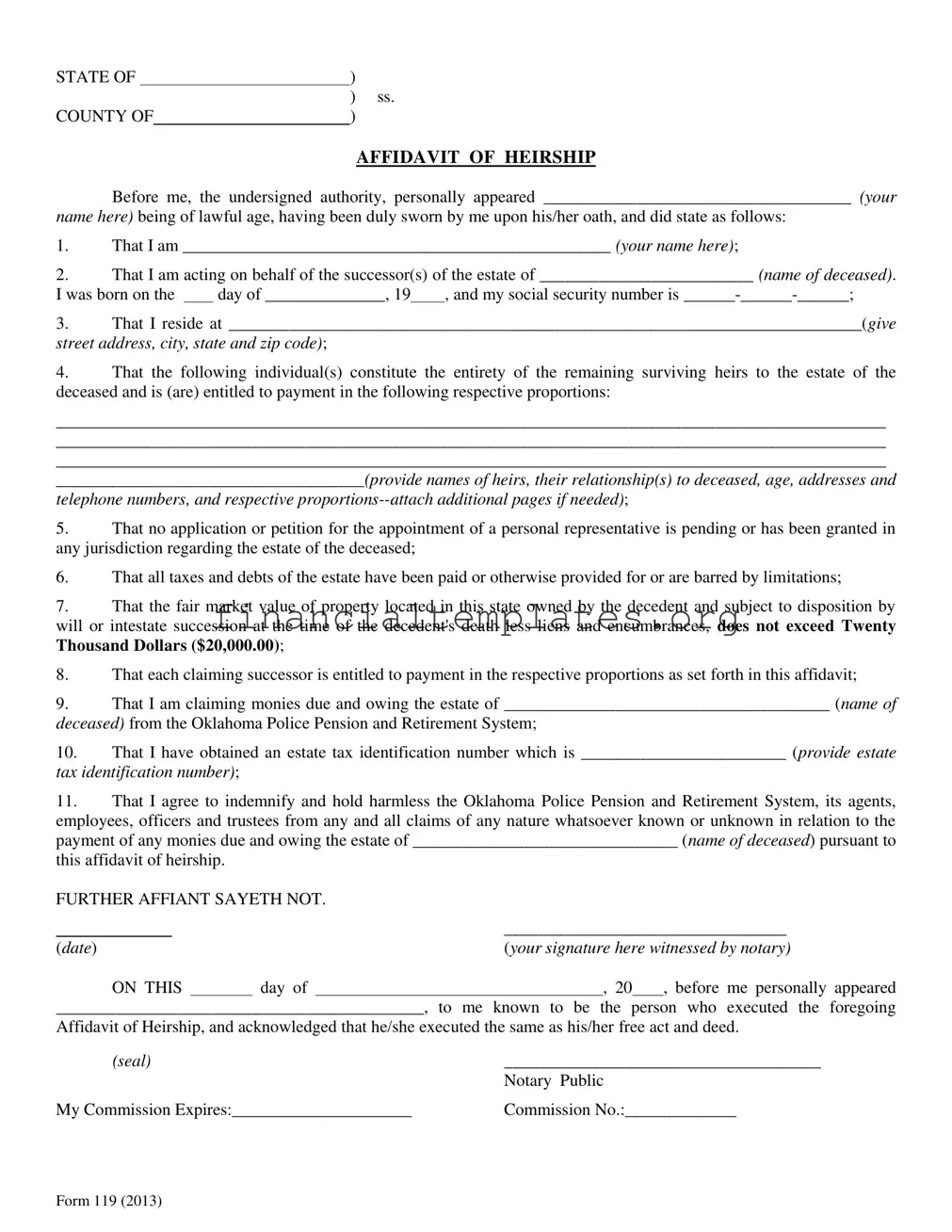

Affidavid Of Heirship Example

STATE OF |

) |

||

|

|

|

) ss. |

COUNTY OF |

|

) |

|

AFFIDAVIT OF HEIRSHIP

Before me, the undersigned authority, personally appeared ____________________________________ (your

name here) being of lawful age, having been duly sworn by me upon his/her oath, and did state as follows:

1.That I am __________________________________________________ (your name here);

2.That I am acting on behalf of the successor(s) of the estate of _________________________ (name of deceased).

I was born on the |

|

day of ______________, 19 |

, and my social security number is |

|

|

|

|

|

|

3.That I reside at __________________________________________________________________________(give street address, city, state and zip code);

4.That the following individual(s) constitute the entirety of the remaining surviving heirs to the estate of the deceased and is (are) entitled to payment in the following respective proportions:

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

____________________________________(provide names of heirs, their relationship(s) to deceased, age, addresses and

telephone numbers, and respective

5.That no application or petition for the appointment of a personal representative is pending or has been granted in any jurisdiction regarding the estate of the deceased;

6.That all taxes and debts of the estate have been paid or otherwise provided for or are barred by limitations;

7.That the fair market value of property located in this state owned by the decedent and subject to disposition by will or intestate succession at the time of the decedent's death less liens and encumbrances, does not exceed Twenty Thousand Dollars ($20,000.00);

8.That each claiming successor is entitled to payment in the respective proportions as set forth in this affidavit;

9.That I am claiming monies due and owing the estate of ______________________________________ (name of deceased) from the Oklahoma Police Pension and Retirement System;

10.That I have obtained an estate tax identification number which is ________________________ (provide estate tax identification number);

11.That I agree to indemnify and hold harmless the Oklahoma Police Pension and Retirement System, its agents, employees, officers and trustees from any and all claims of any nature whatsoever known or unknown in relation to the payment of any monies due and owing the estate of _______________________________ (name of deceased) pursuant to this affidavit of heirship.

FURTHER AFFIANT SAYETH NOT. |

|

|

|

|

||||

|

|

|

|

|

_________________________________ |

|||

(date) |

|

|

|

(your signature here witnessed by notary) |

||||

ON THIS |

|

day of |

|

|

, 20 , before me personally appeared |

|||

|

|

|

|

|

|

|

|

|

___________________________________________, to me known to be the person who executed the foregoing

Affidavit of Heirship, and acknowledged that he/she executed the same as his/her free act and deed.

(seal) |

_____________________________________ |

|

Notary Public |

My Commission Expires:_____________________ |

Commission No.:_____________ |

Form 119 (2013)

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Affidavit of Heirship | This document is used to establish the rightful heirs to the estate of a deceased person when there is no will. |

| Content Requirements | It must include the affiant’s information, details of the heirs, declaration that no application for a personal representative is pending, and that all taxes and debts of the estate are settled. |

| Oklahoma Specific Use | This version specifically mentions claiming funds from the Oklahoma Police Pension and Retirement System, indicating it's tailored for use within Oklahoma. |

| Monetary Limitation | It applies when the estate's fair market value in Oklahoma, minus debts, does not exceed $20,000. |

| Governing Law | The form adheres to Oklahoma state laws governing the transfer of estate assets without a will. |

Guide to Writing Affidavid Of Heirship

Filling out an Affidavit of Heirship is an important process for individuals acting on behalf of successors to an estate. This document is used to legally declare the heirs to an estate when someone dies without a will. It's a step toward ensuring that assets and property are rightfully distributed according to the deceased's wishes or state law. The process might seem daunting at first glance, but by following these clear, step-by-step instructions, you'll be able to complete the form with confidence.

- Start by entering the state and county in which the affidavit is being filed at the top of the document where indicated.

- In the space provided, enter your name after the phrase "personally appeared." This indicates who is submitting the affidavit.

- Fill in your name again on the line following "That I am," to affirm your identity.

- Input the name of the deceased on the line following "acting on behalf of the successor(s) of the estate of," to identify whose estate is being addressed.

- Enter your birth date and social security number where requested to provide further identification of yourself.

- Complete the section regarding your residence by providing your full address, including street, city, state, and zip code.

- List all surviving heirs to the estate, including their names, relationships to the deceased, ages, addresses, telephone numbers, and the respective proportions of the estate they are entitled to. Attach additional pages if required.

- Confirm that no application or petition for the appointment of a personal representative is pending or has been granted in any jurisdiction.

- State that all taxes and debts of the estate have been paid, provided for, or are barred by limitations.

- Declare the fair market value of the property in the state owned by the decedent at the time of death, ensuring it does not exceed twenty thousand dollars.

- Assure that each claiming successor is entitled to payment in the respective proportions as set forth in this affidavit.

- Claim any monies due to the estate of the deceased from specific institutions, if applicable, and provide the estate tax identification number.

- Agree to indemnify and hold harmless the relevant institutions from any claims in relation to the payment of monies due to the estate.

- Date and sign the affidavit in the presence of a notary. The notary will then complete the final section, which includes the date, sealing the document, and adding their commission details.

After completing the Affidavit of Heirship form, it's crucial to submit it to the appropriate local or state office, as directed by the laws of the state where the decedent lived or where the property is located. This submission is the next step in properly managing the deceased's estate, ensuring that assets are distributed correctly and legally. Remember, each state might have different requirements or additional steps, so it's important to consult with a legal professional if you have any doubts or questions about this process.

Understanding Affidavid Of Heirship

- What is an Affidavit of Heirship?

An Affidavit of Heirship is a legal document used to establish the heirs of a deceased person's estate when they die without a will. It identifies the rightful heirs and outlines their entitlement to the estate's assets. This affidavit is particularly useful in simplifying the transfer of property amongst heirs without going through a prolonged probate process.

- Who needs to file an Affidavit of Heirship?

This affidavit is typically filed by a person acting on behalf of the successors or heirs of the deceased's estate. It's ideal for estates where the deceased has not left a will and has property that needs to be transferred to the rightful heirs.

- What information is required to complete an Affidavit of Heirship?

The form requires detailed information, including the affiant's name and relationship to the deceased, names and details of all surviving heirs, any debts and taxes of the estate that have been settled, and a statement concerning the value of the estate's property. Additionally, it requires the estate tax identification number and a commitment to indemnify the involved agency from claims related to the estate's disbursement.

- Can an Affidavit of Heirship be used for all types of property?

An Affidavit of Heirship is generally used for the transfer of tangible property, like real estate and vehicles, in the deceased's name. However, its applicability to different property types may vary by jurisdiction. It is advisable to consult legal advice to understand its utility for diverse assets.

- Is a notary required for an Affidavit of Heirship?

Yes, the affiant's signature must be notarized for the document to be legally valid. The notary public also confirms the identity of the affiant and ensures that the affiant understands the document they are signing.

- What happens after filing an Affidavit of Heirship?

Once filed, the Affidavit of Heirship serves as proof of the heir's entitlement to the estate assets. It may be used to transfer ownership of property, close accounts, and distribute assets among the heirs according to the details outlined in the affidavit.

- Are there any limitations to the value of the estate for using an Affidavit of Heirship?

In the document example provided, the estate's property value, after deductions for liens and encumbrances, should not exceed Twenty Thousand Dollars ($20,000.00). However, this value can vary based on local laws, so it's essential to check the regulations in the relevant jurisdiction.

- Does filing an Affidavit of Heirship avoid the probate process?

The affidavit can help transfer property to heirs without formal probate, making the process quicker and less costly. However, it does not entirely eliminate the need for probate in all circumstances, especially for larger estates or when disputes among heirs arise.

- How long does it take for an Affidavit of Heirship to be processed?

The processing time can vary based on the jurisdiction and the specific circumstances of the estate. It's advisable to consult with a local legal professional for an estimated timeline.

- Is there a risk to the affiant when signing an Affidavit of Heirship?

While the affiant is required to affirm the truth of the information under oath, which carries legal responsibility, the document includes an indemnity clause. This clause is meant to protect the affiant against claims related to the estate's distribution, provided the information given is accurate and truthful.

Common mistakes

Filling out an Affidavit of Heirship can seem straightforward, but mistakes can easily happen if you rush through it or don't understand what's being asked. Below is a list of common errors people make on this form that can complicate the process of settling an estate.

Not double-checking personal information: It's crucial to ensure that your name, address, and social security number are correct. Even small errors can raise questions about your identity or delay the process.

Leaving out any heir: Make sure to list all surviving heirs. Forgetting someone or assuming they're not entitled can create legal issues or disputes among family members later on.

Inaccurate description of heirs: When detailing the heirs, it's important to correctly state their relationship to the deceased, their age, and contact information. This ensures clarity and avoids potential confusion.

Forgetting to attach additional pages: If there isn't enough space to list all heirs and their details, you need to attach additional pages. Failing to do so can make the affidavit incomplete.

Incorrectly stating the estate’s value: Underestimating or overestimating the value of the decedent's estate can have legal and tax implications. Ensure the stated value is accurate and reflects the fair market value.

Not mentioning existing debts and taxes: Claiming that all debts and taxes have been settled without actually verifying can lead to legal problems. It's better to accurately disclose the status of any debts and taxes.

Omitting the estate tax identification number: This is a unique number for the estate and failing to provide it can complicate financial transactions related to the estate.

Failing to sufficiently indemnify the Oklahoma Police Pension and Retirement System: The indemnification statement protects against future claims. Not agreeing to this fully or understanding its implications can lead to issues down the line.

When you’re dealing with something as important as an Affidavit of Heirship, paying attention to the details can save a lot of time and prevent legal headaches. Making sure all the information provided is accurate and complete is the key to a smooth process.

Documents used along the form

When dealing with the aftermath of a loved one's passing, it's common to need more than just an Affidavit of Heirship to properly manage their estate. This form is a key step in establishing the rightful heirs to someone's property when there's no will present. However, several other documents often come into play to ensure a smooth process of transferring the decedent's assets and taking care of their final affairs. Below are some additional forms and documents frequently used alongside the Affidavit of Heirship.

- Death Certificate: This official document confirms the death of the individual. It's required for almost all legal processes following a death, including the transfer of assets and closure of accounts.

- Will: When available, a will dictates the decedent's wishes regarding the distribution of their assets. While an Affidavit of Heirship is often used in the absence of a will, the will itself is a critical document when present.

- Letter of Testamentary: This legal document is issued by a court and grants authority to the executor named in the deceased's will. It allows them to distribute the estate according to the will's instructions.

- Letter of Administration: Similar to the Letter of Testamentary, but used when there is no will. It appoints an administrator to manage the estate's distribution according to the state's intestacy laws.

- Trust Documents: If the decedent established a trust, these documents outline how their assets should be handled and distributed, often bypassing the traditional probate process.

- Real Estate Deeds: Transferring property ownership requires updated deeds reflecting the new owners' names, which is especially relevant when real estate is part of an estate.

- Inventory and Appraisal Forms: Completing these forms helps to accurately account for the estate's assets, ensuring fair distribution among heirs or beneficiaries.

Understanding and gathering these documents can be a daunting task during a difficult time. Each plays a vital role in the process of settling an estate, from validating the decedent's death and executing their last wishes to properly distributing their assets. While the Affidavit of Heirship is integral when there's no will, the combined effect of these documents provides a clearer pathway through the legal complexities following someone's passing.

Similar forms

The Last Will and Testament is a document that shares similarities with the Affidavit of Heirship as it details how a deceased person's assets should be distributed among heirs. While both documents serve to identify beneficiaries or heirs, a Last Will and Testament is prepared ahead of a person’s death, expressing their final wishes. The Affidavit of Heirship, on the other hand, is used in the absence of a will to establish legal heirship, especially concerning property and assets not covered explicitly by a will, or when a will is not present.

Similar to an Affidavit of Heirship, a Transfer on Death Deed allows the direct transfer of property to beneficiaries upon the owner’s death without needing to go through probate court. This document helps bypass lengthy legal processes, much like how the Affidavit of Heirship simplifies the asset distribution process without a formal probate. However, the key difference is that the Transfer on Death Deed is arranged before death, specifying the intended beneficiary of specific real estate, thus providing a direct, straightforward transfer posthumously.

An Estate Tax Identification Number Application is another document that bears resemblance to the Affidavit of Heirship, as it is involved in the process of estate settlement after an individual’s passing. The Estate Tax ID number is crucial for the estate’s executor to report to the IRS for tax purposes related to the deceased's estate. While the Affidavit of Heirship is used to identify legal heirs, obtaining an Estate Tax Identification Number is a necessary step in managing the deceased’s obligations and rights, especially concerning tax liabilities.

Finally, the Power of Attorney is somewhat similar to the Affidavit of Heirship as both involve the delegation of authority regarding personal affairs. However, the Power of Attorney is executed while the person is alive, granting another individual the power to act on their behalf in various capacities, including financial decisions and legal matters. In contrast, the Affidavit of Heirship comes into play after death, identifying heirs who have the right to certain assets, thus implicitly transferring the authority over those assets without the direct involvement of the deceased.

Dos and Don'ts

When filling out an Affidavit of Heirship form, it is important to proceed with careful attention to detail and accuracy. This document is a critical step in managing the estate of someone who has passed away, especially in cases where a formal will was not left. Here are some guidelines to ensure the process is handled correctly.

Do:

- Provide accurate information. Ensure that all names, dates, and addresses are correct and match official documents.

- Verify heirship claims. Confirm that all individuals listed as heirs are legally entitled to inheritance under state law.

- Attach additional pages if necessary. If the space provided is not sufficient, attach additional sheets with the required information and reference them appropriately in the form.

- Review state laws. Each state has different laws regarding heirship; make sure you understand these laws to fill out the form accurately.

- Seek professional advice. Consider consulting with a legal professional specializing in estate planning or probate law to ensure the form is correctly completed.

- Keep copies. After notarization, make copies of the affidavit for your records and for any institutions requiring proof of heirship.

Don't:

- Leave sections blank. If a section does not apply, write “N/A” rather than leaving it empty to show that you didn’t overlook it.

- Guess information. If you’re unsure about specifics, take the time to verify details before submitting the form. Incorrect information can lead to delays or disputes.

- Overlook debts and taxes. Confirm that all debts and taxes of the estate are disclosed and addressed in the affidavit to avoid future liabilities.

- Forget to list all heirs. Ensure every possible heir is included to prevent legal complications down the road.

- Rush through the process. Take your time to carefully complete each part of the affidavit. Mistakes can be time-consuming and costly to correct.

- Sign without a notary present. The form requires notarization to be legally valid, so signing it in the absence of a notary will make it incomplete.

Correctly filling out an Affidavit of Heirship is a significant responsibility that contributes to a smoother legal process in handling the decedent's estate. By following these guidelines, you can help ensure that the process is conducted accurately and respectfully, honoring the deceased’s legacy and providing clarity for the heirs.

Misconceptions

When dealing with the transfer of assets after a loved one's death, an Affidavit of Heirship is often used to expedite the process. However, several misconceptions can complicate its use and understanding. Here are eight common misunderstandings about the Affidavit of Heirship form:

- It grants immediate access to the deceased’s assets. Despite popular belief, an Affidavit of Heirship does not provide instant access to a deceased person's assets. It serves to legally declare the heirs but does not bypass the need for some assets to go through probate.

- It’s universally accepted by all institutions. Not all institutions respond to an Affidavit of Heirship in the same way. Banks, for instance, may have their own policies and require additional documentation.

- Only for large estates. The implication that this document is only for large, complicated estates is incorrect. Small estates benefit from using an Affidavit of Heirship to simplify the transfer of certain assets, provided the estate meets specific state criteria.

- It replaces a will. An Affidavit of Heirship does not replace a will. Instead, it serves as a tool for heirs to establish their right to inherit assets in the absence of a will or in conjunction with probate proceedings.

- Legal representation is not necessary. While not always required, seeking legal advice is highly advisable when completing an Affidavit of Heirship. Legal professionals can ensure accuracy and compliance with state laws, preventing potential disputes or rejections.

- It eliminates the need for probate. This document does not eliminate the need for probate in all cases. While it can simplify the process for transferring certain assets, some aspects of the estate may still require formal probate proceedings.

- Any family member can file it. While it's true that a close relative often files the Affidavit of Heirship, specific qualifications may need to be met, and the filer may need to be recognized as a legitimate heir or have the consent of all heirs.

- It covers assets in multiple states. The Affidavit of Heirship is generally state-specific. Assets located outside of the state where the affidavit is filed typically require separate affidavits or processes according to each state's laws.

Understanding these misconceptions about the Affidavit of Heirship can prevent frustrations and ensure a smoother process in managing a deceased family member's estate.

Key takeaways

When filling out and using an Affidavit of Heirship form, it is essential to understand its purpose and the detailed requirements for completion. Below are key takeaways to guide individuals through this process:

- The Affidavit of Heirship is used to identify the legal heirs of a deceased person's estate, especially when no will exists.

- It requires the affiant, the person filling out the form, to provide their full name, relationship to the deceased, residence, and social security number.

- The form necessitates detailed information about the deceased, including their last address, the names and relationships of all surviving heirs, and the proportion of the estate each heir is entitled to receive.

- It's crucial to declare that no application for the appointment of a personal representative for the deceased's estate is pending or has been granted.

- The affidavit must confirm that all taxes and debts of the estate have been settled or are no longer claimable due to statutory limitations.

- A statement about the fair market value of the decedent's property within the state, asserting it does not exceed a specified amount, is required.

- For those claiming successorship, acknowledgment of the entitlement to payment in the stated proportions is necessary.

- The affiant agrees to indemnify and hold harmless the entity from which they are claiming funds (e.g., the Oklahoma Police Pension and Retirement System) against all potential claims in relation to the payment.

Properly completing an Affidavit of Heirship involves a comprehensive understanding of the decedent's estate and a careful compilation of all required information. Error-free completion and thorough accuracy are vital to expedite the resolution and distribution of the estate's assets.

Popular PDF Documents

Minnesota No Sales Tax - Entities eligible for the ST3 form include government agencies, nonprofits, and educational institutions.

How Long Does an Eviction Take - Issued after a court decides a landlord is entitled to regain possession due to unpaid rent.

IRS 720 - It plays a significant role in the healthcare sector by including provisions for taxes on medical devices and pharmaceuticals.