Get 601 Sales Tax Form

In the world of business and taxation in Gujarat, the 601 Sales Tax form plays a crucial role for professionals seeking to operate as sales tax practitioners under the Gujarat Value Added Tax Act, 2003. This application is directed towards the Commissioner of Commercial Tax in Gujarat, laying out a platform for qualified individuals to register and officially engage with tax authorities. Through a detailed procedure outlined in the form, applicants are required to showcase their qualifications, such as passing recognized accountancy examinations and holding requisite educational credentials. The form not only asks for personal and educational details but also delves into the applicants' past government service, if any, making it a comprehensive document for assessment. Furthermore, providing true copies of qualifications and any government service records, along with originals for perusal, underscores the transparency and thoroughness expected in the application process. Receipt of this application is acknowledged officially, indicating the formality and importance of the enrolment process in adhering to the Gujarat Value Added Tax Rules, 2006. The 601 form is, therefore, a critical step for aspiring sales tax practitioners in Gujarat, emphasizing qualification, transparency, and proper procedure.

601 Sales Tax Example

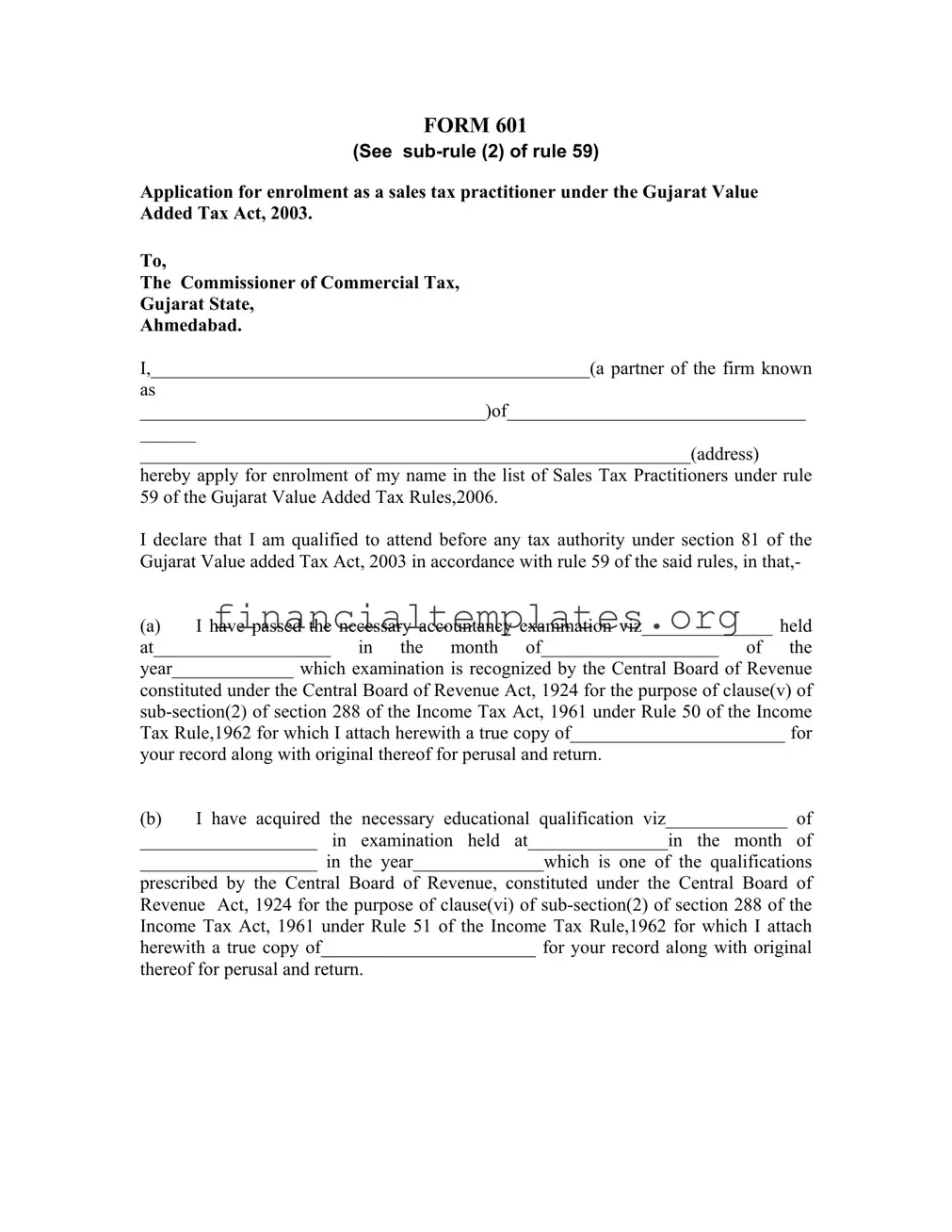

FORM 601

(SEE

Application for enrolment as a sales tax practitioner under the Gujarat Value Added Tax Act, 2003.

To,

The Commissioner of Commercial Tax,

Gujarat State,

Ahmedabad.

I,_______________________________________________(a partner of the firm known

as

_____________________________________)of________________________________

______

___________________________________________________________(address)

hereby apply for enrolment of my name in the list of Sales Tax Practitioners under rule 59 of the Gujarat Value Added Tax Rules,2006.

I declare that I am qualified to attend before any tax authority under section 81 of the Gujarat Value added Tax Act, 2003 in accordance with rule 59 of the said rules, in that,-

(a)I have passed the necessary accountancy examination viz______________ held at___________________ in the month of___________________ of the year_____________ which examination is recognized by the Central Board of Revenue constituted under the Central Board of Revenue Act, 1924 for the purpose of clause(v) of

(b)I have acquired the necessary educational qualification viz_____________ of

___________________ in examination held at_______________in the month of

___________________ in the year______________which is one of the qualifications prescribed by the Central Board of Revenue, constituted under the Central Board of Revenue Act, 1924 for the purpose of clause(vi) of

(2) In respect of Government service in any Department.

Serial |

Name of all Department |

Address. |

Period. |

No. |

served in. |

3. |

4. |

|

|

||

1. |

2. |

|

|

|

|

|

|

|

|

|

|

|

Post held |

Reason for leaving the service |

|

|

|

|

|

|

|

|

|

State whether the applicant resigned from service or that applicant was removed from services of he was dismissed, and reasons therefore. A true copy of the order accepting resignation/ of removal of dismissal is sent here with for your record alongwith original thereof for perusal and return.

The above statements are true and complete.

Place :

Date : |

Signature___________________ |

*Strike out which is not applicable.

Acknowledgement

Received an application in Form 601 ________________________ for an

enrolment under rule 59 of the Gujarat Value Added Tax Rules, 2006.

Date______________ |

Receiving Officer. |

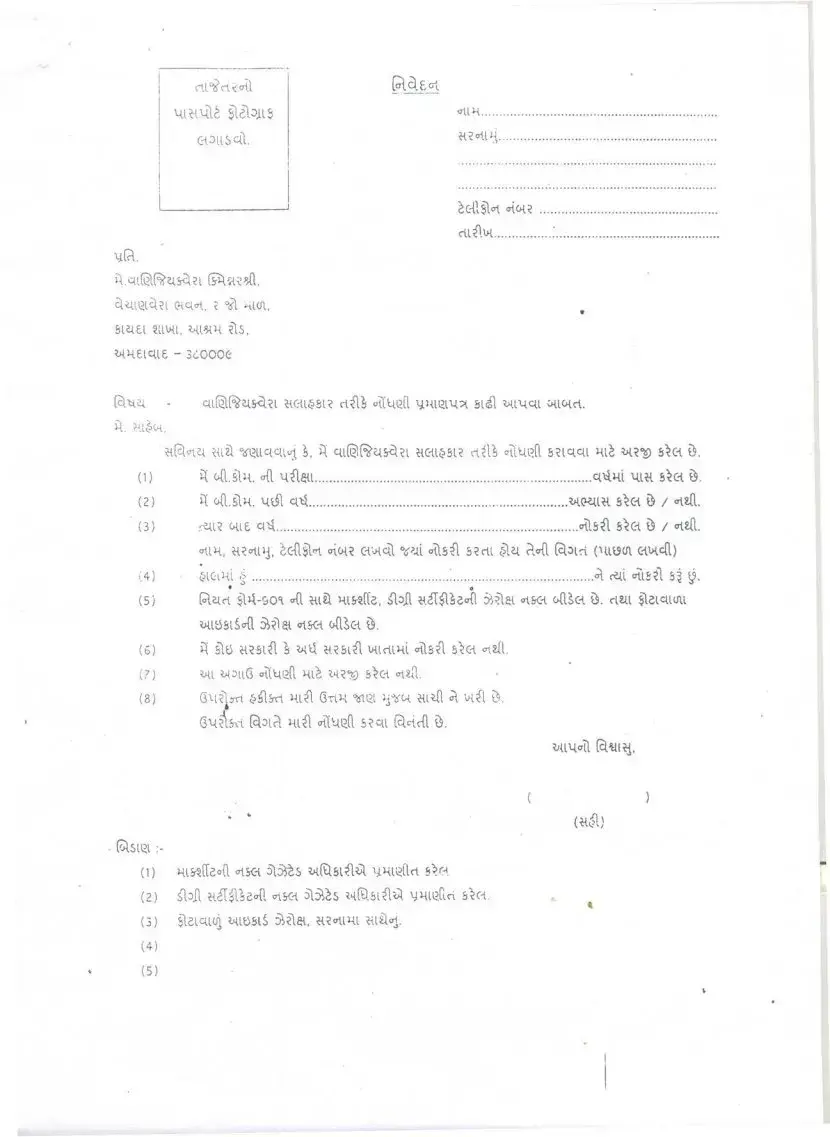

\tl ot ci ;: aU

\.tl~tU~ ~il:>Jl~

\l (rt.

rata.Eat

aUloot |

... |

......... |

~ i?aUI} |

|

............. |

....................................................................... |

|

|

........................................................................ |

|

|

~cit$1. 01. |

cri. V{i? |

................... |

ci.l~.Vt |

: |

............... |

.

(q~i?{ - |

ql@~~5<ti?l ~Kll<?8l( 1i~1 "Ult12(l\l1U12l\.l?lBl~ |

Qtl\.lCU"tlv{li. |

|

|

|

|||

ii. ~.l&v{. |

|

|

|

|

|

|

|

|

~(Q01.~ ~lV. °o12llqQl1 5. i{ |

oUltl~G8i?lqql ~l~ |

~(~ |

||||||

(1) |

i{ V{l.Sl~. aD.\.l~~l |

|

|

Cl~~l |

\.ll~ |

B~({ ~. |

||

(2) |

it |

vil.5l~. \.J,Jl Ct~ |

|

|

/ o1.Ut. |

|||

(3) |

f.~li? V{l£ CI~ |

|

|

aU8~ |

||||

|

o1.l~. ~(o1.l1j. ~({t~<1 a\V{( |

~~ |

~,AD.(CtJlct (\ll~(J\ |

({wc(l) |

||||

|

. |

.. |

. |

|

""I . |

~ |

n . . |

|

(4) |

<?l0l~l g |

0 |

|

"1 ~l |

o1.l&~lS~ tiI. |

|||

|

|

t |

|

|

|

|

|

|

(5 i |

fol~1i |

|||||||

~leslsaD. ~~I~

(6)i{ 5l~ ~i?Sl~ 1 Q{tt ~(Sl~ Wllil~i at\.~dl 5~C{ 01.~1.

(?)~l oPllG oUtt12(l~l~ ~Ai?':0S~C1o1.~l

(8)

.StSlQl :-

-

(1)

(2) |

SlJll ~.&~Bca{1,o1.SC{5l~~s ~1{(B.~8l~ \I |

. |

|

|

(3)$tclCtluj We8lS ~~~. ~i?o1.l~l ~UUoj.

Document Specifics

| Fact | Detail |

|---|---|

| Form Number | 601 |

| Form Title | Application for enrolment as a sales tax practitioner |

| Governing Law | Gujarat Value Added Tax Act, 2003 |

| Associated Rules | Rule 59 of the Gujarat Value Added Tax Rules, 2006 |

| Eligibility Criteria | Passing an accountancy examination recognized by the Central Board of Revenue and necessary educational qualifications |

| Submission | To the Commissioner of Commercial Tax, Gujarat State, Ahmedabad |

Guide to Writing 601 Sales Tax

Completing the 601 Sales Tax Form is an essential step for individuals aspiring to become sales tax practitioners in Gujarat under the Gujarat Value Added Tax Act, 2003. This document serves as an application for enrolment, affirming that the applicant possesses the requisite qualifications to represent before tax authorities. The procedure involves detailing personal information, educational and professional credentials, and any government service history, followed by a confirmation of the truthfulness of the statements provided. The undertaking of filling out this form is meticulous, requiring attention to detail to ensure accuracy and completeness.

- Begin by entering your full name where indicated at the start of the form.

- Insert the name of the firm you are associated with, if applicable.

- Provide your complete address, ensuring clarity and precision.

- Detail the accountancy examination you have passed, including the name of the examination, the location where it was held, the month and year of the examination, and its recognition status by the Central Board of Revenue. Attach a true copy of the relevant certificate for record, along with the original for perusal and return.

- State your educational qualifications that are relevant to the application, mentioning the degree or qualification obtained, the institution, location, month, and year of the examination. Similar to the previous step, attach a true copy for the record and the original for verification purposes.

- If applicable, list all government departments you have served in, including the name of the department, address, period of service, post held, and reason for leaving the service. Specify whether you resigned, were removed, or were dismissed, including the reasons for such an outcome. Attach a true copy of the order relating to resignation, removal, or dismissal.

- At the bottom of the form, enter the place, current date, and your signature. If any section is not applicable, remember to strike it out as instructed.

- After reviewing the form for completeness and accuracy, submit it along with all necessary attachments to the Commissioner of Commercial Tax, Gujarat State, Ahmedabad.

By following these detailed instructions carefully, applicants can ensure that their application for enrolment as a sales tax practitioner is properly filled out and submitted, paving the way for their professional journey in the field of sales tax consultancy and representation in Gujarat.

Understanding 601 Sales Tax

What is Form 601 and who should use it?

Form 601 is an application form for enrollment as a sales tax practitioner under the Gujarat Value Added Tax Act, 2003. It is specifically designed for individuals seeking to represent firms or entities in dealings with the tax authorities in Gujarat regarding sales tax matters. Individuals qualified to attend before any tax authority as per section 81 of the Gujarat Value Added Tax Act, 2003, and who meet the qualification criteria laid out in rule 59 of the Gujarat Value Added Tax Rules, 2006, should use this form. Qualified persons typically include those who have passed certain accountancy examinations recognized by the Central Board of Revenue and those with specific educational qualifications. Additionally, applicants must disclose any government service history, including details about the positions they have held and their reasons for leaving such positions.

What documents are required to be attached with Form 601?

Applicants must attach a true copy of their qualification certificates, such as accountancy examination certificates or educational qualification certificates, as mentioned in the form. These documents must be recognized by the Central Board of Revenue for the purpose specified within the form. Additionally, if applicable, the applicant must provide a true copy of the order accepting resignation, or of removal or dismissal from government services. It is crucial that both a copy for record and the original document are submitted for perusal and return by the Commissioner of Commercial Tax.

Where should Form 601 be submitted?

Form 601 should be submitted to the Commissioner of Commercial Tax, Gujarat State, in Ahmedabad. The complete submission includes not only the filled application form but also the required attached documents as specified in the application instructions. The address and specific office for submission can typically be found on the Gujarat Commercial Tax Department's official website or by directly contacting their office.

How does one qualify to be enrolled as a sales tax practitioner in Gujarat?

To qualify for enrollment as a sales tax practitioner in Gujarat, an individual must fulfill certain educational and examination criteria. Firstly, the person must have passed an accountancy examination that is recognized by the Central Board of Revenue. The specific examinations recognized are detailed in the rules corresponding to section 288 of the Income Tax Act, 1961. Secondly, the applicant must possess certain educational qualifications, again, as recognized by the Central Board of Revenue for the purpose of enrollment. Besides academic qualifications, the person applying needs to ensure they have not been dismissed or removed from government services under circumstances that would disqualify them from enrollment.

Is there an acknowledgment process after submitting Form 601?

Yes, after submitting Form 601, an acknowledgment receipt is issued to the applicant. This receipt is proof that the application for enrollment under rule 59 of the Gujarat Value Added Tax Rules, 2006, has been received by the Commissioner's office. The date of receipt and details of the receiving officer are mentioned on this acknowledgment. It's essential to keep this acknowledgment safe, as it may be required for future references or inquiries about the application status.

Common mistakes

When filling out the Form 601 for Sales Tax Practitioner enrolment under the Gujarat Value Added Tax Act, there are common mistakes that applicants should avoid to ensure a smooth processing of their application. Understanding these mistakes can help in submitting an accurate and complete application.

- Not attaching the necessary documents: The form requires applicants to attach true copies of their accountancy and educational qualifications. Omitting these attachments can lead to application rejection.

- Incomplete details: Every section of the form asks for specific information, including personal details, professional qualifications, and past government service. Leaving sections incomplete can invalidate the form.

- Illegible handwriting: While filling out the form manually, ensuring that the handwriting is legible is crucial. Hard-to-read applications may lead to misunderstandings or processing delays.

- Forgetting to sign the form: An unsigned form is considered incomplete and invalid. The applicant's signature is necessary for the verification and validation of the information provided.

- Inaccurate information: Providing false or inaccurate information not only jeopardizes the application's approval but can also lead to legal consequences for the applicant.

Avoiding these common mistakes can significantly increase the chances of successful enrolment as a Sales Tax Practitioner. Applicants should double-check their forms before submission to ensure all the required information is accurate and complete.

Documents used along the form

When completing and submitting the Form 601 for enrollment as a sales tax practitioner, several additional forms and documents often accompany the application, depending on the specific requirements and the applicant's circumstances. Understanding these additional documents can help streamline the application process and ensure compliance with the Gujarat Value Added Tax Act, 2003.

- Proof of Educational Qualification: A copy of certificates demonstrating the applicant has met the educational qualifications required for enrollment as mentioned in Form 601.

- Proof of Accountancy Examination: Documentation that shows the applicant has passed the accountancy examination recognized by the Central Board of Revenue, which is a prerequisite for enrollment.

- Experience Certificate: Documents verifying the applicant’s employment history, including positions held and reasons for leaving, to fulfill the experience criteria set forth for a sales tax practitioner.

- Government Service Documentation: If applicable, documents relating to any government service the applicant has rendered, including a true copy of the order for resignation, removal, or dismissal.

- Identity Proof: A government-issued photo ID to establish the identity of the applicant, such as a driving license, passport, or Aadhaar card.

- Address Proof: Documents to verify the address of the applicant, like a utility bill or house lease agreement, to ensure correspondence and verification can be accurately directed.

- Character Certificate: A certification from a competent authority indicating the good character of the applicant, necessary for establishing trustworthiness and reliability.

- No Objection Certificate (NOC) from Current Employer: If currently employed, an NOC stating the employer has no objection to the applicant enrolling as a sales tax practitioner.

- Passport Size Photographs: Recent photographs to be affixed on the application form and for identification purposes during the process of enrollment.

- Receipt of Application Fee Payment: A proof of payment for the application fee, confirming the transaction was successful and the application is duly supported by the requisite fee.

Gathering these documents in preparation for the application process can significantly enhance the efficiency and outcome of the application for enrollment as a sales tax practitioner. Each document plays a crucial role in verifying the credentials, qualifications, and reliability of the applicant in adherence to the rules and standards set forth by the Gujarat Value Added Tax Act, 2003.

Similar forms

The 1040 U.S. Individual Income Tax Return form is one example of a document with similarities to the Form 601 Sales Tax form. Just like the 601 form requires information about qualifications and past exams, the 1040 form requires filers to report their income from various sources, as well as deductions and credits, to calculate their tax liability. Both forms serve as crucial tools for reporting to tax authorities, though focusing on different aspects of taxation.

The W-9 Request for Taxpayer Identification Number and Certification is another document that shares some resemblance with the Form 601. While the Form 601 is used by sales tax practitioners in Gujarat, India, the W-9 is widely utilized in the United States by individuals and entities to provide their taxpayer identification number to entities that will pay them income. Both forms are integral in ensuring the correct reporting and documentation for tax purposes.

The Schedule C (Form 1040) Profit or Loss from Business is similarly related to Form 601 in that it pertains to tax filing and documentation. Schedule C is used by sole proprietors in the U.S. to report the income and expenses of their business, which directly affects their tax liability. This form, like the 601, requires detailed information to ensure compliance with tax laws and regulations.

The VAT-100 Value Added Tax Return form in jurisdictions with VAT systems is akin to the Form 601, as both deal with the specifics of tax on sales. Though the VAT-100 is more about reporting the tax collected and paid on sales and purchases, and the Form 601 focuses on the enrollment of sales tax practitioners, they both play key roles in the administration of sales tax/vat.

The Business License Application forms used in various localities that require businesses to register and sometimes report their estimated sales tax collections have a functional likeness to the Form 601. These forms are essential for businesses to legally operate and for local governments to track and collect sales tax, mirroring the way Form 601 is used to ensure sales tax practitioners are properly enrolled and qualified.

The IRS Form 4506-T Request for Transcript of Tax Return shares the purpose of documentation and verification with the Form 601. Form 4506-T allows individuals and businesses to request tax return information that can be used for various purposes, including verifying income and tax compliance. While serving different functions, both forms are vital for the accurate and transparent reporting and verification of tax-related matters.

Lastly, the Application for Employer Identification Number (EIN), IRS Form SS-4, is somewhat comparable to the Form 601. While SS-4 is used in the U.S. to apply for an EIN necessary for tax filing and reporting by entities, the Form 601 enrolls individuals as sales tax practitioners. Both are initial steps required for individuals or entities to partake in taxation processes within their respective systems.

Dos and Don'ts

When preparing to fill out the Form 601 Sales Tax application, it's important to follow specific do's and don'ts to ensure the process is smooth and the application is accepted. Here are some key guidelines:

- Do ensure that all personal details filled out on the form match those on your official documents.

- Do attach true copies of your educational and accountancy qualifications as required under sections (a) and (b), ensuring they are recognized by the Central Board of Revenue.

- Do include a true copy and the original of any government service orders if applicable, for perusal and return.

- Do sign the declaration to confirm that the information provided is true and complete.

- Don't leave any mandatory fields blank. If any section does not apply, make sure to indicate as instructed in the form.

- Don't attach documents without checking their validity and relevancy to the clauses mentioned in the form.

- Don't forget to keep a copy of the filled form and attached documents for your records before submission.

These steps are crucial for ensuring that the enrollment as a Sales Tax Practitioner under the Gujarat Value Added Tax Act, 2003, is completed without delays or rejection. Paying attention to the specified details and requirements will streamline the process and support your successful registration.

Misconceptions

Many individuals hold misconceptions about the Form 601 Sales Tax form, often leading to confusion. Below are nine common misconceptions and their explanations to help clarify these misunderstandings.

- Form 601 is only for businesses in Gujarat. While it is specific to the Gujarat Value Added Tax Act, 2003, it's crucial for individuals seeking enrollment as sales tax practitioners who may serve businesses beyond Gujarat.

- Anyone can apply for enrollment. In reality, applicants need to meet specific qualifications, such as passing necessary accountancy examinations and having certain educational qualifications recognized by the Central Board of Revenue.

- You only need to submit the application form to become a sales tax practitioner. The process requires not just submission but also the attachment of true copies and originals of qualifications for perusal and return, indicating a more thorough evaluation process.

- Past government service is irrelevant to the application. The form requests detailed information about any government service, including the reason for leaving such service, showing that past government service is, in fact, considered.

- The form doesn’t need to be signed. A signature is required at the bottom of the form, underscoring the applicant's declaration that the information provided is true and complete.

- Electronic submissions are accepted. Given the requirement for original documents for perusal and return, this suggests that a physical submission may be required, though specific submission guidelines should always be checked.

- Approval is immediate upon submission. The acknowledgment section implies there's a process following submission, indicating that approval may not be immediate.

- Form 601 is the final step in becoming a sales tax practitioner. The form is an application for enrollment, which suggests it is just one part of the process and not necessarily the final step.

- There is no need to strike out non-applicable sections. The form includes a note to "strike out which is not applicable," indicating that applicants must tailor the form to their specifics, enhancing clarity and relevance.

Understanding the specifics of Form 601 can help applicants accurately complete their applications and set realistic expectations about the process. Paying close attention to the form's requirements can prevent common pitfalls and streamline the enrolment process.

Key takeaways

Understanding the 601 Sales Tax form, specifically designed for enrollment as a sales tax practitioner under the Gujarat Value Added Tax Act, 2003, presents various key takeaways crucial for applicants. This form serves as a vital link for professionals aspiring to navigate the realm of sales tax within Gujarat proficiently. Here are essential insights to grasp:

- Personal and professional details are crucial. The form requires applicants to fill in their name, partnership details if any, and address. This foundational information forms the backbone of the application.

- Educational qualifications must align with specified requirements. As detailed, applicants must have passed specific accountancy examinations recognized by the Central Board of Revenue, indicating a structured approach towards assessing an individual's competency and expertise.

- Attachment of relevant documents is mandatory. Applicants must attach a true copy of their educational qualifications and proof of passing the required examinations. This step ensures that all claims are verifiable, maintaining the process's integrity.

- Government service history plays a role. The form prompts applicants to list their government service history, if any, providing insight into the applicant's work background and experience in public service.

- Reasons for leaving previous government services must be disclosed. This requirement ensures transparency and allows for a holistic evaluation of the applicant's professional journey.

- The form necessitates an acknowledgment of truthfulness. By signing the document, the applicant affirms that all provided information is true and complete, reinforcing the form's legal and ethical dimensions.

- Submission culminates in an official acknowledgment. The receiving officer's acknowledgment of the application underscores the procedural step towards enrollment as a sales tax practitioner, marking the applicant's entry into the professional realm governed by the Gujarat Value Added Tax Rules.

Completing and submitting the 601 Sales Tax form is a critical step for professionals seeking to practice within Gujarat's sales tax domain. Each section of the form is designed to ensure that applicants are qualified, responsible, and fully aware of the responsibilities they aspire to undertake. Therefore, adhering to the outlined requirements and understanding their implications is imperative for successful enrollment and future practice.

Popular PDF Documents

Oregon Income Tax Form - Filing deadlines are critical to avoid penalties and ensure timely processing by the Oregon Department of Revenue.

IRS Schedule O 990 or 990-EZ - Through Schedule O, organizations defend their compliance with nonprofit laws and regulations, potentially avoiding audits and penalties from the IRS.