Blank ACH Payment Authorization Form Form

In the realm of digital transactions and automated banking services, the ACH Payment Authorization Form emerges as a cornerstone for businesses and individuals alike. This form serves as a formal consent, granting permission to companies to withdraw funds directly from an individual's bank account for recurring or one-time payments. It plays a pivotal role in streamlining payment processes, ensuring timely transactions while minimizing the need for manual interventions. Whether it’s for utility bills, subscription services, or payroll deposits, the form encapsulates a comprehensive understanding between the payer and the payee, setting clear guidelines on the timing, amount, and frequency of transactions. Beyond a mere procedural document, the ACH Payment Authorization Form embodies the trust and efficiency inherent in modern financial exchanges, providing a secure framework that protects all parties involved.

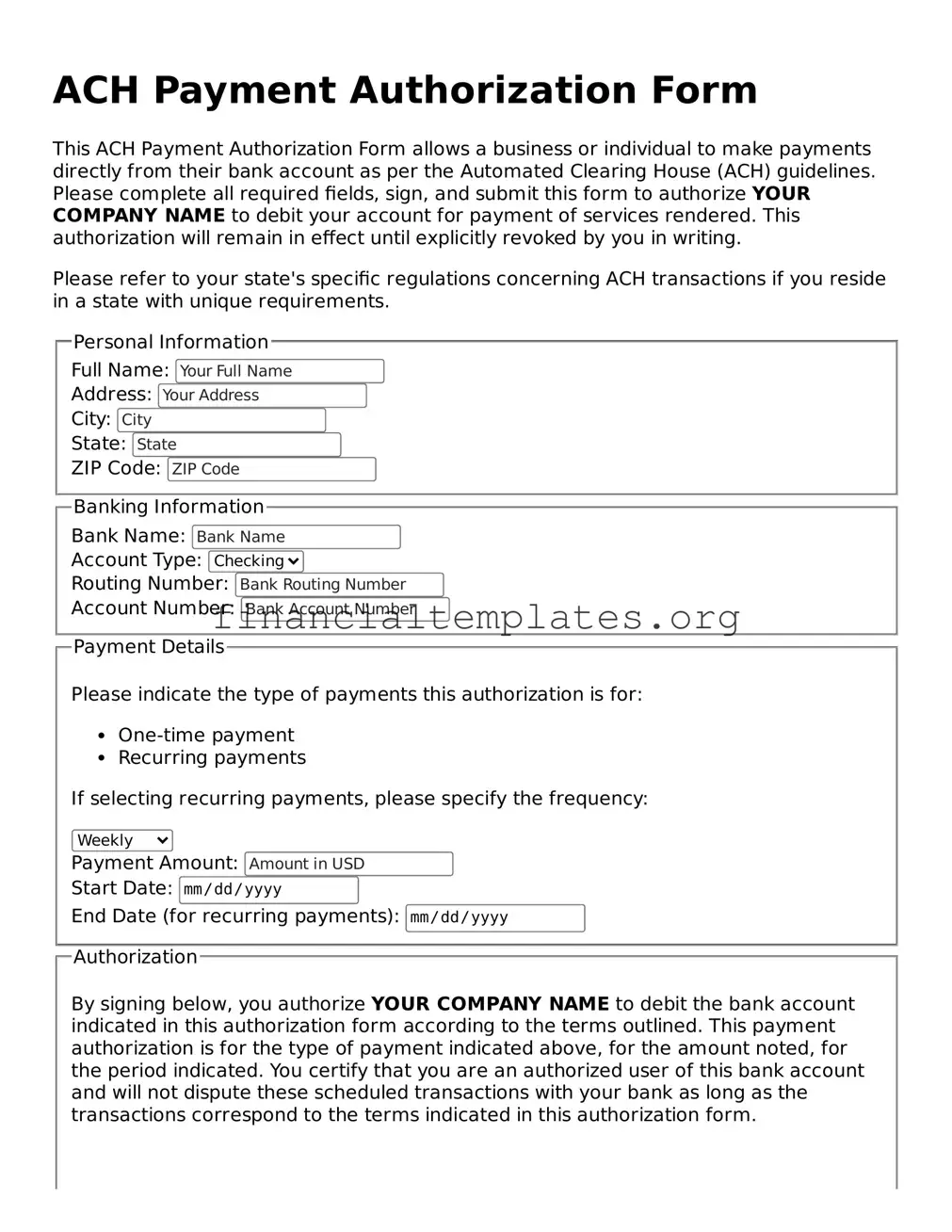

ACH Payment Authorization Form Example

ACH Payment Authorization Form

This ACH Payment Authorization Form allows a business or individual to make payments directly from their bank account as per the Automated Clearing House (ACH) guidelines. Please complete all required fields, sign, and submit this form to authorize YOUR COMPANY NAME to debit your account for payment of services rendered. This authorization will remain in effect until explicitly revoked by you in writing.

Please refer to your state's specific regulations concerning ACH transactions if you reside in a state with unique requirements.

PDF Properties

| Fact Name | Description |

|---|---|

| Purpose of Form | ACH Payment Authorization Forms are used by businesses to obtain permission from an individual or another business to debit their bank account for a specified amount on pre-agreed dates. |

| Legality and Requirement | The form is a legal document that complies with the operating rules of the National Automated Clearing House Association (NACHA), ensuring that electronic payments are both efficient and secure. |

| Revocation Clause | These forms typically include a clause that allows the account holder to revoke their authorization, subject to the business's policy on notice period. |

| Governing Law | While ACH transactions are governed federally by NACHA rules, state laws may also apply, particularly regarding the enforcement of agreements and handling disputes. It is crucial to reference specific state laws where applicable. |

Guide to Writing ACH Payment Authorization Form

After deciding to take advantage of the convenience offered by automatic payments through the Automated Clearing House (ACH) network, the next step involves correctly filling out an ACH Payment Authorization Form. This document is crucial for authorizing the electronic transfer of funds from your bank account to the entity you're paying, ensuring a streamlined payment process for recurring payments like bills or subscriptions. Below is a guide to help you accurately complete the form, avoiding common pitfalls and ensuring that your payments are processed without any hitches.

Steps to Fill Out an ACH Payment Authorization Form

- Personal Information: Begin by providing your full legal name as it appears on your bank account. This ensures that there is no confusion regarding the account holder's identity.

- Bank Information: Enter your bank's name, as well as the bank's routing number— a nine-digit code found at the bottom left corner of your checks. This number is essential for directing the payment to the right financial institution.

- Account Information: Provide your bank account number, ensuring you double-check the number to prevent any errors that could delay your payment.

- Type of Account: Specify whether your account is a checking or savings account. This differentiation is crucial as some automatic payments are only processed from checking accounts.

- Payment Information: Detail the exact amount you authorize to be transferred if it's a fixed amount, or state that the payment amounts may vary if you're authorizing variable payments.

- Payment Schedule: Clearly indicate how often you authorize these payments to occur— for example, monthly, quarterly, or as specified invoices are generated. This information prevents any misunderstandings regarding the frequency of withdrawals from your account.

- Authorization Signature: Lastly, sign and date the form. Your signature provides the necessary legal consent for the entity to initiate the specified transactions from your account. Without your signature, the form is not valid.

After completing these steps, review the form to ensure all the information provided is accurate and matches your bank records. Once you're satisfied, submit the form to the authorized collecting party, such as your billing company's payment department or another entity you are authorizing for ACH payments. Remember, keeping a copy of the filled-out form for your records is always a good practice for tracking and verification purposes should any discrepancies arise in the future.

Understanding ACH Payment Authorization Form

-

What is an ACH Payment Authorization Form?

An ACH (Automated Clearing House) Payment Authorization Form is a document that an individual or a business uses to grant permission to another party to electronically withdraw funds from their bank account. This form is often used for recurring payments, such as utility bills, insurance premiums, or loan payments.

-

Who needs to complete the ACH Payment Authorization Form?

Any individual or entity that wishes to make payments directly from their bank account without the use of traditional checks or cash needs to complete an ACH Payment Authorization Form. This is also applicable to those who are receiving payments and want them directly deposited into their bank accounts.

-

What information is required on the ACH Payment Authorization Form?

The form typically requires the following information: the name of the account holder, bank routing number, account number, type of account (checking or savings), the amount of money to be transferred, and the frequency of the transaction. It must also include the authorizing signature of the account holder.

-

Is the authorization permanent?

No, the authorization is not permanent. The account holder can revoke it at any time, provided they follow the procedure outlined by the entity that issued the ACH Payment Authorization Form. It is important to notify the entity in writing if one wishes to cancel the authorization to ensure the request is processed in a timely manner.

-

How is my personal and banking information protected?

Entities that process ACH transactions are required to comply with federal regulations that protect sensitive data. This includes implementing security measures to safeguard personal and banking information from unauthorized access. Additionally, federal laws such as the Electronic Fund Transfer Act offer protections against unauthorized transactions.

-

Can I choose the date on which the payment is withdrawn from my account?

Yes, in many cases, you can specify the date on which the payment should be withdrawn from your account. This date should be indicated on the ACH Payment Authorization Form. However, it's important to verify with the receiving party to ensure that your specified date aligns with their processing schedules.

-

What should I do if I need to change my banking information?

If your bank account number or routing number changes, you must fill out a new ACH Payment Authorization Form with your updated information. Promptly submit this updated form to the entity processing your payments to avoid any missed or delayed transactions.

-

Are there any fees associated with ACH payments?

Typically, ACH payments have lower fees compared to credit card transactions or wire transfers. However, some banks or institutions might charge a minimal fee for processing ACH payments. It is advisable to check with your bank or the entity receiving the payments to understand any associated fee structure.

-

What happens if there are insufficient funds in my account?

If there are insufficient funds in your account at the time of the transaction, your bank may refuse the payment. This could result in fees from both your bank and the entity attempting to process the payment. To avoid this, ensure sufficient funds are available in your account on the day the payment is scheduled.

-

How do I obtain an ACH Payment Authorization Form?

Your bank or the entity you wish to pay or receive payment from can provide you with an ACH Payment Authorization Form. Many organizations also offer downloadable forms on their websites. Make sure to use the form provided by the entity processing the payment to ensure it includes all necessary details specific to their requirements.

Common mistakes

Filling out the ACH Payment Authorization Form might seem straightforward, but there are common mistakes that can complicate the process. To ensure a smooth transaction, here are six errors to avoid:

Not double-checking account information.

Entering bank account or routing numbers incorrectly is a common error. It's important to review these numbers carefully; even a single digit off can direct payments to the wrong account.

Forgetting to sign the form.

It may seem obvious, but forgetting to sign the form invalidates the authorization. Always make sure to sign and date the form to give it legal standing.

Ignoring account type selection.

Another mistake is not specifying the type of account being used for the transaction, whether it's a checking or savings account. This detail is crucial for processing the payment correctly.

Omitting contact information.

Contact information is vital for any follow-up required. If the form is submitted without a way to contact the account holder, resolving issues becomes more difficult.

Failure to specify payment details.

When the payment specifics, such as the amount and the payment date, are not clearly defined, it can lead to misunderstandings or delays in payment processing.

Using outdated forms.

Financial institutions update their forms periodically. Using an outdated version can result in processing delays or even rejection of the payment authorization.

Avoiding these mistakes can help ensure that your ACH transactions are processed smoothly and efficiently.

Documents used along the form

In the realm of financial transactions, a myriad of forms and documents work in tandem to ensure transactions are processed smoothly and securely. Among these, the ACH Payment Authorization Form plays a pivotal role, enabling the authorization of electronic payments directly from bank accounts. Accompanying this crucial form are several other documents, each serving its specific function to streamline the process of financial transactions.

- Direct Deposit Enrollment Form: This form is typically used by employees to authorize the direct deposit of their paychecks into their bank accounts. It often accompanies the ACH Payment Authorization Form, especially in payroll setups, ensuring employees receive their earnings efficiently.

- Vendor Direct Payment Form: Businesses use this document to authorize payments to be made directly to their bank accounts from clients or partners. It's crucial for B2B transactions, allowing for smoother, more reliable payment processes.

- Electronic Funds Transfer (EFT) Authorization Form: Similar to the ACH Payment Authorization Form, the EFT Authorization Form allows for the electronic transfer of funds between bank accounts. However, it's broader in scope, encompassing various types of electronic payments beyond ACH transfers.

- Customer Payment Agreement Form: This document outlines the terms and conditions between a service provider or vendor and their clients regarding payment schedules, amounts, and methods. It often references ACH payments as a preferred or accepted payment method.

- Billing Information Update Form: Essential for maintaining up-to-date billing information, this form is used by customers or clients to update their payment information. It ensures that ACH transactions can be processed without delay, attributed to outdated or incorrect account details.

Together, these documents form the backbone of modern financial transactions, ensuring that payments are made securely and efficiently. Each plays a specific role in making sure that the flow of money is uninterrupted and accurately recorded, complementing the functionality of the ACH Payment Authorization Form. As digital transactions become increasingly prevalent, the importance of these forms and documents continues to grow, solidifying their place in the financial ecosystem.

Similar forms

The Direct Deposit Authorization Form shares similarities with the ACH Payment Authorization Form in that both collect banking information to set up electronic transactions. While the ACH form might be used for a broad range of payments, the Direct Deposit form specifically handles the transfer of funds into an individual's bank account, typically for payroll. This form ensures employees receive their wages without the need for physical checks.

Standing Order Mandate Forms are quite alike because they authorize regular transactions from a bank account, comparable to ACH Payment Authorization Forms. These mandates direct a bank to send a specified amount of money at regular intervals to another account. It's a way for individuals to automate recurring payments, much like setting up automatic billing through ACH, but it's more commonly used in the banking systems outside the U.S.

Debit Authorization Forms are similar as they grant permission to withdraw funds directly from a bank account. While ACH Payment Authorization includes a range of electronic transactions, a Debit Authorization Form specifically allows businesses to deduct payments for services or goods directly from a customer's account, streamlining the billing process for recurring charges.

Credit Card Authorization Forms parallel the ACH form by providing a method to authorize payments, but through credit card transactions instead of bank transfers. This form is essential for businesses that want to charge a customer's credit card on a recurring basis or for a one-time charge, requiring the cardholder's signature to approve charges ahead of time.

Electronic Funds Transfer (EFT) Authorization Forms are closely related as they permit digital transfers of money from one account to another, encompassing ACH payments, wire transfers, and other electronic payments. The EFT Authorization Form is a broader category that includes various types of electronic payments, making it a versatile tool for managing digital transactions.

Wire Transfer Authorization Forms also share commonalities by facilitating the transfer of funds between accounts, but these are typically faster and can be international, unlike most ACH transactions which are domestic. This form requires detailed information to ensure the swift and secure transfer of large sums of money, often for transactions like closing on a property or transferring funds between businesses.

The Recurring Payment Authorization Form is akin to the ACH Payment Authorization Form in that it enables businesses to charge a customer’s account at preset intervals. This is particularly useful for subscription services or regular payments like mortgages or car loans, allowing for a hands-off approach to ensure timely payments without the need for monthly manual processing.

Finally, the Bank Draft Authorization Form resembles the ACH Payment Authorization Form because it authorizes the electronic transfer of funds from a bank account for payments. While bank drafts are more commonly used for one-time transactions or purchases, such as a down payment on a home, they share the electronic authorization feature with ACH payments, providing a secure and documented process for financial transactions.

Dos and Don'ts

Filling out an ACH (Automated Clearing House) Payment Authorization Form is a straightforward process that allows for the electronic transfer of funds between bank accounts. However, to ensure a smooth and error-free submission, there are specific dos and don'ts to consider. Here's a compiled list to guide you through the process:

Do:

- Double-check your bank account and routing numbers for accuracy. Incorrect information can delay the transaction or send funds to the wrong account.

- Read the authorization form thoroughly before filling it out to understand what you're consenting to, including the frequency and amount of the payments.

- Keep a copy of the completed authorization form for your records. It serves as proof of your consent to the ACH transaction.

- Ensure that the name and details on the form match those associated with your bank account. This helps in preventing any issues due to mismatching information.

- Be aware of the terms and conditions, especially regarding how to cancel the authorization. Knowing the process can save you from future hassles.

- Use a pen with black or blue ink when filling out the form if doing it by hand. This ensures the information is legible and durable over time.

- Confirm with your bank or the entity requesting the form about any additional steps or documentation required. Some institutions may have specific requirements.

Don't:

- Do not leave any fields blank. Incomplete forms may be rejected or delay the process. If a section doesn't apply, mark it as "N/A" (not applicable).

- Do not use pencil or colors of ink that can easily fade or be erased. This can cause issues with legibility and record-keeping.

- Do not sign the form without reading and understanding the implications of the authorization you're giving. If something is unclear, seek clarification.

- Do not forget to notify the entity receiving the ACH payments if you close or change your bank account. Failing to update your information could lead to missed payments.

- Avoid making corrections on the form without initialing them. Uninitialed corrections can raise questions about the form's authenticity.

- Do not hesitate to ask for help if you encounter any difficulties while filling out the form. It's better to inquire than to make a mistake.

- Do not disclose your ACH Payment Authorization Form details publicly. Keep the information secure to prevent unauthorized access to your bank account.

Misconceptions

When it comes to ACH Payment Authorization Forms, many folks have misconceptions about what they are and how they work. Let's clear up some of these common misunderstandings:

- It's too complicated to set up: Actually, setting up an ACH payment authorization is quite straightforward. Once you've filled out the necessary information on the form, you've done the hard part. The process has been simplified to encourage more businesses and individuals to use it.

- It's only for businesses: This is not true. While businesses commonly use ACH payments for transactions like payroll and supplier payments, individuals can also use them for various payments, such as rent or even personal transfers.

- You can't cancel once you've authorized: Many people think that after you authorize an ACH payment, you're locked in. However, you can cancel an authorization, usually by notifying your bank or the business involved a few days before the scheduled payment.

- It's less secure than writing checks: In reality, ACH payments are generally more secure than writing checks. Your bank and the receiving party handle the transaction data securely, reducing the risk of lost or stolen checks.

- There's a high fee to use ACH payments: This misconception could deter some from using ACH payments. Typically, ACH transaction fees are lower compared to credit card transaction fees, making them a cost-effective option for both sending and receiving payments.

- ACH payments are immediate: While ACH payments are faster than check payments, they're not instant. Transactions may take a few business days to process. It's crucial to account for this time frame when making payments or expecting funds.

- Any bank account can be used for ACH payments: Most checking accounts support ACH transactions, but not all bank accounts do. Certain types of savings accounts, for instance, may not allow outgoing ACH payments.

- ACH and Wire Transfers are the same: Though both are ways to send money, they operate differently. ACH payments can take a couple of days and typically have lower fees, whereas wire transfers are faster but come with higher fees.

- Authorization forms are valid indefinitely: An authorization form has an expiration date or condition set by the entity requesting the authorization. You should review and renew these forms as required or when your banking information changes.

Understanding the facts about ACH Payment Authorization Forms can help individuals and businesses make informed decisions about managing their transactions efficiently and securely.

Key takeaways

Filling out and using the ACH Payment Authorization Form is a straightforward process, but it's crucial to get every detail right to ensure smooth transactions. Here are five key takeaways to keep in mind:

- Complete Information Is Crucial: Fill out every field on the form accurately. Incomplete or incorrect information can lead to delays or processing errors, potentially causing late payments or other financial complications.

- Know the Types of Authorization: The form may be used for one-time or recurring payments. Be clear about which type of payment authorization you're giving to avoid misunderstanding and ensure your account is charged correctly.

- Keep a Copy for Your Records: After submitting the form, it’s important to keep a copy for your records. This document will be essential if there are any disputes or you need to cancel the authorization in the future.

- Understand Your Rights: As a consumer, you have the right to revoke authorization at any time. However, the process for doing so should be followed according to the instructions on the form or as provided by the institution.

- Security is Paramount: When dealing with financial information, security cannot be overemphasized. Ensure that the form is submitted through secure channels to protect your bank account details from unauthorized access.

Popular Documents

IRS Schedule K-1 1120-S - It breaks down the financial movements in categories such as real estate income, dividends, and interest income, specific to each investor.

3520 Instructions - Legally empowers someone else to take care of your tax filings and negotiations.