Get Ach Vendor Payment Form

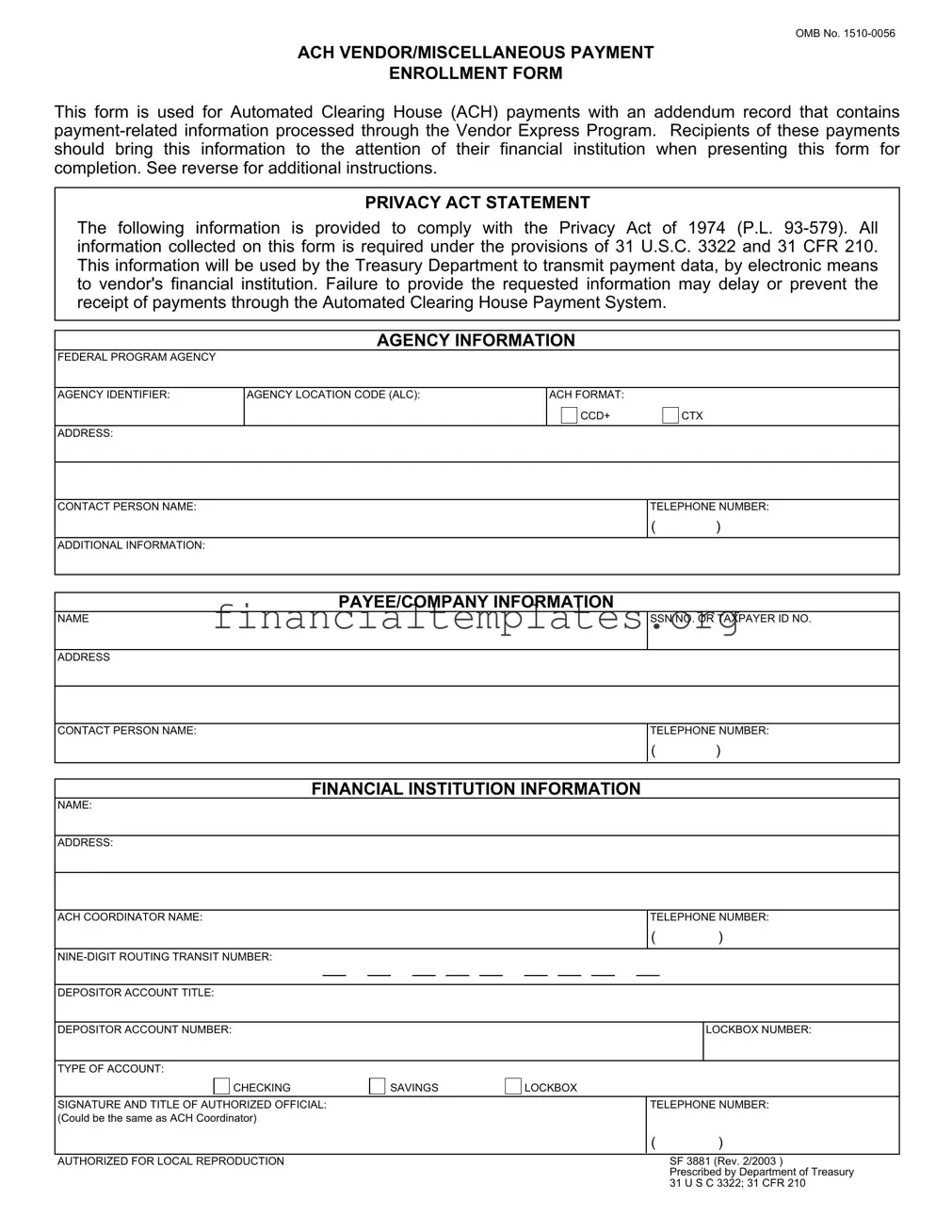

In the intricate web of modern business transactions, the efficiency and security of payments are paramount. The ACH Vendor/Miscellaneous Payment Enrollment Form serves as a crucial instrument in streamlining the payment processes through the Automated Clearing House (ACH) payments system, specifically tailored for vendors engaging with federal agencies. This form, adorned with the OMB No. 1510-0056, acts as a bridge facilitating electronic transactions directly to a vendor’s financial institution, thereby expediting the transfer of funds while ensuring accuracy and reducing paperwork. Detailed within this form are sections designated for agency information, detailing the specifics of the federal program agency initiating the payment, and payee/company information, where vendors provide essential identification details and banking information. Crucially, the financial institution’s segment captures the requisite banking details necessary to process these electronic payments. Moreover, the form is designed with a Privacy Act Statement, adhering to the Privacy Act of 1974, to underline the importance of confidentiality and the thoughtful handling of personal and financial data. In addition to offering clarity on the procedural aspects, instructions for completing and replicating the form ensure comprehensibility and ease of use for all parties involved. This structured approach not only underlines the government’s commitment to employing efficient payment mechanisms but also highlights the regulatory compliance and data security aspects inherent in the automation of vendor payments.

Ach Vendor Payment Example

OMB No.

ACH VENDOR/MISCELLANEOUS PAYMENT

ENROLLMENT FORM

This form is used for Automated Clearing House (ACH) payments with an addendum record that contains

PRIVACY ACT STATEMENT

The following information is provided to comply with the Privacy Act of 1974 (P.L.

AGENCY INFORMATION

FEDERAL PROGRAM AGENCY

AGENCY IDENTIFIER: |

AGENCY LOCATION CODE (ALC): |

ACH FORMAT: |

|

|

||

|

|

|

|

CCD+ |

|

CTX |

|

|

|

|

|

||

|

|

|

|

|

|

|

ADDRESS: |

|

|

|

|

|

|

CONTACT PERSON NAME:

ADDITIONAL INFORMATION:

TELEPHONE NUMBER:

( )

PAYEE/COMPANY INFORMATION

NAME

ADDRESS

CONTACT PERSON NAME:

SSN NO. OR TAXPAYER ID NO.

TELEPHONE NUMBER:

( )

FINANCIAL INSTITUTION INFORMATION

NAME:

ADDRESS:

ACH COORDINATOR NAME:

TELEPHONE NUMBER:

( )

DEPOSITOR ACCOUNT TITLE:

DEPOSITOR ACCOUNT NUMBER: |

|

|

|

|

|

LOCKBOX NUMBER: |

||

|

|

|

|

|

|

|

|

|

TYPE OF ACCOUNT: |

|

|

|

|

|

|

||

|

|

CHECKING |

|

SAVINGS |

|

LOCKBOX |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

SIGNATURE AND TITLE OF AUTHORIZED OFFICIAL: |

|

|

|

|

TELEPHONE NUMBER: |

|||

(Could be the same as ACH Coordinator) |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

( |

) |

AUTHORIZED FOR LOCAL REPRODUCTION |

SF 3881 (Rev. 2/2003 ) |

|

Prescribed by Department of Treasury |

|

31 U S C 3322; 31 CFR 210 |

Instructions for Completing SF 3881 Form

Make three copies of form after completing. Copy 1 is the Agency Copy; copy 2 is the Payee/ Company Copy; and copy 3 is the Financial Institution Copy.

1.Agency Information Section - Federal agency prints or types the name and address of the Federal program agency originating the vendor/miscellaneous payment, agency identifier, agency location code, contact person name and telephone number of the agency. Also, the appropriate box for ACH format is checked.

2.Payee/Company Information Section - Payee prints or types the name of the payee/company and address that will receive ACH vendor/miscellaneous payments, social security or taxpayer ID number, and contact person name and telephone number of the payee/company. Payee also verifies depositor account number, account title, and type of account entered by your financial institution in the Financial Institution Information Section.

3.Financial Institution Information Section - Financial institution prints or types the name and address of the payee/company's financial institution who will receive the ACH payment, ACH coordinator name and telephone number,

Burden Estimate Statement

The estimated average burden associated with this collection of information is 15 minutes per respondent or recordkeeper, depending on individual circumstances. Comments concerning the accuracy of this burden estimate and suggestions for reducing this burden should be directed to the Financial Management Service, Facilities Management Division, Property and Supply Branch, Room

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of the Form | This form is utilized for Automated Clearing House (ACH) payments specifically with an addendum record for payment-related information, processed through the Vendor Express Program. |

| Privacy Act Compliance | The form adheres to the Privacy Act of 1974, ensuring all collected information is required under the provisions of 31 U.S.C. 3322 and 31 CFR 210, used for transmitting payment data electronically. |

| Implications of Non-compliance | Failure to provide the requested information on the form may lead to delays or prevent the receipt of payments via the ACH Payment System, emphasizing the importance of accurate completion. |

| Completion Instructions | Instructions for completing the form include making three copies post-completion, with each designated for the Agency, the Payee/Company, and the Financial Institution, detailing specific information to be provided by each party. |

Guide to Writing Ach Vendor Payment

Filling out the ACH Vendor/Miscellaneous Payment Enrollment Form is important for vendors seeking to receive payments electronically through the Automated Clearing House (ACH). This form ensures that payment information is accurately transmitted to a vendor's financial institution. Following the correct steps will streamline the process, ensuring prompt and correct payment. It's necessary to comply with the Privacy Act of 1974 when handling this form, meaning that all provided information must be accurate and complete to avoid delays or issues with payment reception.

Steps for Completing the ACH Vendor Payment Enrollment Form:

- Agency Information Section:

- Print or type the name and address of the Federal program agency originating the payment.

- Fill in the agency identifier and agency location code (ALC).

- Provide the contact person's name and telephone number.

- Check the appropriate box to indicate the ACH format: CCD+ or CTX.

- Payee/Company Information Section:

- Print or type the payee/company's name and address.

- Enter the social security number (SSN) or taxpayer identification number (TIN).

- Provide the name and telephone number of the payee/company's contact person.

- Verify the financial information provided by the financial institution, including the depositor account number, account title, and type of account.

- Financial Institution Information Section:

- Print or type the financial institution's name and address where the ACH payment will be received.

- Fill in the ACH coordinator's name and telephone number.

- Enter the nine-digit routing transit number.

- Check the box to indicate the type of account: Checking or Savings.

- Include the signature, title, and telephone number of the authorized official from the financial institution.

- After completing the form, make three copies:

- Keep one copy for the agency (Agency Copy).

- Provide one copy to the payee/company (Payee/Company Copy).

- Send one copy to the financial institution (Financial Institution Copy).

Once the form is accurately completed and distributed, the vendor is prepared to receive ACH payments. Double-check all entries for correctness to prevent any potential delays in payment processing. Remember, accurate and complete submissions are crucial for a smooth transaction process.

Understanding Ach Vendor Payment

What is the ACH Vendor/Miscellaneous Payment Enrollment Form?

This form enables payments to be transferred electronically from a federal program agency to a vendor's bank account through the Automated Clearing House (ACH) system. It ensures that payment-related information is included as an addendum record.

What information is required to complete the ACH Vendor Payment Enrollment Form?

Three main sections need to be filled out: Agency Information, which includes details about the federal program agency; Payee/Company Information, providing vendor details; and Financial Institution Information, which specifies the vendor's banking details.

Why is the ACH Vendor Payment Enrollment Form important?

It is essential for vendors who wish to receive payments electronically from federal agencies, ensuring faster and more secure transactions. Failure to provide the requested information may delay or prevent receipt of payments.

What happens if I do not submit the ACH Vendor Payment Enrollment Form?

Not submitting this form could lead to delays or failures in receiving payments electronically from federal agencies, necessitating alternative, slower payment methods.

How is my privacy protected when I fill out the ACH Vendor Payment Enrollment Form?

The Privacy Act of 1974 protects the information provided on this form. The Treasury Department uses this information only to transmit payment data electronically, ensuring your details are used strictly for payment processing.

Is it mandatory to provide a Social Security Number or Taxpayer ID Number on the form?

Yes, providing a Social Security Number or Taxpayer ID Number is required for identification purposes and to process payments correctly to the right vendor.

How do I know which ACH format to select?

The ACH format (CCD+ or CTX) depends on the federal program agency's preference or requirement. This information can typically be found in the agency's payment instructions or by contacting the agency directly.

What should I do after completing the ACH Vendor Payment Enrollment Form?

After completing the form, make three copies: one for the agency, one for yourself (the payee or company), and one for your financial institution. Ensure all parties receive their respective copy to facilitate the payment process.

Can changes be made to the form after submission?

If changes are needed after submission, contact the federal program agency directly. You might need to complete a new form to update information like bank details, contact information, or payment preferences.

Who can I contact for help with the ACH Vendor Payment Enrollment Form?

For help, you should first refer to the additional instructions provided on the reverse side of the form. If further assistance is needed, contact the federal program agency you're working with or your financial institution's ACH coordinator.

Common mistakes

When filling out the ACH Vendor Payment Enrollment Form, attention to detail is crucial. Common mistakes can lead to delays or issues in processing payments. Here’s a list of ten errors often encountered:

Not double-checking the agency information. The Federal program agency's name, address, and other identifiers must be accurate to ensure the payment is processed by the correct agency.

Entering incorrect Payee/Company Information. This includes the payee’s or company’s name, address, and especially the Social Security Number (SSN) or Taxpayer Identification Number (TIN), as errors here can lead to misdirected or delayed payments.

Failing to confirm the account information. The depositor account number and title must match the account holder's records exactly.

Selecting the wrong type of account. Knowing whether the account is checking, savings, or a lockbox is fundamental for correctly routing the payment.

Omitting the correct ACH format. The selection between CCD+ and CTX can affect how information is processed and must be selected carefully based on the type of payment.

Inaccuracies in the Financial Institution Information. This includes the name, address, and especially the nine-digit routing transit number of the financial institution.

Forgetting to obtain or include the signature and title of the authorized official. This verification step is critical for validating the form’s information.

Mistakes in contact information. Both the contact person’s name and telephone numbers for the agency, payee/company, and financial institution need to be current and accurate.

Not using the form’s latest version. Using an outdated form can lead to incorrect processing as instructions and requirements may have changed.

Overlooking the Privacy Act Statement and instructions. Understanding the use of collected information and properly filling out the form according to the instructions can prevent many errors.

Ensuring the accuracy and completeness of all sections of the ACH Vendor Payment Enrollment Form is paramount. Even seemingly minor mistakes can disrupt the payment process, leading to delays or the need to resubmit the form. Always review each section carefully before submission.

Documents used along the form

When processing payments through the Automated Clearing House (ACH) system, the ACH Vendor/Miscellaneous Payment Enrollment Form serves as a crucial document for setting up the vendor's information in the payment system. However, this form is often not the only document required for complete and efficient processing. Several other forms and documents frequently accompany the ACH form to ensure that all vendor payment procedures are followed correctly and comprehensively.

- W-9 Form - Required for U.S. persons (including residents and citizens) to provide their taxpayer identification number (TIN) to the entity that will pay them. It helps in ensuring accurate tax reporting to the IRS.

- Direct Deposit Authorization Form - Used by the payee to authorize direct deposit payments into their bank account and to provide the payer with the necessary account information.

- Invoice - A detailed statement provided by the vendor listing the goods or services provided, their costs, and the total amount due. It supports the payment request.

- Purchase Order - Issued by the buyer to the vendor to authorize a purchase. It outlines the items or services requested, quantities, and agreed-upon prices.

- Bank Letter - Often used to verify the bank account details provided by the payee/vendor. It is a statement from the bank confirming the account holder's details.

- Contract or Agreement - A document outlining the terms and conditions of the service or product purchase between the payee/vendor and the payer. It legally binds both parties to the terms of the agreement.

- IRS Form 945 - Used to report withheld federal income tax from non-payroll payments. It may be relevant in situations where taxes are withheld from vendor payments.

Together, these documents form a comprehensive package that supports the electronic payment process, ensuring that all transactions comply with legal requirements, and that payments are processed smoothly, securely, and efficiently. By having a thorough understanding of each document's purpose and requirements, entities can streamline their payment processes and maintain accurate records for financial management and reporting.

Similar forms

The W-9 Form (Request for Taxpayer Identification Number and Certification) shares similarities with the ACH Vendor Payment form. Both require the supplier or individual to provide their Taxpayer Identification Number (TIN) or Social Security Number (SSN), ensuring the correct linkage of financial transactions and tax records. Each form serves to facilitate smooth financial transactions while adhering to federal regulations, minimizing tax reporting issues, and ensuring accurate payment processing and reporting.

The Direct Deposit Enrollment Form, often used by employers for setting up payroll deposits, closely aligns with the ACH Vendor Payment form. It captures essential information such as bank routing and account numbers, similar to the financial institution details required on the ACH form. This facilitates the electronic transfer of funds, ensuring employees or vendors receive payments directly in their chosen bank account efficiently and securely.

A Vendor Application Form, although more comprehensive in scope, shares the purpose of gathering key details about a vendor, akin to the ACH Vendor Payment form. It includes identifying information such as business name and taxpayer or social security numbers, and may also ask for banking details for payment purposes. Both forms are used to streamline the payment process between businesses and their vendors or contractors.

The Electronic Funds Transfer (EFT) Authorization Form mirrors the ACH Vendor/Miscellaneous Payment Enrollment Form in its purpose to authorize electronic payments. The EFT form collects banking information, including routing and account numbers, facilitating a direct, electronic transfer of funds. This similarity underscores the move towards more efficient, digital payment processes across different contexts.

The IRS Form 8300 (Report of Cash Payments Over $10,000 Received in a Trade or Business) shares a commonality with the ACH Vendor Payment form through its focus on financial transactions and compliance. While Form 8300 is specific to large cash transactions and their reporting, both forms gather taxpayer identification to comply with federal regulations, highlighting the importance of transparency in financial operations.

The Purchase Order Form, used by businesses to authorize the purchase of goods or services, relates indirectly to the ACH Vendor Payment form. While it does not collect bank information, it initiates the transaction process that culminates in payment, potentially through ACH, to the vendor. The capturing of detailed information about the transaction lays the groundwork for a smooth payment process.

The Business Credit Application Form is another document that, while broader in scope, includes elements similar to those in the ACH Vendor Payment form. It may request bank and trade references along with financial information to evaluate creditworthiness. Part of the information gathered can include banking details for future transactions, underscoring the interconnectedness of credit and payment processes.

The Bank Account Verification Letter serves a purpose closely aligned with the information verification aspect of the ACH Vendor Payment form. By confirming the account holder's details and the account status, it ensures that electronic transfers, like those facilitated through the ACH system, are made accurately to verified accounts, thereby minimizing the risk of errors or fraud.

The Invoice Form, although typically a request for payment rather than a payment authorization, intersects with the ACH Vendor Payment form through its role in the payment process. Invoices detail what services or products have been provided, culminating in the need for payment that might be processed via ACH, thus linking the provision of services with the mechanics of payment.

Dos and Don'ts

Filling out the ACH Vendor Payment Enrollment Form is a crucial step for ensuring smooth, electronic transactions between your business and federal agencies. To help you navigate this process with ease, let's dive into some key dos and don'ts that will keep you on the right track.

Do:

- Review the entire form before filling it out. Getting familiar with the form's structure and requirements will help you gather all the necessary information ahead of time, preventing back-and-forths that could delay your payments.

- Double-check the accuracy of your financial information. Errors in your bank account or routing number can lead to failed transactions. Always verify these details with your financial institution to ensure accuracy.

- Keep a copy for your records. After completing the form and making the three required copies, retain one for your own documentation. This will be invaluable in case any disputes or discrepancies arise in the future.

- Provide clear and legible information. Whether you're typing or writing by hand, make sure all entries are readable. This reduces the risk of errors when your information is processed.

Don't:

- Leave sections incomplete. Each section of the form requests specific information that's critical for processing your payments. If a section doesn't apply to you, mark it as "N/A" instead of leaving it blank.

- Guess any information. If you're unsure about specific details, such as your agency location code or the correct ACH format, reach out to the relevant federal agency or your financial institution for clarification.

- Use outdated forms. Forms and their requirements can change. Always check that you're using the latest version of the form to comply with the most recent guidelines and regulations.

- Forget to sign the form. An unsigned form is often considered incomplete. Ensure that the authorized official from your financial institution signs the form, as this is a critical step for validation.

By adhering to these guidelines, you'll be able to complete the ACH Vendor Payment Enrollment Form accurately and efficiently, paving the way for hassle-free electronic payments.

Misconceptions

When dealing with the ACH Vendor Payment Enrollment Form, various misconceptions can lead to confusion and errors in the processing of payments. Below are nine common misconceptions that need to be addressed to ensure clarity and efficiency in utilizing the form.

- Misconception 1: The form is optional for electronic payments. This is incorrect as the form is mandatory for any vendor wishing to receive payments via the Automated Clearing House (ACH) system. The necessity of this form is underlined by the leverage and efficiency ACH payments offer over traditional check payments.

- Misconception 2: Personal information is not secure when submitted through this form. In reality, the form adheres to the Privacy Act of 1974, ensuring that all information provided is used solely for the purpose of transmitting payment data to the vendor's financial institution and is handled with the utmost security and confidentiality.

- Misconception 3: Any bank account can be used for receiving payments. The form actually requires specific information regarding the type of account (checking or savings), along with a nine-digit routing transit number and depositor account number, ensuring that only valid and appropriately structured accounts are used for receiving payments.

- Misconception 4: The form only needs to be completed once and never updated. Vendors should update their ACH Vendor Payment Enrollment Form whenever there are changes in their banking information, contact details, or any other pertinent information that could affect the receipt of payments.

- Misconception 5: The Agency Information Section is irrelevant to the payee. This section provides essential details about the federal program agency originating the payment, including contact information, which could be crucial for addressing any payment-related inquiries or issues.

- Misconception 6: Submission of the form guarantees immediate payment processing. While completing and submitting the form is a critical step, processing times can vary depending on several factors, including the accuracy of the information provided and the processing capabilities of the involved financial institutions.

- Misconception 7: Electronic submissions of the form are always acceptable. Depending on the agency and the specific procedures in place, some submissions might require a hard copy of the form with original signatures to be mailed, hindering the assumption that digital submissions are universally accepted.

- Misconception 8: Financial institutions do not play a significant role in this process. Financial institutions not only receive the payment but also are responsible for verifying the depositor account details and ensuring that the payment is credited to the correct account, underscoring their vital role in the ACH payment process.

- Misconception 9: The burden estimate for completing the form is overly exaggerated. With an estimated average burden of 15 minutes per respondent, this takes into account the potential complexity and necessity for accuracy when entering the required information, stressing the importance of diligence in completing the form.

Understanding and addressing these misconceptions are crucial for vendors and financial institutions alike to ensure the smooth and efficient processing of ACH payments. Clear communication and adherence to the specified requirements on the ACH Vendor Payment Enrollment Form are essential for leveraging the benefits of electronic payments.

Key takeaways

- Understanding the purpose of the ACH Vendor/Miscellaneous Payment Enrollment Form is crucial. It is utilized for Automated Clearing House (ACH) payments incorporating an addendum record with payment-related information to be processed through the Vendor Express Program.

- The importance of the Privacy Act Statement cannot be overstated. This piece of information complies with the Privacy Act of 1974, ensuring that all collected data on this form, required under 31 U.S.C. 3322 and 31 CFR 210, is used solely by the Treasury Department to transmit payment data electronically to the vendor’s financial institution.

- Failure to provide requested information on the form could lead to delays or prevent the receipt of payments through the ACH Payment System, emphasizing the necessity for completeness and accuracy.

- The form is divided into three main sections: Agency Information Section, Payee/Company Information Section, and Financial Institution Information Section – each requiring specific details relevant to processing the payment correctly.

- In the Agency Information Section, federal agencies must provide details about the federal program agency, such as the name, address, identifier, and the contact person’s name and telephone number. Also, selecting the appropriate ACH format is critical.

- For the Payee/Company Information Section, the payee or company receiving the payment must include their name, address, social security or taxpayer ID number, and contact information, along with verification of depositor account details as provided by their financial institution.

- In the Financial Institution Information Section, it's necessary for the payee’s financial institution to supply its name, address, ACH coordinator details, routing transit number, and the payee/company account information including the account title, number, and type.

- Making three copies of the completed form is advised – one for the agency, one for the payee/company, and one for the financial institution – to ensure that all involved parties have a record of the transaction.

- Lastly, the burden estimate statement provides an average time expected to complete the form, pegged at 15 minutes per respondent or recordkeeper. It also invites suggestions for reducing this burden, showing an openness to improving the process efficiency.

Popular PDF Documents

E File Extension - Automatic extension through Form 4868 offers peace of mind, allowing filers to focus on accuracy over rushing to meet the original deadline.

Irs Power of Attorney - Highlights the need for the representative to sign and declare they are eligible to practice before the IRS.

IRS 4868 - A successfully filed Form 4868 automatically grants an extension, with no approval from the IRS needed.