Get Ach Payment Enrollment Form

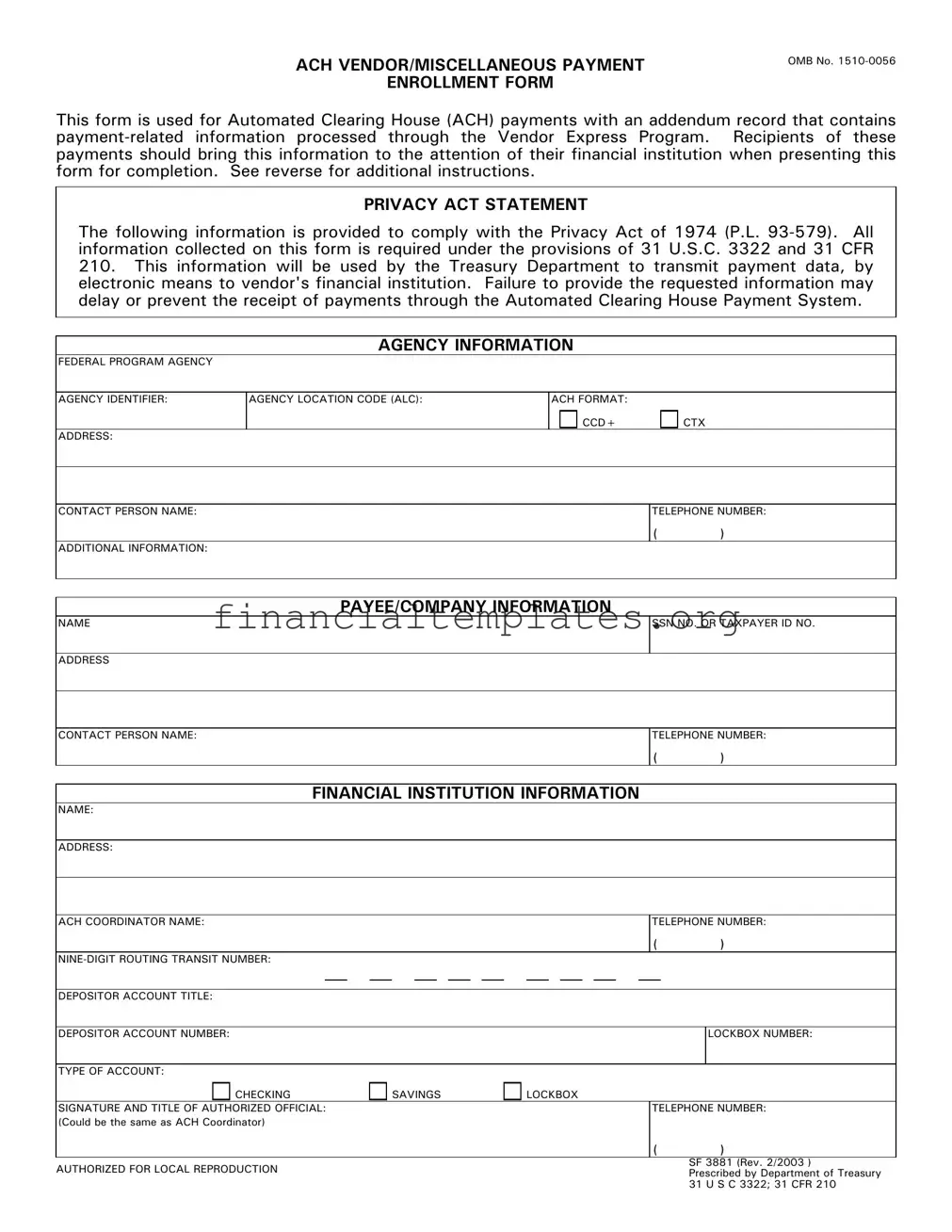

The ACH Payment Enrollment Form, officially designated as SF 3881 and presided over by the U.S. Department of the Treasury, plays an instrumental role in streamlining financial transactions through the Automated Clearing House (ACH) system, particularly within the realm of vendor and miscellaneous payments via the Vendor Express Program. Key to facilitating electronic transactions, this form ensures that payment information is efficiently transmitted to the recipient’s financial institution with all necessary details for processing. It encompasses sections that meticulously gather critical data from the federal agency initiating the payment, the payee or company receiving it, and the financial institution handling the funds. Entities are required to furnish detailed information, including agency identifiers, contact details, social security or taxpayer ID numbers, as well as bank account information to secure the accuracy of transfers. The significance of the form also lies in its incorporation of the Privacy Act Statement, articulating the protection of the collected information and underscoring the legal mandate for its collection — a compliance measure with 31 U.S.C. 3322 and 31 CFR 210. Additionally, instructions for the completion and distribution of the form ensure clarity and ease for all parties involved, reinforcing the overall aim to facilitate prompt and secure payments. Failure to properly complete the form may lead to delays or potential issues in receiving payments, highlighting the importance of accurate and complete submissions.

Ach Payment Enrollment Example

ACH VENDOR/MISCELLANEOUS PAYMENT

ENROLLMENT FORM

OMB No.

This form is used for Automated Clearing House (ACH) payments with an addendum record that contains

PRIVACY ACT STATEMENT

The following information is provided to comply with the Privacy Act of 1974 (P.L.

210.This information will be used by the Treasury Department to transmit payment data, by electronic means to vendor's financial institution. Failure to provide the requested information may delay or prevent the receipt of payments through the Automated Clearing House Payment System.

AGENCY INFORMATION

FEDERAL PROGRAM AGENCY

AGENCY IDENTIFIER: |

AGENCY LOCATION CODE (ALC): |

ACH FORMAT: |

CCD+ |

CTX |

ADDRESS:

CONTACT PERSON NAME:

ADDITIONAL INFORMATION:

TELEPHONE NUMBER:

()

PAYEE/COMPANY INFORMATION

NAME

ADDRESS

CONTACT PERSON NAME:

SSN NO. OR TAXPAYER ID NO.

TELEPHONE NUMBER:

()

FINANCIAL INSTITUTION INFORMATION

NAME:

ADDRESS:

ACH COORDINATOR NAME: |

TELEPHONE NUMBER: |

|

|

|

|

|

|

|

( |

) |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DEPOSITOR ACCOUNT TITLE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DEPOSITOR ACCOUNT NUMBER: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOCKBOX NUMBER: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TYPE OF ACCOUNT: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHECKING |

|

SAVINGS |

|

|

|

|

LOCKBOX |

|

|

|||||||||||

SIGNATURE AND TITLE OF AUTHORIZED OFFICIAL: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TELEPHONE NUMBER: |

|||

(Could be the same as ACH Coordinator) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|||||||||||

AUTHORIZED FOR LOCAL REPRODUCTION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SF 3881 (Rev. 2/2003 ) |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prescribed by Department of Treasury |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31 U S C 3322; 31 CFR 210 |

|

Instructions for Completing SF 3881 Form

Make three copies of form after completing. Copy 1 is the Agency Copy; copy 2 is the Payee/Company Copy; and copy 3 is the Financial Institution Copy.

1.Agency Information Section - Federal agency prints or types the name and address of the Federal program agency originating the vendor/miscellaneous payment, agency identifier, agency location code, contact person name and telephone number of the agency. Also, the appropriate box for ACH format is checked.

2.Payee/Company Information Section - Payee prints or types the name of the payee/company and address that will receive ACH vendor/miscellaneous payments, social security or taxpayer ID number, and contact person name and telephone number of the payee/company. Payee also verifies depositor account number, account title, and type of account entered by your financial institution in the Financial Institution Information Section.

3.Financial Institution Information Section - Financial institution prints or types the name and address of the payee/company's financial institution who will receive the ACH payment, ACH coordinator name and telephone number,

Burden Estimate Statement

The estimated average burden associated with this collection of information is 15 minutes per respondent or recordkeeper, depending on individual circumstances. Comments concerning the accuracy of this burden estimate and suggestions for reducing this burden should be directed to the Financial Management Service, Facilities Management Division, Property and Supply Branch, Room

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used for Automated Clearing House (ACH) payments with an addendum record for payment-related information, processed through the Vendor Express Program. |

| Privacy Act Compliance | The form collects information in compliance with the Privacy Act of 1974, under the provisions of 31 U.S.C. 3322 and 31 CFR 210, for the purpose of transmitting payment data to the vendor's financial institution. |

| Consequence of Non-compliance | Failure to provide the requested information may delay or prevent the receipt of payments through the Automated Clearing House Payment System. |

| Sections of the Form | The form includes sections for Agency Information, Payee/Company Information, and Financial Institution Information. |

| Instructions for Completion | Three copies of the form should be made after completion: one for the agency, one for the payee/company, and one for the financial institution. |

| Burden Estimate | The estimated average burden associated with the collection of information on this form is 15 minutes per respondent or recordkeeper, depending on individual circumstances. |

Guide to Writing Ach Payment Enrollment

Filling out the ACH Payment Enrollment Form is a key step for recipients who wish to receive payments through the Automated Clearing House Payment System. It is imperative that each section is completed with accuracy to ensure timely and correct payments. The process involves providing detailed information about the federal agency, the payee or company, and the financial institution receiving the funds. Completeness and precision in filling out this form will aid in the smooth processing of transactions and prevent potential delays.

- Agency Information Section: Begin by entering the name and address of the federal program agency initiating the vendor or miscellaneous payment in the designated fields. Include the agency identifier and agency location code (ALC). Type in the contact person's name and provide their telephone number. Mark the appropriate ACH format box with either CCD+ or CTX, according to the type of payment to be processed.

- Payee/Company Information Section: The payee, or the company receiving the payment, must enter their name and address. Include the Social Security Number (SSN) or Taxpayer Identification Number (TIN) in the corresponding field. Input the contact person's name and telephone number for the payee/company. It's important to review and verify the depositor account number, account title, and account type that will be entered by the financial institution in the next section.

- Financial Institution Information Section: The financial institution that will receive the ACH payment should list its name and address. The ACH coordinator's name and telephone number are required. Fill in the nine-digit routing transit number necessary for directing the payment to the correct bank. The depositor (payee/company) account title and account number must also be entered. Ensure the right account type (checking, savings, or lockbox) is selected. Lastly, the form must be signed by an authorized official of the financial institution, including their title and telephone number.

- After completing all sections of the form, create three copies. Retain one copy for the agency, provide another to the payee or company, and furnish the last copy to the financial institution involved.

Upon thoroughly filling out the form and distributing the copies as directed, you have effectively initiated the process for receiving ACH payments. It is essential for all parties to verify the information for accuracy to facilitate smooth transactions. Remember to inform your financial institution of this setup to ensure they are prepared to receive and process these electronic payments correctly.

Understanding Ach Payment Enrollment

What is an ACH Vendor/Miscellaneous Payment Enrollment Form?

This form is for setting up Automated Clearing House (ACH) payments, which transfer funds electronically to a vendor's financial institution. It includes an addendum with payment-related details and is part of the Vendor Express Program.

Why do I need to complete this form?

Completing this form is necessary for receiving electronic payments through the ACH Payment System from the Treasury Department. It ensures payment data is correctly transmitted to the vendor's financial institution.

What happens if I don't provide all the required information?

Not providing the requested information may delay or prevent the receipt of your ACH payments. It's essential to fill out the form accurately to ensure timely payment processing.

How is my privacy protected when I supply information on this form?

The information collected is protected by the Privacy Act of 1974. It specifies that personal information is only used for transmitting payment data to your financial institution and not for any unrelated purposes.

What are the sections of the form I need to complete?

- Agency Information Section: Includes details about the Federal program agency.

- Payee/Company Information Section: Provides the payee's or company's information.

- Financial Institution Information Section: Contains the financial details required for making the ACH payment.

What should I do after completing the form?

After filling out the form, you should make three copies. Keep one for the Agency, one for the Payee/Company, and one for the Financial Institution.

Who can I contact if I have questions about the form?

If you have any questions or need further clarification while filling out the form, you should contact the person named in the Agency Information Section of the form. They will be able to provide you with the necessary assistance.

How long does it take to complete the form?

The estimated time to complete this form is about 15 minutes. However, this can vary depending on your individual circumstances.

Common mistakes

Completing the ACH Payment Enrollment form accurately is crucial for ensuring timely and correct payments. However, people often make errors during this process. Here are ten common mistakes:

- Not checking the appropriate box for the ACH format, leading to processing errors.

- Failing to provide complete agency information, including the agency identifier and location code, which are essential for identifying the payment's origin.

- Omitting contact details, such as the telephone number of the contact person at the agency, which is necessary for any follow-up or clarification.

- Incorrectly entering the payee/company's name or address, resulting in payments being delayed or sent to the wrong entity.

- Leaving the social security or taxpayer ID number blank, a critical identifier for the payment process.

- Not verifying the depositor account number and type of account (checking or savings) entered by the financial institution, which could lead to misdirected funds.

- Forgetting to include the financial institution's name and address, impeding the payment's routing.

- Skipping the entry of the nine-digit routing transit number, or entering it incorrectly, which is vital for directing the payment to the correct bank.

- Not obtaining or providing the signature, title, and telephone number of the authorized official from the financial institution, a requirement for authentication.

- Failing to distribute the form copies as instructed, which can cause confusion and delays in the payment process.

It's important for individuals to review their information meticulously and consult with their financial institution or the agency contact person if they encounter uncertainties during the form completion process.

Avoiding these mistakes is crucial for the smooth processing of ACH payments, ensuring that funds reach the intended recipient on time and without issue.

Documents used along the form

The Automated Clearing House (ACH) Payment Enrollment form serves as a crucial mechanism in modernizing the way payments are processed, ensuring a transition from traditional paper checks to an electronic format for faster and more secure transactions. When integrating an ACH payment system, businesses and individuals might often find themselves handling various other forms and documents that are pivotal in facilitating smooth financial transactions. Here's a brief look at some of these essential documents.

- W-9 Form: Essential for confirming the taxpayer identification number (TIN) or Social Security Number (SSN) of the payee. This form is a prerequisite for ensuring that the correct entity is receiving the payments and for tax reporting purposes.

- Direct Deposit Authorization Form: This document is used to authorize the setup of direct deposits to an employee's or vendor's bank account. It typically requires the account holder's name, bank account details, and authorization for the company to deposit funds directly into the specified bank account.

- Bank Account Verification Letter: Sometimes required to confirm the authenticity of the bank account details provided by an employee or a vendor. This letter, issued by the bank, reaffirms the account number, routing number, and the account holder's name.

- Business Credit Application: Used by businesses when initiating a relationship with a new vendor or creditor. This form evaluates the creditworthiness of the business seeking credit terms, often necessitating information pertaining to the business's financial stability.

- Invoice: It's common to associate the ACH Payment Enrollment form with the processing of invoices. An invoice details the goods or services provided, with corresponding prices, and provides the necessary information to process payments electronically.

Understanding and accurately completing these documents alongside the ACH Payment Enrollment form can significantly streamline the payment process, ensuring transactions are not only efficient but also compliant with legal standards. Whether for payroll, vendor payments, or other financial transactions, the synergy between these forms fosters a seamless financial management system.

Similar forms

The Direct Deposit Signup Form is closely related to the ACH Payment Enrollment Form in purpose and content. Both forms facilitate the electronic transfer of funds into bank accounts, reducing the need for physical checks. The Direct Deposit Signup Form, often used by employers to deposit salaries directly into employees' bank accounts, collects similar information such as the bank's routing number, account number, and account type. Both forms ensure the accurate and secure transmission of funds through electronic means, offering a convenient alternative to traditional payment methods.

The IRS Form 8050, Direct Deposit of Corporate Tax Refund, shares similarities with the ACH Payment Enrollment Form, especially in its function of transmitting payments electronically to bank accounts. Like the ACH form, Form 8050 requires tax filers to provide bank routing and account numbers to receive tax refunds via direct deposit. This method speeds up the refund process and mirrors the efficiency sought in vendor or miscellaneous payments through the ACH system, emphasizing the importance of accurate banking information for seamless financial transactions.

The Social Security Administration's Direct Deposit Sign-Up Form resembles the ACH Payment Enrollment Form because both are designed to route payments or benefits directly into an individual's bank account. The forms collect comparable information, such as the recipient's account number and the financial institution's routing number, to facilitate this electronic transfer. Adopting direct deposit via these forms expedites the payment process, reduces errors, and increases the security of transferring funds, benefitting both the issuing agencies and the recipients.

The Electronic Funds Transfer (EFT) Authorization Form is another document that closely aligns with the ACH Payment Enrollment Form. It serves a broad range of purposes, including authorizing recurring payments or deposits into a specified bank account. Like the ACH form, the EFT Authorization Form requires detailed banking information, such as the account and routing numbers, to ensure accurate and timely electronic transactions, emphasizing the utility of EFT in modern financial operations.

The Vendor Direct Deposit Authorization Form closely matches the ACH Payment Enrollment Form in both its purpose and details required. Primarily used by businesses to receive payments from customers or partners, this form necessitates the provision of banking details similar to those on the ACH form - including routing and account numbers. Both forms highlight the shift towards efficient, secure, and environmentally friendly electronic payments in commercial transactions.

The Utility Company Direct Debit Form is akin to the ACH Payment Enrollment Form as it enables automatic billing through direct withdrawal from a customer's bank account. While it typically focuses on recurring payments, the underlying principle of securely and efficiently transferring funds from one account to another aligns with the objectives of the ACH system. Both forms require consumers to provide sensitive financial information to set up this convenience, underscoring the trust and security requisite in electronic transactions.

The Medicare Premium Payment Authorization form also shares similarities with the ACH Payment Enrollment Form, particularly in facilitating the automatic electronic payment of monthly premiums from a subscriber's bank account. This form, like the ACH Payment Enrollment Form, collects banking information to set up the direct debit, ensuring timely and secure payments. It exemplifies the broader use of ACH payments across different sectors, from business transactions to personal finance, including healthcare premiums.

Dos and Don'ts

When filling out the ACH Payment Enrollment Form, it's important to follow some do's and don'ts to ensure the process goes smoothly and your form is processed without delays. Here are some tips to keep in mind:

Do:- Double-check the information you provide, especially your financial institution details like the nine-digit routing transit number and depositor account number.

- Ensure all sections are filled out completely, including the Agency Information Section, Payee/Company Information Section, and Financial Institution Information Section.

- Use legible handwriting or type the information if possible to avoid any confusion or misinterpretation of your details.

- Verify the type of account you are enrolling, whether it is checking or savings, and ensure this is clearly indicated in the Financial Institution Information Section.

- Contact the appropriate contact person listed if you have any questions or require clarification on filling out the form correctly.

- Make the required number of copies after completing the form: one for the agency, one for the payee/company, and one for the financial institution.

- Omit any required information, as this could delay or prevent the receipt of payments through the Automated Clearing House Payment System.

- Sign the form without reviewing it thoroughly for any mistakes or missing details.

- Forget to provide your contact information, including a telephone number where you can be reached in case of any issues or further verification needs.

- Use outdated information, particularly if there have been recent changes to your bank account or routing number.

- Ignore the Privacy Act Statement provided with the form, as it contains important information about the use of the data you submit.

- Disregard the Burden Estimate Statement, as it offers insights into the expected time commitment for filling out the form and ways to make the process more efficient.

Misconceptions

When dealing with ACH (Automated Clearing House) Payment Enrollment Forms, there are several misconceptions that people commonly have. Understanding these misconceptions is crucial for ensuring that payments are processed efficiently and securely. Here are six such misconceptions explained:

- Misconception 1: The form is optional for electronic payments.

Many people believe that the ACH Payment Enrollment Form is optional and that electronic payments can be set up without it. However, this form is a mandatory step for setting up ACH payments to ensure that payment-related information is correctly processed through the Vendor Express Program.

- Misconception 2: The Privacy Act Statement is not important.

Some individuals may overlook the Privacy Act Statement, considering it to be standard legal jargon without importance. Yet, this section is crucial as it complies with the Privacy Act of 1974, ensuring the individual's information is protected and detailing the legal basis for information collection.

- Misconception 3: Any financial institution can process ACH payments without specific information.

A common misconception is that financial institutions can process ACH payments without needing detailed information from the ACH Payment Enrollment Form. In truth, specific details such as the nine-digit routing transit number, account title, and type of account are essential for the accurate processing of payments.

- Misconception 4: ACH payment enrollment does not require verification.

It's mistakenly believed that once you submit your ACH Payment Enrollment Form, no further verification is needed. Conversely, the payee/company must verify the depositor account number, account title, and account type entered by the financial institution, ensuring that payments are not misdirected.

- Misconception 5: The process is completed with just one copy of the form.

The process demands thoroughness, contrary to the belief that submitting a single copy of the form suffices. After completing the form, it is necessary to make three copies, with each serving a specific purpose for the agency, the payee/company, and the financial institution.

- Misconception 6: The form immediately accelerates payment processing.

There's a false expectation that submitting the ACH Payment Enrollment Form will speed up the payment process instantly. Although electronic payments are generally quicker than manual checks, the initial setup and validation of the information can take time. Failure to provide accurate information might also delay or prevent the successful processing of payments.

Understanding these misconceptions and the accurate processes involved in ACH Payment Enrollment is vital for both individuals and institutions to ensure smooth and efficient payment transactions.

Key takeaways

When filling out and using the ACH Payment Enrollment form, it is important to understand the purpose and the necessary details to ensure smooth processing. Here are four key takeaways:

- The ACH Payment Enrollment Form is crucial for setting up Automated Clearing House (ACH) payments, allowing for electronic transactions directly to a vendor's financial institution. This system streamlines payments, making them faster and more secure.

- Accurate completion of the Agency Information Section is necessary. This includes the name and address of the Federal program agency, agency identifier, contact information, and ACH format selection. It is essential for correctly identifying the origin of the payment.

- In the Payee/Company Information Section, the payee or company must provide their name, address, Social Security or Taxpayer Identification Number, and contact details. Verifying the account details entered by the financial institution in this section is also vital to prevent misdirected payments.

- The Financial Institution Information Section requires the bank's details, including the name, address, ACH coordinator's name, and contact information, along with the payee's account information. The signature and title of the approving financial institution official are also necessary to authenticate the information.

Each party involved in the form completion - the agency, the payee/company, and the financial institution - plays a critical role in ensuring that the payment process operates efficiently. Understanding the purpose of each section and providing accurate, complete information is key to successful ACH payment enrollment.

Popular PDF Documents

940 Tax - It details the employer’s part in supporting the federal program that assists unemployed individuals.

How to Get Power of Attorney in Tennessee - The power of attorney for tax matters is a strategic planning tool for individuals and businesses alike.

Should I Claim for Homeowners' Property Tax Exemption - It is structured to capture essential information about the disability through a physician’s lens, reinforcing the medical basis for the tax exemption application.