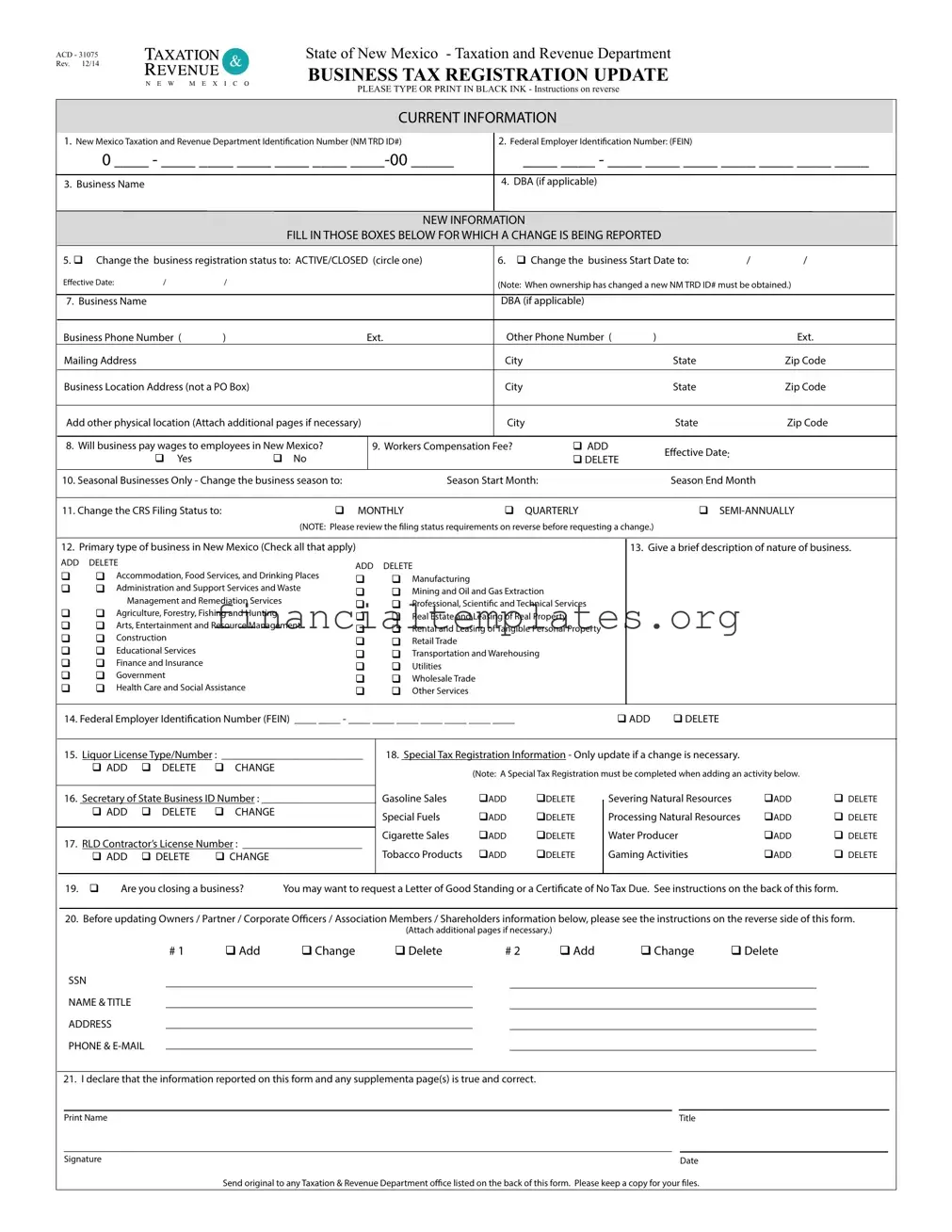

Get Acd 31075 Tax Registration Update Form

Navigating the nuances of business tax registration updates in New Mexico has been made straightforward with the ACD-31075 form, provided by the State of New Mexico Taxation and Revenue Department. As businesses evolve, so do their details and structures, making it essential to report any changes accurately to ensure compliance with state laws and the correct application of tax obligations. The form, which underwent its latest revision in December of 2014, serves as a critical tool for entities looking to update their New Mexico Taxation and Revenue Department Identification Number (NM TRD ID#), Federal Employer Identification Number (FEIN), business name, or the nature of their business among other particulars. It also caters to updates in various tax programs such as Gross Receipts, Compensating, Withholding, and Workers Compensation Fee, to name a few. Completing the form requires attention to detail, as it covers a broad spectrum of information including changes in business registration status (active or closed), adjustments in business start dates, updates on the business's physical and mailing addresses, and a thorough delineation of the business's nature and activities. Specifically designed to document only the changes needed, this form is a cornerstone for maintaining up-to-date records with the Taxation and Revenue Department, facilitating seamless business operations within New Mexico.

Acd 31075 Tax Registration Update Example

ACD - 31075

State of New Mexico - Taxation and Revenue Department

Rev. 12/14 |

|

|

|

|

|

|

|

BUSINESS TAX REGISTRATION UPDATE |

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

N |

E |

W M E |

X I |

C O |

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE TYPE OR PRINT IN BLACK INK - Instructions on reverse |

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT INFORMATION |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

1. New Mexico Taxation and Revenue Department Identiication Number (NM TRD ID#) |

|

|

2. Federal Employer Identiication Number: (FEIN) |

|

|

|

|

|

||||||||||||||||||||||

|

|

|

0 ____ - ____ ____ ____ ____ ____ |

|

|

|

____ ____ - ____ ____ ____ ____ ____ ____ ____ |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

3. Business Name |

|

|

|

|

|

|

|

|

|

|

|

4. DBA (if applicable) |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NEW INFORMATION |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

FILL IN THOSE BOXES BELOW FOR WHICH A CHANGE IS BEING REPORTED |

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

5. q |

Change the business registration status to: ACTIVE/CLOSED (circle one) |

|

6. q Change the business Start Date to: |

/ |

/ |

|

|

|

||||||||||||||||||||||

|

Efective Date: |

|

|

/ |

|

/ |

|

|

|

|

|

|

|

(Note: When ownership has changed a new NM TRD ID# must be obtained.) |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

7. Business Name |

|

|

|

|

|

|

|

|

|

|

|

DBA (if applicable) |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Business Phone Number ( |

) |

|

|

|

Ext. |

|

|

Other Phone Number ( |

) |

|

|

|

Ext. |

|

|

|||||||||||||||

|

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

State |

|

Zip Code |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Business Location Address (not a PO Box) |

|

|

|

|

|

|

City |

|

|

|

|

|

|

State |

|

Zip Code |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Add other physical location (Attach additional pages if necessary) |

|

|

|

|

City |

|

|

|

State |

|

Zip Code |

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

8. Will business pay wages to employees in New Mexico? |

|

9. Workers Compensation Fee? |

q ADD |

|

|

Efective Date: |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

q |

Yes |

|

q |

No |

|

|

|

|

|

|

|

q DELETE |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

10. Seasonal Businesses Only - Change the business season to: |

|

|

|

Season Start Month: |

|

|

Season End Month |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

11. Change the CRS Filing Status to: |

|

q MONTHLY |

|

|

q |

QUARTERLY |

|

|

|

|

q |

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

(NOTE: Please review the iling status requirements on reverse before requesting a change.) |

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

12. Primary type of business in New Mexico (Check all that apply) |

|

|

|

|

|

|

|

|

|

|

13. Give a brief description of nature of business. |

|||||||||||||||||||

|

ADD |

DELETE |

|

|

|

|

|

|

|

ADD DELETE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

q |

q |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Accommodation, Food Services, and Drinking Places |

q |

|

q |

Manufacturing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

q |

q |

Administration and Support Services and Waste |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

q |

|

q Mining and Oil and Gas Extraction |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

Management and Remediation Services |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

q |

|

q Professional, Scientiic and Technical Services |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

q |

q |

Agriculture, Forestry, Fishing and Hunting |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

q |

|

q Real Estate and Leasing of Real Property |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

q |

q |

Arts, Entertainment and Resource Management |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

q |

|

q Rental and Leasing of Tangible Personal Property |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

q |

q |

Construction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

q |

|

q |

Retail Trade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

q |

q |

Educational Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

q |

|

q |

Transportation and Warehousing |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

q |

q |

Finance and Insurance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

q |

|

q |

Utilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

q |

q |

Government |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

q |

|

q |

Wholesale Trade |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

q |

q |

Health Care and Social Assistance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

q |

|

q |

Other Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

14. Federal Employer Identiication Number (FEIN) ____ ____ - ____ ____ ____ ____ ____ ____ ____ |

|

|

|

q ADD |

|

q DELETE |

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

15. Liquor License Type/Number : __________________________ |

|

18. Special Tax Registration Information - Only update if a change is necessary. |

|

|

|

|

|||||||||||||||||||||||

|

|

|

q ADD |

q |

DELETE |

q |

CHANGE |

|

|

|

|

|

(Note: A Special Tax Registration must be completed when adding an activity below. |

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

Gasoline Sales |

qADD |

qDELETE |

|

|

Severing Natural Resources |

qADD |

q DELETE |

||||||||||||||||||||

|

|

16. Secretary of State Business ID Number : _____________________ |

|

|

|||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||

|

|

|

q ADD |

q |

DELETE |

q |

CHANGE |

|

|

|

Special Fuels |

qADD |

qDELETE |

|

|

Processing Natural Resources |

qADD |

q DELETE |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cigarette Sales |

qADD |

qDELETE |

|

|

Water Producer |

|

qADD |

q DELETE |

|||||||||

|

|

17. RLD Contractor’s License Number : ______________________ |

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

qADD |

qDELETE |

|

|

|

|

|

|

|

|

qADD |

q DELETE |

|||||||||||||||

|

|

|

q ADD |

q DELETE |

q CHANGE |

|

|

|

Tobacco Products |

|

|

Gaming Activities |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

19. |

q |

Are you closing a business? |

You may want to request a Letter of Good Standing or a Certiicate of No Tax Due. See instructions on the back of this form. |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

20. Before updating Owners / Partner / Corporate Oicers / Association Members / Shareholders information below, please see the instructions on the reverse side of this form. |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Attach additional pages if necessary.) |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

# 1 |

q Add |

q Change |

|

|

q Delete |

# 2 |

q Add |

|

q Change |

q Delete |

|

|

|||||||||||

|

|

SSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME & TITLE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PHONE & |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21. I declare that the information reported on this form and any supplementa page(s) is true and correct. |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Print Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Send original to any Taxation & Revenue Department oice listed on the back of this form. Please keep a copy for your iles. |

|

|

|

|

|

|||||||||||||||||

ACD - 31075

Rev. 12/14

This business tax registration update is to be used for the following tax programs: Gross Receipts, Compensating, Withholding, Workers Compensation Fee, Gasoline, Special Fuels, Cigarette, Tobacco Products, Severance, Resource, Water Producers and Gaming Activities. All attachments must contain the business name and New

Mexico Taxation and Revenue Department Identiication Number (NM TRD ID#). Should you need assistance completing this update, please contact the department at one of the ofices listed below.

COMPLETE ONLY THE AREAS TO BE UPDATED OR CHANGED – If the ownership of a proprietorship has changed, a new NM TRD ID# is required (i.e. A proprietorship has now become a corporation; a different family member is now taking ownership of the family business, etc). If the owner- ship of a partnership has changed (i.e. a partner is no longer involved or you wish to add a partner) a new NM TRD ID# is required.

CURRENT INFORMATION

1.Provide the New Mexico Taxation and Revenue Department Identiication Number (NM TRD ID#)

2.Provide the Federal Employer Identiication Number (FEIN) if applicable. If the FEIN has changed as a result of an ownership change, a new NM TRD ID# is required.

3.Provide the current business name and name the business is Doing Business As (DBA) (as it appears on Taxation and Revenue Department records before the change is made).

NEW INFORMATION

4.Enter the name you are DOING BUSINESS AS if applicable.

5.Change the business registration status to ACTIVE or CLOSED. Circle one. Provide an effective date for the status change.

6.Change the Business Start Date if the date originally indicated is incorrect and no business activity has occurred.

7.Change as needed the Business Name, DBA, Business Phone Number and Extension, Other Phone Number, Mailing Address, Business Location Address and add any other physical locations. (Attach additional pages if necessary). Complete ONLY items that have changes.

8.Check Yes or No. Every employer, including employers of some agricultural workers, who withhold a portion of an employee’s wages for payment of federal income tax, must withhold NM income tax..

9.Check the box to Add or Delete the Workers’ Compensation Fee status. Provide an effective date when you become (or plan to become) a covered employer or are no longer subject to the fee. For more information contact the Workers’ Compensation Administration at (505)

10.Seasonal Businesses only – When the business is engaged in business activity outside the Business Season, the entity is no longer a Seasonal Business. Indicate the new Business Season for a seasonal business only.

11.Request to change the CRS iling Status to Monthly, Quarterly, or

a)Monthly – due by the 25th of the following month if combined taxes due average more than $200 per month or if you wish to ile monthly regardless of the amount due. Monthly periods are from the 1st of each month to the last day of each month.

b)Quarterly- due by the 25th of the month following the end of the quarter if combined taxes due for the quarter are less than $600 or an average of less than $200 per month in the quarter. Quarters are January 1st - March 31st; April 1st – June 30th ; July 1st – September 30th ; October 1st – December 31st.

c)Semiannual due by the 25th of the month following the end of the

12.Add or Delete the business activity in which the business is engaged. More than one business activity can be selected. Please describe all business activities that are "added". If you are unsure as to your entity's business classiication, please contact one of ofices listed below.

13.Briely describe the nature of the type(s) of business in which you will be engaging. The lack of information may affect the type of NTTC for which you qualify.

14.Add or Delete the Federal Employer Identiication Number (FEIN), issued by the Internal Revenue Service. If the FEIN has changed as a result of an owner ship change, a new NM TRD ID# is required.

15.Liquor License Type/Number. - Add, Delete or Change the Liquor License Type/No. issued by the Alcohol and Gaming Division of the Regulation and Licensing

Department.

16.Secretary of State Business Number. – Add, Delete or Change the Business Number issued by the Secretary of State.

17.RLD Contractor's License Number. – Add, Delete, or Change the License Number issued by the Construction Industries Division of the Regulation and Licensing

Department.

18.Special Tax Registration information – Add or Delete an activity, which qualiies for Special Tax purposes. A Special Tax Registration form must be com pleted when adding an activity. Taxpayers selling, leasing, or transferring a liquor license should request a letter of no objection from the Taxation & Revenue

Department.

19.Check this box if you are closing a business. Proprietorships may want to request a Letter of Good Standing from the Department to verify that there are no outstanding liabilities or

20.You may update an owner’s or partner’s address, telephone number, or

21.he registration update should be signed by an Owner, Partner, Corporate Oicer, Association Member, Shareholder, or authorized representative.

Return this form and all attachments to one of the ofices listed below.

Taxation & Revenue Department |

Taxation & Revenue Department |

Taxation & Revenue Department |

Manuel Lujan Sr. Building |

2540 El Paseo, Bldg #2 |

400 N. Pennsylvania Ste.200 |

1200 South St. Francis Dr. |

PO Box 607 |

PO Box 1557 |

PO Box 5374 |

Las Cruces, NM |

Roswell, NM |

Santa Fe, NM |

(575) |

(575) |

(505) |

|

Taxation & Revenue Department |

Taxation & Revenue Department |

5301 Central NE |

3501 E. Main St., Suite N |

PO Box 8485 |

PO Box 479 |

Albuquerque, NM |

Farmington, NM |

(505) |

(505) |

Document Specifics

| Fact | Detail |

|---|---|

| Form Title | ACD - 31075 Business Tax Registration Update |

| Revision Date | December 2014 |

| Issuing Department | New Mexico Taxation and Revenue Department |

| Purpose | To update business tax registration information |

| Submission Requirement | Send original to any Taxation & Revenue Department office listed on the back of the form. Keep a copy for your records. |

| Areas to Update | Business registration status, start date, business name/DBA, business phone number, mailing and business location addresses, and specific tax program participation among others. |

| Special Instructions | If ownership changes, a new NM TRD ID# is required. Detailed instructions provided for specific updates like worker's compensation fee, special tax registration, and business activity type. |

| Governing Law | New Mexico State Law |

Guide to Writing Acd 31075 Tax Registration Update

Filing the ACD-31075 Tax Registration Update form is an essential process for businesses in New Mexico that need to report changes in their tax registration details. This could involve updating business names, addresses, ownership details, or business activity types. Following the right steps ensures that the state's records are accurate and up to date, which is crucial for compliance with state tax laws. Below is a step-by-step guide to help you complete the form accurately.

- Current Information Section:

- Enter your New Mexico Taxation and Revenue Department Identification Number (NM TRD ID#).

- If applicable, fill in your Federal Employer Identification Number (FEIN).

- Provide the current business name and, if applicable, the name you are doing business as (DBA).

- New Information to Report Section: Complete only the items that have changed.

- For a change in business registration status, circle either ACTIVE or CLOSED and provide the effective date of this change.

- If you need to update the business start date, enter the new start date and its effective date.

- Update as necessary the business name, DBA, phone numbers, mailing address, business location address, and add any other physical locations (attach additional pages if needed).

- Indicate whether your business will pay wages to employees in New Mexico by checking Yes or No.

- Add or delete Workers' Compensation Fee status and provide the effective date for this change.

- For seasonal businesses, update the business season start and end months.

- Choose the new CRS filing status that applies to your business: Monthly, Quarterly, or Semi-annually.

- Add or delete the primary type of business in New Mexico and provide a brief description of the nature of your business.

- If the Federal Employer Identification Number (FEIN) has changed due to ownership change, add or delete the FEIN.

- Update the Liquor License Type/Number, Secretary of State Business Number, RLD Contractor's License Number as necessary.

- For special tax registration information, add or delete specific activities requiring special tax consideration.

- If closing a business, check the appropriate box to indicate this.

- Updating Owners/Partners/Officers Information: You can add, change, or delete details about owners, partners, corporate officers, association members, or shareholders. Make sure to attach additional pages if necessary.

- Signature: The form must be signed by an Owner, Partner, Corporate Officer, Association Member, Shareholder, or authorized representative. Print the name and title of the person signing the form, then sign and date it.

- Send the original completed form and any additional pages to one of the Taxation & Revenue Department offices listed on the back of the form. Keep a copy for your records.

After you've submitted your form, the Taxation and Revenue Department will process your updates. It's important to keep a copy of the form for your records. Following these steps will help ensure that your business's registration details are up-to-date, which is essential for maintaining good standing with the New Mexico State Taxation and Revenue Department.

Understanding Acd 31075 Tax Registration Update

-

Who needs to fill out the ACD 31075 Tax Registration Update form?

Business owners in New Mexico who need to update their tax registration records should use this form. This includes changes such as updates to business name, DBA, ownership, contact information, business location, tax filing status, or business activities.

-

When is a new New Mexico Taxation and Revenue Department Identification Number (NM TRD ID#) required?

A new NM TRD ID# is necessary when there is a change in ownership of a proprietorship or partnership. This includes a proprietorship becoming a corporation, or if a partnership sees a change in partners.

-

What changes can be reported on the ACD 31075 form?

Changes that can be reported include registration status (active/closed), updating the business start date, changes to the business name or DBA, updating business and mailing addresses, changes in tax filing status, updating business activities, and modifying special tax registration information.

-

How do seasonal businesses update their business season?

Seasonal businesses should indicate the new start and end months of their business season directly on the form, if there has been a change from what was previously registered.

-

Can updates to owner or corporate officer information be made on this form?

Yes, updates regarding an owner's or corporate officer's address, telephone number, or email address can be made. It's also possible to add, change, or delete information about corporate officers, association members, or shareholders.

-

What should I do if I'm closing my business?

If you're closing your business, check the appropriate box on the form. You may also want to request a Letter of Good Standing or a Certificate of No Tax Due to confirm there are no outstanding tax liabilities. Additional steps might be required for corporations dissolving or withdrawing from business in New Mexico.

Common mistakes

- Failing to use black ink or a typewriter as specifically requested on the form, which can cause readability issues.

- Overlooking the instruction to only fill in the sections that are being updated or changed. Many individuals mistakenly fill out the entire form, leading to unnecessary data entry and confusion.

- Forgetting to provide the New Mexico Taxation and Revenue Department Identification Number (NM TRD ID#) and the Federal Employer Identification Number (FEIN). These identifiers are crucial for accurately updating business information.

- Neglecting to circle the desired option for changing the business registration status to ACTIVE or CLOSED. The effectiveness of this update relies on clearly marking the intended status change and providing an effective date.

- Inaccurately reporting the business start date when a change is necessary, often due to misunderstanding the original start date or the impact of significant business changes.

- Omitting details for new physical locations or failing to attach additional pages when the space provided is insufficient. This oversight can result in incomplete records for where the business operates.

- Misunderstanding the requirements for changing the CRS filing status. Many individuals select a new filing status without reviewing the criteria for monthly, quarterly, or semi-annually filing, leading to potential complications with tax obligations.

People often make mistakes when filling out the ACD 31075 Tax Registration Update form, which can lead to processing delays or incorrect filings. Below are some of the common errors encountered:

Besides these common mistakes, ensuring the accuracy and completeness of all other sections applicable to specific business changes is vital for a smooth update process.

Documents used along the form

When updating your business's tax registration with the ACD - 31075 form in New Mexico, there are several other forms and documents you might need to complete or update as part of maintaining or adjusting your business's record and compliance requirements. Here are a few key documents often used in conjunction with the ACD - 31075 Tax Registration Update form:

- CRS-1 Form - Business Tax Registration: A crucial document for new businesses or those that haven't previously registered for taxes in New Mexico. It's used to apply for a Combined Reporting System (CRS) identification number for reporting gross receipts tax, compensating tax, and withholding tax.

- ACD-31096 - Application for Business Tax Identification Number: This form is necessary for businesses that need to obtain a new New Mexico Taxation and Revenue Department identification number, especially pertinent if there's been a change in ownership or business structure.

- ACD-31015 - Nontaxable Transaction Certificates Application: If your business makes sales that are exempt from gross receipts tax under New Mexico law, this application allows you to provide documentation to your suppliers, preventing them from charging tax on exempt items.

- Form RPD-41272 - Application for Refund: Businesses that believe they have overpaid taxes can use this form to apply for a refund. It's particularly relevant if changes in business operations, as updated on the ACD - 31075, affect tax liabilities.

- Letter of Good Standing Request Form: Although not a form per se, a request for a Letter of Good Standing from the New Mexico Taxation and Revenue Department may be necessary during business transitions, dissolutions, or when applying for certain types of business financing or contracts, to prove compliance with state tax laws.

When handling your business taxes and regulatory compliance, these documents, alongside the ACD - 31075 Tax Registration Update form, play critical roles. Keeping accurate and current records can save time and protect against legal or financial issues in the future. Always consult the New Mexico Taxation and Revenue Department or a tax professional if you have questions about which forms are necessary for your specific situation.

Similar forms

The Form SS-4, Application for Employer Identification Number (EIN), issued by the Internal Revenue Service (IRS), shares similarities with the ACD 31075 form in that both are critical for business tax identity. The Form SS-4 is necessary for obtaining an EIN, which is required for tax reporting purposes by the IRS, mirroring how the ACD 31075 requires a Federal Employer Identification Number for business tax updates in New Mexico. Both forms function as a means to ensure that businesses are properly registered for tax purposes and can be seen as foundational documents for business operation within their respective jurisdictions.

The Uniform Business Identifier (UBI) application form used in various states is another document with resemblances to the ACD 31075. The UBI form is essential for businesses to acquire a unique identifier that facilitates tax filing and regulatory compliance, comparable to the New Mexico Taxation and Revenue Department Identification Number mentioned in the ACD 31075. Both documents assist in the cataloging and identification of businesses for state-level oversight, promoting an organized system for monitoring business activities and tax liabilities.

The Business License Registration form, required by city or county authorities, bears similarity to the ACD 31075 form. While the ACD 31075 deals with state-level tax registration updates, the Business License Registration focuses on obtaining permission to operate legally within a specific locality. Both forms signify a step in the compliance process, ensuring businesses adhere to governmental regulations, albeit on different scales. However, both play crucial roles in the establishment and continued legal operation of businesses.

The Seller's Permit application, relevant in states with sales tax, aligns with the purpose of the ACD 31075. This permit allows businesses to collect sales tax on taxable sales, paralleling the ACD 31075's role in updating business tax information critical for state revenue services. They are interconnected in the broader context of tax administration, with each serving to ensure businesses contribute appropriately to state revenues through different channels.

Change of Address forms issued by postal services also share a common purpose with the ACD 31075. Though distinct in their application—one for postal records and the other for tax registration—they both facilitate the essential update of address information, ensuring communications and legal documents are accurately directed. This comparison highlights the administrative necessity of keeping governmental entities informed of current business details.

The Workers' Compensation Insurance Registration form is comparable to sections of the ACD 31075 that pertain to workers' compensation. Both documents are pivotal for businesses employing individuals, ensuring compliance with state laws regarding worker protection and insurance. This ensures that businesses are not only registered correctly for tax purposes but also adhere to labor laws and insurance requirements, safeguarding both the employer and employees.

The Quarterly Federal Tax Return (Form 941), mandatory for employers, finds a counterpart in the ACD 31075's provisions for updating business information relevant to tax obligations. Though the Form 941 deals specifically with federal payroll taxes, and the ACD 31075 encompasses a broader range of state tax updates, both are instrumental in managing and reporting essential tax information, ensuring businesses remain compliant with tax laws.

The Zoning Permit application process, while primarily concerning land use and building codes, shares the regulatory compliance element with the ACD 31075. Updating tax registration details through the ACD 31075 is akin to obtaining zoning approval in that both are required steps for legal business operations, highlighting the multifaceted nature of business compliance extending from taxation to municipal regulations.

The Franchise Tax Board's Change of Business Information form, specific to changes in business status or ownership, mirrors the ACD 31075's function. Both documents are crucial for updating governmental records to reflect current business operations accurately. The need for up-to-date records underscores the government's role in maintaining an accurate registry of active and compliant business entities.

The Liquor License Renewal application shares a procedural similarity with the ACD 31075, particularly in sections concerning the update of liquor license information. Both involve the submission of current business details to state authorities for the purpose of regulatory compliance. While one is focused on tax status, and the other on permission to sell alcoholic beverages, each underscores the importance of maintaining current records according to state laws and regulations.

Dos and Don'ts

When updating your business tax registration with the ACD-31075 form in New Mexico, attention to detail and adherence to instructions significantly impact the process's accuracy and legality. Here is a guide to ensure a smooth update process:

- Do provide the New Mexico Taxation and Revenue Department Identification Number (NM TRD ID#) accurately to avoid any processing delays.

- Do use black ink if filling out the form by hand to ensure legibility and prevent any information from being missed during processing.

- Do check the specific boxes for changes being reported and fill out only those sections of the form to prevent any unintended modifications to your business registration.

- Do attach additional pages if necessary, especially when reporting changes to business location addresses or adding new physical locations, ensuring all information is thorough and complete.

- Don't submit the form without reviewing the instructions on the reverse side, as these instructions provide essential guidance on completing the update form correctly.

- Don't forget to sign the form at section 21, as an unsigned form may result in processing delays or be considered incomplete by the Taxation and Revenue Department.

- Don't overlook the option to request a Letter of Good Standing or a Certificate of No Tax Due if closing a business. This can provide crucial verification of your tax status.

- Don't hesitate to contact the department for assistance if you have questions or uncertainties about completing the form. The contact information provided at the end of the form is there to support you through this process.

By prioritizing accuracy, completeness, and adherence to the form's instructions, businesses can ensure their tax registration update is processed efficiently and correctly.

Misconceptions

- One common misconception is that the ACD 31075 Tax Registration Update form is only for businesses that are closing. In reality, this form is versatile and intended for various updates. It can be used to change registration status to either active or closed, but it also facilitates changes to business information such as name, start dates, and addresses. This form encompasses a broad range of updates that a business in New Mexico might need to report.

- Another misunderstanding involves the idea that a new New Mexico Taxation and Revenue Department Identification Number (NM TRD ID#) is automatically issued upon submission of the form. In fact, a new NM TRD ID# is only required and issued if there are changes in ownership, such as moving from a proprietorship to a corporation or changing partners in a partnership. This step ensures the continuation of accurate and up-to-date business records.

- Many believe that the submission of the ACD 31075 form is a lengthy and complex process requiring professional legal or accounting help. While professional advice is beneficial, especially for complicated changes, the form itself is designed to be straightforward. It includes clear instructions for completion, allowing business owners to update their tax registration details without undue difficulty.

- There's also a misconception that updating the Federal Employer Identification Number (FEIN) through the ACD 31075 automatically updates the business's information with the IRS. However, any change to the FEIN requires direct communication with the IRS. The ACD 31075 form only updates the FEIN for state records, which are maintained separately from federal records.

- Lastly, some believe that the ACD 31075 form is the correct way to request tax clearance or a Letter of Good Standing from the New Mexico Taxation and Revenue Department. While closing a business does involve these documents, the form itself is not a request for them. Instead, it updates the department on the business's closure, and a separate process must be followed to obtain tax clearance or a Letter of Good Standing.

Key takeaways

When updating your business tax registration with the ACD 31075 form, it's important to focus on several key takeaways to ensure the process goes smoothly and accurately:

- Use black ink for printing or typing to ensure the form is legible. This is crucial for avoiding processing delays or errors.

- Ensure you have the correct New Mexico Taxation and Revenue Department Identification Number (NM TRD ID#) and Federal Employer Identification Number (FEIN) available, as these are essential for identifying your business with state and federal agencies.

- Clearly distinguish between current information and new information. The form separates these sections to streamline updates for changes in your business’s registration status, business name, location, and other critical details.

- Only complete the areas of the form that need updating. There's no need to fill out sections that remain unchanged, saving time and reducing potential for error.

- If there's been a change in ownership, a new NM TRD ID# might be required. This is particularly important for proprietorships becoming corporations or when there is a significant shift in partnership composition.

- Changes in business activity types or primary business operations must be reflected on the form. Providing a brief description of your business’s nature can assist in ensuring you receive the correct tax assistance and information.

- Consideration of special tax registration information is necessary if your business engages in activities eligible for special taxes, like gasoline sales or gaming activities. New activities may require completing an additional Special Tax Registration form.

- If closing a business, it might be beneficial to request a Letter of Good Standing or a Certificate of No Tax Due from the Department to verify that all liabilities have been addressed. This is an essential step for dissolving a business properly and avoiding future liabilities.

Ensure you sign the form and return it to one of the Taxation & Revenue Department offices listed on the form’s reverse side. Keeping a copy for your records is also advisable.

Popular PDF Documents

W8 Bene - Its use underlines the importance of transparency and accountability in employment relationships and tax obligations.

How to Report a Workplace Injury - By requiring employer and employee signatures, the form ensures that both parties acknowledge the accuracy of the information provided.

Tax Returns - The form is also relevant for non-U.S. residents to disclose scholarship or fellowship grants that are taxable in the United States.