Get Ach Stop Payment Form

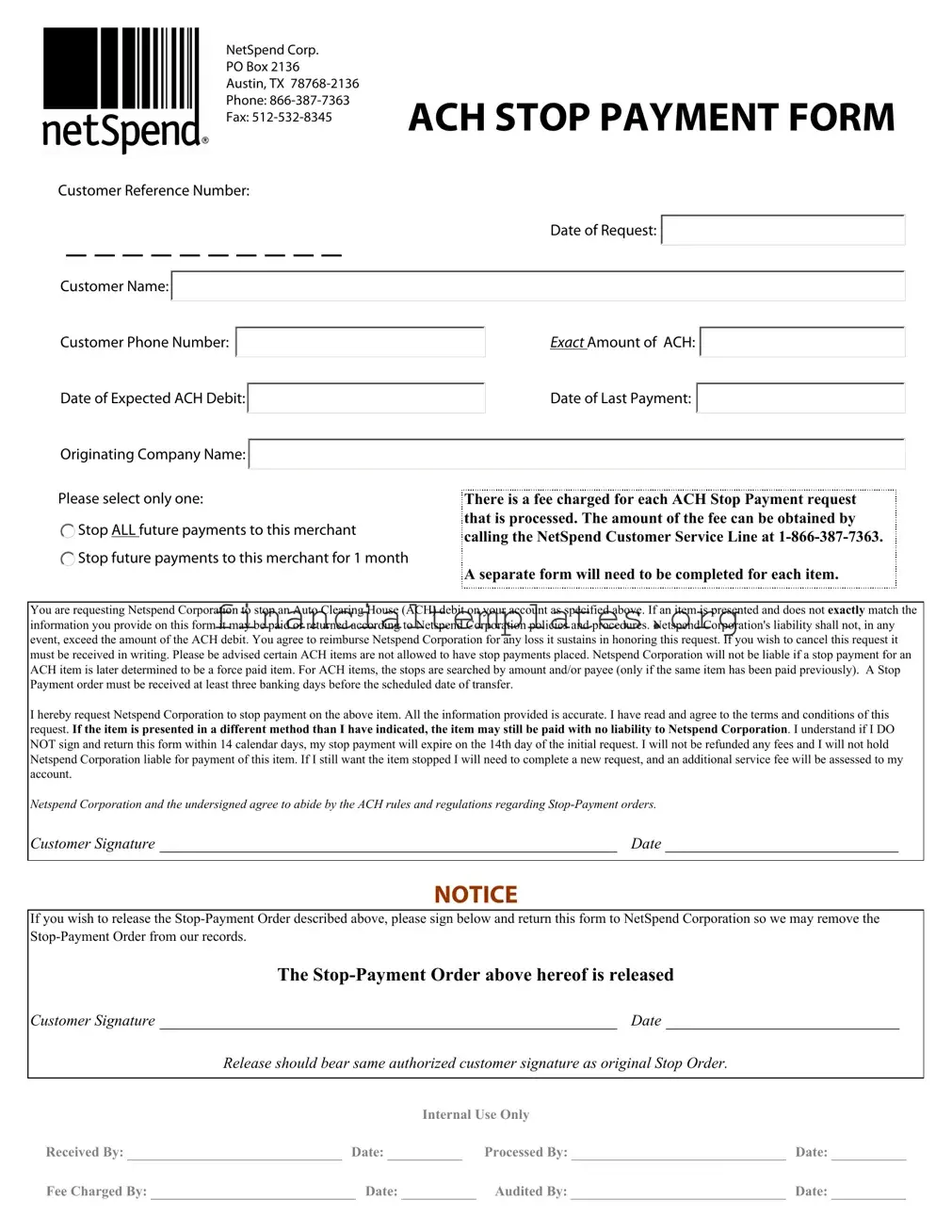

Managing your finances often requires direct action, especially when unauthorized or incorrect transactions threaten your account's integrity. One such action is the issuance of an ACH Stop Payment request, a critical tool provided by NetSpend Corporation for account holders needing to halt an Automated Clearing House (ACH) debit. This form, housed within the company's processes, demands precise information, including the customer's name, reference number, the exact ACH amount, and details about the transaction in question such as the originator's name and the expected date of the debit. It presents the customer with options to stop payments temporarily or indefinitely, emphasizing that a separate form is necessary for each transaction. Importantly, this process incurs a fee, the specifics of which can be clarified by contacting NetSpend Customer Service. The form outlines the conditions under which a stop payment request can be executed, the timing for the submission relative to the scheduled transaction, and the potential for additional charges should a new stop payment request be necessary. It also sets forth the obligations of NetSpend and the customer in complying with ACH rules and regulations, thereby highlighting the shared responsibility in managing electronic transactions securely and effectively.

Ach Stop Payment Example

|

NetSpend Corp. |

|

|

|

|

|

|||

|

PO Box 2136 |

|

|

|

|

|

|||

|

Austin, TX |

|

|

|

|

|

|||

|

Phone: |

ACH STOP PAYMENT FORM |

|||||||

|

Fax: |

||||||||

|

|

|

|

|

|

||||

Customer Reference Number: |

|

|

|

|

|

||||

_ _ _ _ _ _ _ _ _ _ |

|

Date of Request: |

|

|

|

||||

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customer Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Customer Phone Number: |

|

|

|

|

EXACT Amount of ACH: |

|

|||

|

|

|

|

|

|

|

|

||

Date of Expected ACH Debit: |

|

|

|

Date of Last Payment: |

|

|

|||

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Originating Company Name: |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Please select only one:

Stop ALL future payments to this merchant

Stop ALL future payments to this merchant

Stop future payments to this merchant for 1 month

Stop future payments to this merchant for 1 month

There is a fee charged for each ACH Stop Payment request that is processed. The amount of the fee can be obtained by calling the NetSpend Customer Service Line at

A separate form will need to be completed for each item.

You are requesting Netspend Corporation to stop an Auto Clearing House (ACH) debit on your account as specified above. If an item is presented and does not exactly match the information you provide on this form it may be paid or returned according to Netspend Corporation policies and procedures. Netspend Corporation's liability shall not, in any event, exceed the amount of the ACH debit. You agree to reimburse Netspend Corporation for any loss it sustains in honoring this request. If you wish to cancel this request it must be received in writing. Please be advised certain ACH items are not allowed to have stop payments placed. Netspend Corporation will not be liable if a stop payment for an ACH item is later determined to be a force paid item. For ACH items, the stops are searched by amount and/or payee (only if the same item has been paid previously). A Stop Payment order must be received at least three banking days before the scheduled date of transfer.

I hereby request Netspend Corporation to stop payment on the above item. All the information provided is accurate. I have read and agree to the terms and conditions of this request. If the item is presented in a different method than I have indicated, the item may still be paid with no liability to Netspend Corporation. I understand if I DO NOT sign and return this form within 14 calendar days, my stop payment will expire on the 14th day of the initial request. I will not be refunded any fees and I will not hold Netspend Corporation liable for payment of this item. If I still want the item stopped I will need to complete a new request, and an additional service fee will be assessed to my account.

Netspend Corporation and the undersigned agree to abide by the ACH rules and regulations regarding

Customer Signature _________________________________________________ Date _________________________

NOTICE

If you wish to release the

The

Customer Signature _________________________________________________ Date _________________________

Release should bear same authorized customer signature as original Stop Order.

Internal Use Only

Received By: _______________________ Date: ________ |

Processed By: _______________________ |

Date: ________ |

Fee Charged By: ______________________ Date: ________ |

Audited By: _______________________ |

Date: ________ |

Terms

Automated Clearing House (ACH) - The ACH Network is a nationwide

ACH payments include, but are not limited to:

*Direct Deposit of payroll, Social Security and other government benefits, and tax refunds; *Direct Payment of consumer bills such as loans, utility bills and insurance premiums;

*Federal, state and local tax payments

Customer Name - Name listed on the ACH and the name should appear on the NetSpend account.

Customer Reference Number - This is a number obtained from Netspend and is used to locate your account on their system.

Date of Request - Date customer completed form.

Originating Company Name - Name of company sending the ACH to Netspend. Any individual, corporation or other entity that initiates entries into the Automated Clearing House (ACH) Network.

Written Statement of Unauthorized Debit (WSUD) form - A sworn Statement by a customer declaring that a particular ACH transaction was unauthorized, improper or that authorization for the transaction has been revoked.

Frequently Asked Questions

What happens if the ACH is not stopped in time or shows up on my account?

If the ACH appears on your account, please fill out a WSUPP form. The form may be obtained by calling the NetSpend Customer Service Line at

Will I still be charged a fee for the Stop Payment request if the ACH is not stopped?

Yes. The fee is intended to pay for the processing of the form. This is not a guarantee that the payment will be stopped. NetSpend

will take reasonable measures to ensure that the payment does not post to the account.

When will the Stop Payment fee be removed from my account?

The Stop Payment fee will be obtained when you first communicate to NetSpend your request to stop a payment.

Can I stop payment on any ACH?

Yes. Simply notify NetSpend, either orally or in writing, at least three business days before the scheduled payment date. If you call NetSpend, you may also be required to provide a written request within 14 days. As a courtesy, you may also want to inform the Originating Company that you are stopping a payment. Keep in mind this only stops one payment, until the request is received in writing. If you want to revoke your authorization for all future payments, you need to contact the Originating Company.

Can I stop multiple payments from multiple companies with one form?

No. Due to record keeping purposes, you must fill out one form for each merchant and/or dollar amount. A Stop Payment fee will be assessed for each request.

Document Specifics

| Fact | Detail |

|---|---|

| Form Purpose | This form is used to request NetSpend Corporation to stop an Automated Clearing House (ACH) debit transaction. |

| Governing Law | The ACH Network is governed by NACHA Operating Rules. The Federal Reserve and Electronic Payments Network act as ACH Operators. |

| Customer Information | Required information includes Customer Name, Customer Reference Number, Date of Request, Customer Phone Number, and Originating Company Name. |

| Transaction Details | Details required for a stop payment include the EXACT Amount of ACH, Date of Expected ACH Debit, and Date of Last Payment. |

| Stop Payment Options | Customers can choose to stop all future payments to a merchant or stop future payments for 1 month. |

| Stop Payment Fee | A fee is charged for processing each ACH Stop Payment request, which can be obtained by contacting NetSpend Customer Service. |

| Submission Deadline | A Stop Payment order must be received at least three banking days before the scheduled date of the ACH transaction. |

| Procedure for Unstopped ACH | If an ACH is not stopped in time and appears on the account, a Written Statement of Unauthorized Debit (WSUD) form must be filled out. |

| Form Validity and Authorization Revocation | The stop payment request expires after 14 calendar days if not signed and returned. To revoke a request, it must be received in writing. |

Guide to Writing Ach Stop Payment

When you need to halt an Automated Clearing House (ACH) debit, the ACH Stop Payment Form serves as your request to NetSpend Corporation. This action is significant, notably when you aim to prevent specific payments from being withdrawn from your account. It is vital to note that once this form is submitted and processed, a fee is charged, and certain ACH debits might not be eligible for a stop payment, according to Netspend's policy and regulatory guidelines. To ensure a smooth and successful stop payment request, follow the steps below carefully.

- Write "NetSpend Corp. PO Box 2136 Austin, TX 78768-2136" on the envelope if you're mailing the form, or use the provided fax number, 512-532-8345, to send your request.

- Enter your Customer Reference Number in the designated space. This number helps Netspend identify your account quickly.

- Fill in the Date of Request to document when you are submitting this stop payment order.

- Provide your name in the Customer Name area as it appears on your Netspend account.

- Include your Customer Phone Number for any necessary contact regarding this request.

- Specify the EXACT Amount of ACH you intend to stop. Precision here is crucial for the correct processing of your request.

- Indicate the Date of Expected ACH Debit along with the Date of Last Payment to offer clear context for your request.

- Enter the Originating Company Name, identifying the source of the ACH debit.

- Choose between stopping ALL future payments to this merchant or to stop future payments to this merchant for 1 month by checking the appropriate box.

- After reviewing all the information for accuracy and completeness, sign the form in the Customer Signature space and date it accordingly.

- If applicable, to release a previously requested Stop-Payment order, sign and date in the designated area at the bottom of the form.

Upon completion and submission of the ACH Stop Payment Form, your request will undergo processing by the Netspend team. Be mindful of the requirement for the form to be received at least three banking days before the scheduled date of transfer to enhance the chances of successful stoppage. Should circumstances change, and you decide to cancel this stop payment, your written cancellation must be received before it takes effect. Remember, each stop payment request requires a separate form and incurs a fee, signifying your agreement to Netspend’s terms.

Understanding Ach Stop Payment

-

What happens if the ACH is not stopped in time or shows up on my account?

If the ACH appears on your account despite a stop payment request, a Written Statement of Unauthorized Debit (WSUD) form should be completed. This form can be obtained by contacting the NetSpend Customer Service Line. Filling out this form will help initiate the dispute process for the unauthorized transaction.

-

Will I still be charged a fee for the Stop Payment request if the ACH is not stopped?

Yes, the fee charged for processing a Stop Payment request is applied even if the ACH is not successfully stopped. This fee compensates for the processing efforts and does not guarantee the payment will be halted. NetSpend commits to taking reasonable measures to prevent the ACH from posting to your account.

-

When will the Stop Payment fee be removed from my account?

The Stop Payment fee is charged to your account as soon as NetSpend processes your request to halt a payment. This fee is for processing the request and is not contingent on the outcome.

-

Can I stop payment on any ACH transaction?

Yes, you can request a stop payment on any ACH transaction. You need to notify NetSpend at least three business days before the scheduled payment date. If you make the request by phone, a written request may also be required within 14 days. While NetSpend can stop the payment on their end, it is also prudent to inform the originating company of your intention to stop the payment, particularly if you wish to halt all future payments.

-

Can I stop multiple payments from multiple companies with one form?

No, you cannot use one form to stop payments to multiple merchants or for multiple amounts. For accuracy and tracking purposes, a separate Stop Payment form must be completed for each payment you wish to stop. Note that a fee will be assessed for each stop payment request submitted.

-

What is the ACH Network?

The Automated Clearing House (ACH) Network is a secure, nationwide electronic funds transfer system. It enables participating financial institutions to send and receive electronic transactions, including direct deposits and bill payments. The system is governed by NACHA Operating Rules, ensuring reliable and efficient processing of electronic payments.

-

What does the customer reference number mean?

The customer reference number is a unique identifier assigned to your account. It helps NetSpend quickly locate your account information in their system to process your Stop Payment request promptly. This number is essential for ensuring that your stop payment request is accurately associated with your account.

-

What is the process for canceling a Stop Payment request?

To cancel a Stop Payment request, you need to inform NetSpend in writing. The cancellation must be received before the scheduled ACH transaction date to ensure the stop payment is removed in time. If the original stop payment request was signed, ensure your cancellation request is also signed to match the authorization.

Common mistakes

When filling out the ACH (Automated Clearing House) Stop Payment form, it’s crucial to avoid certain mistakes to ensure that your request is processed efficiently and effectively. Unfortunately, some people may find the process confusing or may not understand the importance of accuracy in their submissions. Here are four common mistakes people make:

- Incorrect or incomplete information: One of the primary mistakes is failing to provide the correct and complete information required on the form. The details such as Customer Reference Number, Date of Request, Customer Name, Customer Phone Number, EXACT Amount of ACH, Date of Expected ACH Debit, Date of Last Payment, and the Originating Company Name must be accurately filled out. An error in any of these fields can lead to the request being delayed or denied.

- Not specifying the type of stop request: The form offers options to either Stop ALL future payments to the merchant or to Stop future payments for 1 month. Failing to select one of these options can lead to ambiguity, rendering the request ineffective. Clear communication about the stop payment duration is essential.

- Ignoring the timing: A Stop Payment order must be received at least three banking days before the scheduled date of the transfer. Overlooking this requirement can result in the inability to stop the payment in time, as the process time will not meet the necessary timeframe to halt the transaction.

- Not providing a signature: The process requires the customer’s signature to validate the request. Neglecting to sign the form or providing a signature that doesn't match the one on file can invalidate the request. Moreover, if there's a need to cancel or release the Stop-Payment Order, a matching signature on the release section is also required to process that change.

To avoid these mistakes, here are some proactive steps:

- Double-check all filled information for accuracy before submitting the form.

- Clearly mark your choice between stopping all payments or only for a specific period.

- Plan ahead to ensure your Stop Payment request is submitted well in advance of the three-banking-day requirement.

- Sign the form and ensure your signature matches the one NetSpend has on file. Consider contacting NetSpend directly if you are unsure about the signature they have.

Attending to these details can greatly increase the likelihood of your ACH Stop Payment request being processed smoothly and prevent unwanted transactions from affecting your account.

Documents used along the form

When managing your finances, especially pertaining to Automated Clearing House (ACH) transactions, it's essential to be aware of various forms and documents that can assist in safeguarding your interests. This knowledge is crucial, for instance, when you need to use an ACH Stop Payment form. This particular document, a tool for stopping specific ACH debits from being processed, is only a part of a suite of financial management tools at your disposal. Below, other important documents are explained, which often complement the ACH Stop Payment request or are similarly used in financial management contexts.

- Account Statement: This document lays out all the transactions that have occurred within a specified period. It can be instrumental in identifying unauthorized transactions or errors that may necessitate an ACH Stop Payment.

- Authorization Agreement for Preauthorized Payments form (AAP): Before an ACH debit can be initiated by a merchant, this form is often required to authorize the transaction. It can be voided if you decide to stop future payments.

- Revocation of Authorization form: Used when you want to cancel the preauthorization you previously gave for ACH debits, effectively stopping future transactions from a specific merchant.

- Written Statement Under Penalty of Perjury (WSUPP): In cases where an ACH transaction was unauthorized or processed despite an active stop payment order, this document serves as a formal claim asserting that fact.

- Dispute Form: If an unauthorized or incorrect transaction slips through, this form is utilized to formally dispute the transaction with your financial institution.

- Account Update or Change Form: Used to update personal information (e.g., address, phone number) or account details, ensuring communications related to ACH transactions are accurately directed.

- Cancellation of Stop Payment Order form: In the event that you change your mind after filing a stop payment request, this document is used to cancel the original order.

- Bank Confirmation Letter: After initiating a stop payment request, this letter from the bank confirms that the order has been placed, providing a record of the action taken.

- Fee Schedule: A document detailing any fees associated with ACH transactions, stop payment requests, or other account-related services, which helps in financial planning and management.

- Customer Agreement or Account Terms and Conditions: This comprehensive document outlines all policies, including those related to ACH transactions and stop payment orders, helping customers understand their rights and obligations.

Each document plays a unique role in managing ACH transactions and ensuring financial wellbeing. It's important to understand how these documents work individually and collectively to protect, manage, and dispute transactions in your accounts. Whether it's stopping an undesired payment, disputing an unauthorized transaction, or setting up pre-authorized debits, being prepared with the right information and documentation is key to effective financial management.

Similar forms

The Written Statement of Unauthorized Debit (WSUD) form strongly resembles the ACH Stop Payment form in its function and purpose. Both are used in situations where a customer needs to address unauthorized or incorrect electronic funds transfers impacting their account. The WSUD allows a customer to formally declare an ACH transaction was not authorized or was conducted improperly, similar to how the ACH Stop Payment form enables a customer to request a halt on an unauthorized or mistaken transfer before it occurs. The emphasis in both cases is on customer authorization and the management of electronic funds transfers.

A Revocation of Authorization form shares similarities with the ACH Stop Payment form in the way it addresses changes to preauthorized electronic transactions. While the ACH Stop Payment form focuses on stopping specific ACH transactions from occurring, a Revocation of Authorization form is used by a customer wishing to cancel all future preauthorized electronic transactions from a specific company or originator. Both documents are critical for customers to manage and control unauthorized transactions or change their preferences for automatic billing and payments.

The Bank Account Closure form, though distinct in its ultimate purpose, parallels the ACH Stop Payment form in that it represents a customer's desire to control or terminate financial transactions. When someone completes a Bank Account Closure form, they're ending all future activity on that account, including incoming and outgoing ACH transfers, which is a broader and more final measure compared to the ACH Stop Payment form's targeted action on a specific ACH debit.

Change of Account Information forms are somewhat similar to the ACH Stop Payment form because both involve the management and updating of a customer’s account details to ensure correct processing of transactions. While the ACH Stop Payment form specifically deals with the stopping of a transaction, the Change of Account Information form is usually completed to update personal or account details to prevent future transaction issues, including those related to ACH debits or credits.

Credit Card Dispute forms share a common objective with the ACH Stop Payment form: disputing a transaction that the customer believes is incorrect or unauthorized. Though the Credit Card Dispute form is used specifically within the context of credit card charges, and the ACH Stop Payment form is used for ACH transactions, both serve a protective function for consumers, allowing them to take action against unauthorized or mistaken transactions.

The Direct Deposit Authorization form, while typically associated with the setup of a recurring inflow of funds to an account, complements the ACH Stop Payment form's role in managing electronic transactions. Where the Direct Deposit Authorization form facilitates the initiation or change of a direct deposit, the ACH Stop Payment form allows a customer to stop specific transactions. Both are vital tools in the hands-on management of electronic funds transfers, allowing customers to ensure that only desired transactions occur.

Finally, the Fraudulent Account Activity Report form correlates with the ACH Stop Payment form as both are mechanisms for protecting against and responding to unauthorized financial activity. Customers fill out a Fraudulent Account Activity Report when they notice unauthorized transactions on their account to formally report and dispute those transactions. This is a reactive measure after the fact, whereas the ACH Stop Payment form is a preemptive action taken to prevent an anticipated unauthorized or undesired debit from taking place.

Dos and Don'ts

When dealing with finances, particularly when requesting a stop payment on an Automated Clearing House (ACH) debit, precision and understanding are key. The ACH Stop Payment form is a crucial document for instructing your bank or financial institution to halt a pre-authorized electronic payment. It's essential to approach this task with care to ensure your directions are clear and enforceable. Below are critical dos and don'ts to observe when filling out an ACH Stop Payment form:

Do:- Review all information thoroughly before submission: Ensure that every piece of information provided, from the Customer Reference Number to the EXACT Amount of ACH, is accurate. Mistakes can lead to unwanted debits and complications.

- Act quickly: The request for a Stop Payment order must be received at least three banking days before the scheduled transfer. Timeliness is essential to prevent the unwanted transaction.

- Communicate with the Originating Company: In addition to submitting a Stop Payment request to NetSpend, it's often wise to inform the company initiating the ACH debit. This dual approach can help ensure the payment is stopped from both ends.

- Keep records: Always retain a copy of your Stop Payment request and any related correspondence. This documentation can be crucial if there are disputes or if the payment is mistakenly processed.

- Delay sending your request: Failing to submit the Stop Payment order within the required timeframe (at least three banking days before the scheduled date of transaction) can result in the payment processing as planned, leaving you liable for charges.

- Assume one form covers all transactions: A separate form is required for each different ACH debit you wish to stop. This detail is critical for maintaining organized and clear records with your financial institution.

- Forget to sign the form: An unsigned form is generally considered invalid. Ensure you sign the form before submission to formally authorize the Stop Payment request.

- Ignore the fee structure: Be aware that a fee is charged for processing an ACH Stop Payment request. Understanding the fee amount and acknowledging this charge helps manage expectations and financial planning.

Adhering to these guidelines can significantly improve the likelihood of successfully stopping an ACH debit and managing your finances effectively. Always remember to review the terms and conditions of your ACH Stop Payment form and, if in doubt, consult directly with your bank or financial institution for clarity and assistance.

Misconceptions

There are several common misconceptions about the ACH Stop Payment form provided by NetSpend Corp. Understanding these misconceptions can help individuals make informed decisions regarding managing their finances and the actions they can take to control unauthorized or unwanted payments. Below are six misconceptions clarified for better understanding:

- Misconception 1: A single ACH Stop Payment form can be used to stop multiple payments from different companies. In reality, NetSpend requires a separate form to be completed for each item, originating company, or specific payment amount. This is crucial for accurate record-keeping and to ensure the precise processing of each stop payment request.

- Misconception 2: It is commonly thought that the stop payment request will automatically prevent all future payments to the merchants. However, the form offers options to stop all future payments or to stop future payments for only 1 month. For lasting revocation of payment authorizations, the customer needs to directly contact the originating company.

- Misconception 3: Many believe that submitting an ACH Stop Payment form guarantees the payment will not be processed. The truth is, NetSpend makes reasonable efforts to stop the payment from posting to the account, but the company's liability does not exceed the amount of the ACH debit, and a fee is charged regardless of the outcome.

- Misconception 4: Some customers might think that the stop payment is effective immediately upon submission. Actually, a Stop Payment order must be received at least three banking days before the scheduled date of the transfer to allow sufficient processing time.

- Misconception 5: It is often misunderstood that if an ACH appears on your account despite a stop payment request, you are left without options. If this happens, customers should complete a Written Statement of Unauthorized Debit (WSUD) form, not the previously thought non-existent WSUPP form, to dispute the transaction as unauthorized.

- Misconception 6: Another common misunderstanding is about the fee charged for processing the stop payment request being refundable if the stop is unsuccessful. The fee is intended to cover the processing of the stop payment request and is charged whether or not the payment is successfully stopped, without refunds.

Correcting these misconceptions helps customers navigate their financial rights and responsibilities more effectively, ensuring they utilize the ACH Stop Payment form correctly and understand the terms and conditions of such requests.

Key takeaways

Filling out and using the ACH Stop Payment form is an important process to understand when you need to halt a payment through the Automated Clearing House (ACH) network. Here are key takeaways to guide you through this process:

- Understand the Fee: Remember, there's a charge for each Stop Payment request you make. To find out how much this fee is, call NetSpend's Customer Service Line.

- One Form Per Transaction: You'll need to complete a separate form for each item or payment you want to stop. This means if you have multiple payments you wish to halt, prepare to fill out multiple forms.

- Accurate Information is Crucial: The success of stopping a payment depends on the accuracy of the information you provide. If any detail doesn't match exactly, the payment might still go through according to NetSpend's policies.

- Timing Matters: Submit your request at least three banking days before the scheduled transfer to ensure it's processed in time. This gives NetSpend the window they need to act on your request.

- Limited Liability: Be aware that NetSpend's liability won't exceed the amount of the ACH debit you're stopping. Furthermore, you're responsible for any losses they might incur because of honoring your stop payment request.

- Writing Is Required to Cancel: Should you decide to cancel your stop payment request, you must do so in writing. Verbal requests won't be accepted for cancellations.

- Expiry of Request: Your request to stop a payment will expire 14 days from the initial request if you don't sign and return the form. No refunds will be given for the stop payment fee if this happens.

- Not All ACH Can Be Stopped: It's important to know that certain ACH transactions can't have stop payments placed on them. Also, if a stop payment is deemed to be for a "force paid" item, NetSpend won't be liable.

- Revoking Authorization: If your intent is to stop all future payments to a merchant, contacting the merchant directly to cancel your authorization with them is advisable, in addition to notifying NetSpend.

By keeping these points in mind and carefully filling out the ACH Stop Payment form, you can effectively manage and control your payments through NetSpend, ensuring that only the transactions you approve proceed.

Popular PDF Documents

3rd Party Designee - This document provides a formal way to communicate your choice of tax representative to the authorities.

Jazz Tax Certificate 2023 - It represents a specific application of tax law, tailored to enhance the effectiveness of charitable organizations.

Rut-25 - Details on the tax implications for specific vehicle transactions, such as gifts or estate transfers, in Illinois.