Get 45016 Tax Form

Navigating the complexities of real estate appraiser certification can be a daunting task, especially when it comes to the application process. At the core of this journey lies State Form 45016, a comprehensive document designed to vet potential candidates for licensure. This form not only requests personal and professional information but also dives deep into the educational background of applicants, ensuring they meet the rigorous standards set forth for certified residential and general appraisers. Candidates are required to disclose their academic achievements, specifying whether they possess an Associate or Bachelor's degree, or, in lieu of these, detailed accounts of relevant semester hours covering a wide range of courses from English Composition to Real Estate Law. Moreover, the form mandates the submission of transcripts, further authenticated by the inclusion of a sealed official transcript, to substantiate educational claims. Additionally, the form serves as a platform for applicants to list their pre-licensing education hours alongside any other professional licenses held within or outside Indiana. Equally important are the sections scrutinizing the applicant's criminal background and professional conduct, aiming to uphold the integrity of the profession. The meticulous nature of the application process, underscored by the requirement for notarized statements on any criminal history or professional misconduct, reflects the form's central role in maintaining high standards within the real estate appraisal sector. By the time applicants sign the Authorization for Release of Information, they consent to a thorough review of their background, essentially underpinning the transparency and accountability expected in the field.

45016 Tax Example

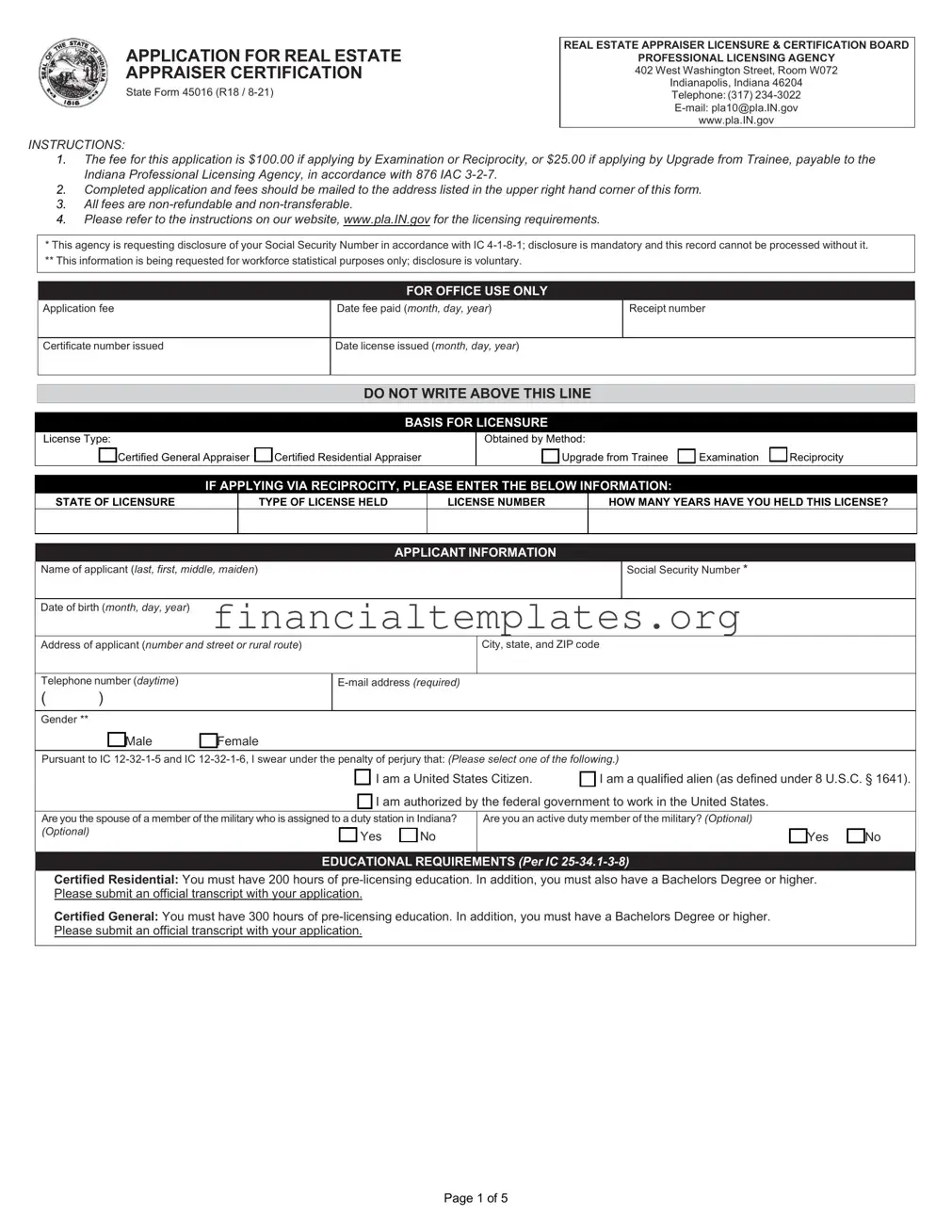

APPLICATION FOR REAL ESTATE APPRAISER CERTIFICATION

State Form 45016 (R18 /

REAL ESTATE APPRAISER LICENSURE & CERTIFICATION BOARD

PROFESSIONAL LICENSING AGENCY

402 West Washington Street, Room W072

Indianapolis, Indiana 46204

Telephone: (317)

www.pla.IN.gov

INSTRUCTIONS:

1.The fee for this application is $100.00 if applying by Examination or Reciprocity, or $25.00 if applying by Upgrade from Trainee, payable to the Indiana Professional Licensing Agency, in accordance with 876 IAC

2.Completed application and fees should be mailed to the address listed in the upper right hand corner of this form.

3.All fees are

4.Please refer to the instructions on our website, www.pla.IN.gov for the licensing requirements.

* This agency is requesting disclosure of your Social Security Number in accordance with IC

**This information is being requested for workforce statistical purposes only; disclosure is voluntary.

FOR OFFICE USE ONLY

Application fee

Date fee paid (month, day, year)

Receipt number

Certificate number issued

Date license issued (month, day, year)

DO NOT WRITE ABOVE THIS LINE

BASIS FOR LICENSURE

License Type:

☐Certified General Appraiser

☐

Certified Residential Appraiser

Obtained by Method:

☐Upgrade from Trainee

☐Examination

☐Reciprocity

IF APPLYING VIA RECIPROCITY, PLEASE ENTER THE BELOW INFORMATION:

STATE OF LICENSURE

TYPE OF LICENSE HELD

LICENSE NUMBER

HOW MANY YEARS HAVE YOU HELD THIS LICENSE?

|

|

|

|

|

|

|

|

APPLICANT INFORMATION |

|

|

|

|

|

|

|||

Name of applicant (last, first, middle, maiden) |

|

|

Social Security Number * |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of birth (month, day, year) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Address of applicant (number and street or rural route) |

City, state, and ZIP code |

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone number (daytime) |

|

|

|

|

|

|

|

|

|

||||||||

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gender ** |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Female |

|

|

|

|

|

|

|

||||||

|

|

☐ |

Male |

☐ |

|

|

|

|

|

|

|

||||||

Pursuant to IC |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

☐ I am a United States Citizen. |

☐ I am a qualified alien (as defined under 8 U.S.C. § 1641). |

||||||||

|

|

|

|

|

|

|

|

☐ I am authorized by the federal government to work in the United States. |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Are you the spouse of a member of the military who is assigned to a duty station in Indiana? |

Are you an active duty member of the military? (Optional) |

|

|

||||||||||||||

(Optional) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐ |

Yes |

☐ |

No |

|

|

|

☐ |

Yes |

☐ |

No |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EDUCATIONAL REQUIREMENTS (Per IC

Certified Residential: You must have 200 hours of

Certified General: You must have 300 hours of

Page 1 of 5

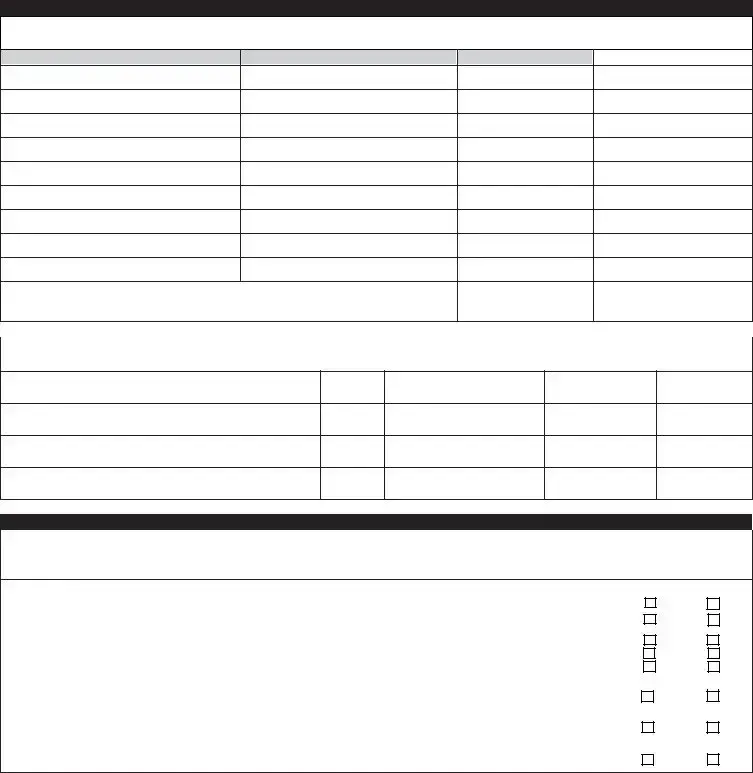

Please list your

COURSE TITLE

SPONSOR

NUMBER OF HOURS

MONTH / YEAR COMPLETED

TOTAL HOURS: Certified Residential must have 200 hours of

Certified General must have 300 hours of

PROFESSIONAL LICENSES HELD IN INDIANA AND OTHER STATES |

|

|

Do you currently hold or have you ever held a professional license or certification in Indiana or another state? |

☐ Yes |

☐ No |

(If yes, list all states below, including Indiana, in which you have held license / certification / registration / permit to practice any state regulated profession.)

TYPE OF LICENSE / CERTIFICATE/ REGISTRATION / PERMIT STATE

LICENSE NUMBER

DATE ISSUED

(month, day, year)

STATUS

QUESTIONS

If your answer is “Yes” to any of the following, explain fully in a signed written statement, including all related details, and provide copies of all relevant arrest or court documents. Describe the event including the location, date and disposition. Falsification of any of the following is grounds for permanent revocation of the license or permit issued pursuant to this application.

1.Except for minor violations of traffic laws resulting in fines, and arrests or convictions that have been expunged by a court,

|

(1) |

have you ever been arrested; |

☐Yes |

☐No |

|

(2) |

have you ever entered into a prosecutorial diversion or deferment agreement regarding any offense, |

☐Yes |

☐No |

|

|

misdemeanor, or felony in any state; |

||

|

|

|

|

|

|

(3) |

have you ever been convicted of any offense, misdemeanor, or felony in any state; |

☐Yes |

☐No |

|

(4) |

have you ever pled guilty to any offense, misdemeanor, or felony in any state; or |

☐Yes |

☐No |

|

(5) |

have you ever pled nolo contendre to any offense, misdemeanor, or felony in any state? |

☐Yes |

☐No |

|

|

|

|

|

2. |

Have you ever been denied a license, certification, registration, or permit to practice real estate, appraising, or any other |

☐Yes |

☐No |

|

|

profession in this or any other state? |

|||

|

|

|

|

|

3. |

Has any complaint been filed against you in the State of Indiana, or in any other state, regarding any professional license |

☐Yes |

☐No |

|

|

youcurrently hold or have previously held or have you practiced real estate or appraising without a license? |

|||

|

|

|

||

|

|

|

|

|

4. |

Has disciplinary action ever been taken against you regarding any professional license, certification, registration, or permit |

☐Yes |

☐No |

|

|

thatyou currently hold or have held? |

|||

Page 2 of 5

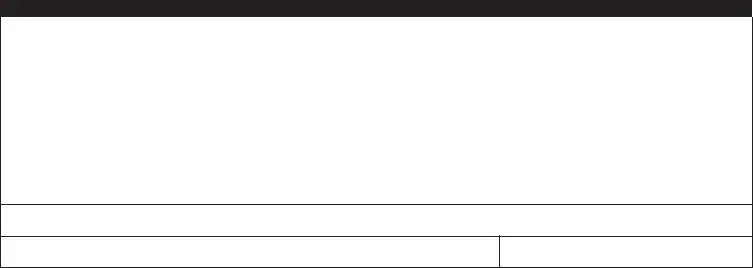

AUTHORIZATION FOR RELEASE OF INFORMATION

I hereby authorize, request and direct any person, firm, officer, corporation, association, organization or institution to release to the Professional Licensing Agency any files, documents, records or other information pertaining to the undersigned requested by the Agency or any of its authorized representatives in connection with processing my application for licensure.

I hereby release the aforementioned persons, firms, corporations, associations, organizations and institutions from any liability with regard to such inspection or furnishing of any information.

I further authorize the Professional Licensing agency to disclose to the aforementioned persons, firms, officers, corporations, association, organizations, and institutions any information which is material to my application, and I hereby specifically release the Agency from any and all liability in connection with such disclosures.

A photostatic copy of this authorization has the same force and effect as the original.

I affirm, under penalties for perjury, that the foregoing representations are true.

Signature of applicant

Date signed (month, day, year)

Page 3 of 5

EXAMINATION APPLICANTS ONLY:

EXPERIENCE SUMMARY

Please summarize your experience as documented in your appraisal log in the chart below.

|

|

APPRAISAL |

|

|

DOCUMENTARY REVIEW |

|

|||||

|

|

|

|

|

|

|

|

|

|

||

WORK PERFORMED |

PERFORMED BY YOU |

|

WITH FIELD INSPECTION |

WITHOUT FIELD INSPECTION |

|

||||||

|

|

|

|

|

|

|

|

||||

|

|

|

|

AND SEPARATE REPORT |

AND SEPARATE REPORT |

|

|||||

|

|

|

|

|

|

||||||

|

|

I |

|

|

II |

|

III |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hours |

|

|

|

Hours |

|

|

Hours |

|

Total |

|

|

|

|

|

|

|

|

Hours |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residential |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Forms) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residential |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Submit Documentation) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL RESIDENTIAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Land, Multifamily) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Multifamily 13+, Proposed Commercial, Industrial) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GENERA |

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Submit Documentation) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL GENERAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL RESIDENTIAL AND GENERAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 4 of 5 |

|

|

|

|

|||

APPRAISAL LOG

DATE OF |

|

PROPERTY ADDRESS |

WORK PERFORMED |

SCOPE OF REVIEW BY |

WORK PERFORMED |

PROPERTY TYPE OR |

|

ACTUAL |

|

APPRAISAL |

NAME OF CLIENT |

BY THE |

THE SUPERVISING |

I, II OR III |

REPORT TYPE |

NUMBER OF |

|||

STREET AND CITY |

RESIDENTIAL FORM |

||||||||

(month, day, year) |

|

TRAINEE / APPLICANT |

APPRAISER |

(From summary page) |

|

HOURS SPENT |

|||

|

|

|

|

||||||

01/01/2015 |

ABC BANK |

1234 Main St. Smallburg |

Inspection, Appraisal |

Inspect subject and |

I |

Residential Form 1004 |

Appraisal Report |

5.5 |

|

and Report |

review report |

||||||||

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of appraiser

Signature of supervisor

Printed name of appraiser |

License number |

Printed name of supervisor |

License number |

Page 5 of 5

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Purpose | Application for Real Estate Appraiser Certification |

| Form Number | State Form 45016 (R9 / 9-08) |

| Approval | Approved by State Board of Accounts, 2008 |

| Address for Submission | Real Estate Appraiser Licensure & Certification Board, Professional Licensing Agency, 402 West Washington Street, Room W072, Indianapolis, Indiana 46204 |

| Contact Information | Telephone: (317) 234-3009, E-mail: pla9@pla.IN.gov, Website: www.pla.IN.gov |

| Mandatory Social Security Number | Required by the state agency in accordance with I.C. 4-1-8-1 |

| Licensure Types | Certified Residential Appraiser, Certified General Appraiser |

| Governing Law | Indiana Code I.C. 4-1-8-1 |

Guide to Writing 45016 Tax

Filling out the State Form 45016 for the Application for Real Estate Appraiser Certification requires attention to detail and careful preparation. This process is essential for those looking to obtain licensure in the real estate appraisal sector, governed by the Real Estate Appraiser Licensure & Certification Board. It's crucial to provide accurate and complete information in every section to avoid delays or denials in certification. Here is a step-by-step guide to assist you through each part of the form:

- Locate the State Form 45016 and ensure you have the most recent version approved by the State Board of Accounts.

- Begin by reading all instructions carefully to understand the form's requirements fully.

- In the "TYPE OF CERTIFICATION" section, select either "Certified Residential Appraiser" or "Certified General Appraiser" by checking the appropriate box.

- Under "APPLICANT INFORMATION," provide your legal name, including any maiden or previous names, your Social Security number (as mandated by I.C. 4-1-8-1 for processing), and current and permanent addresses. Additionally, include your work, home, or cell phone numbers, email address, date of birth, and place of birth.

- For the "EDUCATIONAL REQUIREMENTS" section, check the appropriate box corresponding to your level of education and coursework related to the certification you are seeking. Attach a copy of your transcript.

- In the "COLLEGE REQUIREMENTS" section, indicate whether you have met the requirements through obtaining a degree or by completing specific coursework. Submit an official unopened transcript with your application.

- If applicable, fill out the "COLLEGE COURSE REQUIREMENTS IN LIEU OF DEGREE" section by listing the course number, title, subject matter, and hours for each relevant course you've completed.

- Record your pre-licensing education in the "PRE-LICENSING EDUCATION" section, noting the course title, sponsor, number of hours, and completion dates. Attach additional sheets if necessary.

- In the "PROFESSIONAL LICENSES HELD" section, indicate whether you currently hold or have previously held professional licenses or certifications, including the state, license number, date issued, and status for each.

- Respond to the applicant information questions regarding past convictions, denial of licensure, complaints filed against you, disciplinary actions, and your agreement to adhere to Board regulations. If you answer "Yes" to questions 1-4, provide detailed explanations in a separate notarized statement.

- Sign and date the form, swearing to the accuracy and completeness of the information provided under the penalties of perjury in the "I hereby swear or affirm" section.

- Complete the "AUTHORIZATION FOR RELEASE OF INFORMATION" by signing and dating the form to permit the Indiana Professional Licensing Agency or the Real Estate Appraiser Licensure and Certification Board to access and disclose necessary information for your licensure.

- Fill out the "EXPERIENCE SUMMARY SHEET," detailing the appraisal documentary review work you have performed, with sections for residential and general appraisal experiences.

After thoroughly filling out the form, review all sections to ensure accuracy and completeness. Attach all required documentation, such as your transcripts and any additional sheets for pre-licensing education or experience summaries, ensuring everything is correctly labeled and stapled as needed. Once compiled, submit the application package to the address provided, along with the applicable application fee. Keep a copy of the entire submission for your records. Careful attention to the instructions and requirements will support a smooth certification process.

Understanding 45016 Tax

- What is the 45016 Tax Form and who needs to complete it?

The 45016 Tax Form, officially known as the Application for Real Estate Appraiser Certification, is a document required by the State of Indiana for individuals seeking licensure or certification as real estate appraisers within the state. This form must be completed by anyone who aims to obtain either a Certified Residential Appraiser or a Certified General Appraiser designation. The form is an essential step in verifying an applicant's education, pre-licensing education hours, and professional history, including any prior licensing statuses in Indiana or other states.

- What are the educational requirements for the 45016 Tax Form?

The educational prerequisites detailed in the form diverge based on the type of certification an applicant is pursuing:

- Certified Residential Appraiser: Applicants need 200 hours of pre-licensing education, plus an Associate Degree or higher. Alternatively, 21 semester hours covering specific subject areas can be submitted in lieu of a degree.

- Certified General Appraiser: Requires 300 hours of pre-licensing education and a Bachelor's Degree or higher. As with the residential certification, thirty semester credit hours in specified fields can replace the degree requirement.

It's crucial for applicants to provide transcripts or course documentation to substantiate their educational achievements.

- What other information is required on the 45016 Tax Form?

Beyond educational credentials, the 45016 form collects comprehensive personal and professional information from applicants. This includes:

- Full legal name, Social Security number, and contact details.

- Details of any professional licenses held in Indiana or elsewhere, including license types and statuses.

- Responses to questions about past criminal convictions, denial of professional licenses, complaints filed against professional licenses held, and any disciplinary actions taken.

- Authorization for the release of information related to the licensure process.

- A detailed summary of appraisal experience is also necessary for the form, depending on the type of certification being pursued.

- How is the 45016 Tax Form processed, and what comes next?

After completing and submitting the 45016 form, along with the required fee and supporting documents, the Indiana Professional Licensing Agency reviews the application. This process includes verifying the provided information, checking educational and professional credentials, and assessing the applicant's suitability for licensure. If further information or clarification is needed, the applicant may be contacted. Upon approval, the applicant is notified, and a certificate number and licensure date are issued. Successful applicants can then legally work as certified real estate appraisers in Indiana, adhering to the professional standards and regulations set by the state.

Common mistakes

When completing the State Form 45016 application for Real Estate Appraiser Certification, it's crucial to avoid common mistakes that can delay or invalidate your application. Here are nine frequently encountered errors:

- Not providing the Social Security number: The form explicitly requires your Social Security number under the penalty of processing delay or rejection, as it's mandated by law for identification and verification purposes.

- Skipping the type of certification: Applicants often overlook selecting whether they are applying for Certified Residential or Certified General licensure. This choice is critical as it determines the required education and experience prerequisites.

- Incomplete applicant information: It's important to fill in all sections of the applicant information thoroughly, including both current and permanent addresses, as well as all contact numbers and email addresses, ensuring the agency can reach you without any issues.

- Education requirements not properly documented: Failure to provide adequate proof of the required education or improperly completing the college course requirements section can lead to application denial. Submit an official, unopened transcript as directed.

- Omission of pre-licensing education details: Not accurately recording pre-licensing education hours or forgetting to attach additional sheets if more space is needed can be a serious oversight. Each course, along with its sponsor and completed hours, must be clearly noted.

- Professional licenses inaccurately reported: If you've held any professional license in Indiana or other states, every license must be listed, including the state, type of license, license number, date issued, and its status, to prevent any misrepresentation or fraudulence allegations.

- Neglecting the applicant information questions: Each question in the applicant information section is vital and must be answered truthfully. Failure to disclose past convictions, license denials, or disciplinary actions, followed by a detailed explanation if applicable, can result in application rejection.

- Forgoing the Authorization for Release of Information signature: This signature is imperative to permit the Professional Licensing Agency to obtain and verify your records. Not signing this section hinders the review process, potentially leading to delays.

- Incomplete Experience Summary Sheet: The Experience Summary Sheet must reflect all of your relevant appraisal experience accurately. Omissions or inaccuracies in documenting either residential or general appraisal hours can lead to questions regarding your qualification.

By carefully avoiding these common errors, applicants can improve their chances of a smooth and successful certification process.

Documents used along the form

When applying for real estate appraiser certification using the State Form 45016, applicants often need to provide additional forms and documents to support their application. These supporting documents are crucial for verifying the information provided and ensuring that the applicant meets all the necessary requirements.

- Official College Transcripts: This document provides proof of the applicant's educational qualifications, such as an Associate or Bachelor's degree, including the completion of specific courses required for certification. It must be submitted in an official, unopened transcript form as part of the college requirements detailed in the 45016 form.

- Pre-Licensing Education Certificates: These certificates verify the completion of the required pre-licensing education hours. The form specifies 200 hours for certified residential appraisers and 300 hours for certified general appraisers. Each course completion certificate helps to tally up to these totals.

- Experience Summary Sheet: Applicants are required to demonstrate practical experience in real estate appraisal through a detailed summary sheet. This document lists the types of appraisals performed, such as residential or general, and the total hours spent on these appraisals, ensuring that the applicant meets the practical experience requirements.

- Professional License Verification: For those who have previously or currently hold a professional license in Indiana or another state, this document provides evidence of the license type, status, and validity. It is vital for verifying the applicant's professional standing and background in relevant fields.

- Notarized Statement for Disciplinary Actions or Legal Offenses: If the applicant answers "Yes" to questions about previous convictions, disciplinary actions against professional licenses, or denial of licensure, a notarized statement is required. This document must fully explain the circumstances, providing necessary context and details about the incidents.

Together, these documents complement the 45016 Tax form by providing a comprehensive overview of the applicant's educational background, pre-licensing education, experience, and professional integrity. It's important for applicants to accurately gather and submit these forms to navigate the certification process successfully.

Similar forms

The IRS Form 1040, U.S. Individual Income Tax Return, bears similarity to the 45016 Tax Form due to its requirement for personal information and its role in the financial professional licensure process. Just as the 45016 form necessitates detailed personal and educational background, including Social Security numbers and educational attainment, the Form 1040 requires taxpayers to provide comprehensive income details and personal identification to ascertain accurate tax liability and potential refunds. Both forms serve as critical tools within their respective government agencies to assess qualifications—whether for tax responsibilities or professional certification.

The Uniform Certified Public Accountant (CPA) Examination application form is another document resembling the 45016 Tax Form, especially in the context of the certification process for professionals. Candidates must furnish personal details, educational background, and sometimes, moral character documentation, akin to the 45016 form’s collection of personal, educational, and licensing information for real estate appraiser certification. Both applications are gateways to professional certification, requiring thorough vetting of candidates’ qualifications and ethical standing.

The National Council Licensure Examination for Registered Nurses (NCLEX-RN) application also shares parallels with the 45016 Tax Form. The NCLEX-RN application process demands extensive personal information, educational history, and background checks to ensure candidates are fit to practice nursing. Similarly, the 45016 form requires real estate appraiser candidates to detail their education and past professional licensure to assess their eligibility. Each form plays a pivotal role in safeguarding public interest by ensuring only qualified individuals obtain certification in their respective fields.

The Loan Officer License application closely aligns with the 45016 Tax Form in its collection of personal data, professional history, and educational qualifications. Both forms are integral to licensing processes within financial and real estate sectors, evaluating candidates’ readiness and legality to perform their duties. The requirement for detailed personal information, along with professional and educational histories, ensures that only competent and qualified individuals are authorized to practice, thus protecting consumer interests.

Lastly, the Professional Engineer (PE) license application parallels the 45016 Tax Form through its rigorous collection of personal, educational, and professional experience data to evaluate candidates’ eligibility for licensure. Applicants must demonstrate sufficient education and experience, similar to the requirements for real estate appraisers, ensuring that only those with the requisite knowledge and ethical standards are granted the ability to practice. Both forms are essential to maintaining high standards of professionalism and competency within their respective professions.

Dos and Don'ts

Completing the 45016 Tax form is a detailed process that requires attention to accuracy and adherence to specific guidelines. Here are some essential dos and don'ts to keep in mind:

- Do ensure you completely fill in the form in your PDF viewer or type, as incomplete forms may not be processed.

- Do provide your Social Security number as requested. This information is mandatory for the processing of your record.

- Do check only one type of license or certification you are applying for to avoid confusion and processing delays.

- Don't write above the designated line on the form, as the upper portion is reserved for office use only.

- Don't forget to include an official unopened transcript if you are applying with college course requirements in lieu of a degree.

- Don't leave the pre-licensing education section blank. Certified Residential applicants must document 200 hours, and Certified General applicants must document 300 hours of pre-licensing education.

By following these guidelines, you can streamline the application process for your Real Estate Appraiser Certification and avoid potential setbacks. Remember, accuracy and completeness are critical in ensuring your application is processed without delays.

Misconceptions

When it comes to the State Form 45016, commonly referred to as the application for Real Estate Appraiser Certification, various misconceptions can arise. It's important to understand what this form is about, to streamline the application process and set the correct expectations. Below are five common misconceptions addressed to provide clarity:

- Only Indiana residents can apply: While the form is approved by an Indiana State Board, both residents and non-residents can apply for licensing, as long as they meet the required qualifications and education prerequisites.

- Personal information is optional: Some applicants believe that providing their Social Security number or other personal details is optional. However, disclosure of the Social Security number and complete personal information is mandatory for the processing of the application.

- Educational qualifications are strictly based on degrees: While having an Associate or Bachelor's degree is a pathway towards certification, the form clearly states alternatives based on credit hours in specific subject matter courses for those who do not have a degree. This flexibility is often overlooked.

- Prior criminal history automatically disqualifies you: While the application does inquire about criminal history, it does not state that any history of conviction automatically disqualifies an applicant. Each case is reviewed individually, and candidates are given the chance to provide a full explanation.

- The form is only for new applicants: A misconception exists that State Form 45016 is solely for new certifications. However, it is also necessary for those who are renewing their certification or updating their records with the Board. This form plays a multi-faceted role in the certification process.

Understanding these misconceptions helps in preparing a complete and accurate application, thereby avoiding potential delays in the certification process. It's essential to meticulously review the form and its instructions, and when in doubt, seek clarification from the Professional Licensing Agency to ensure compliance with the application requirements.

Key takeaways

When filling out the 45016 Tax Form for Real Estate Appraiser Certification, there are several key takeaways to keep in mind:

- Ensure all sections of the form are completed in full, either in your PDF viewer or by typing, to avoid delays in the processing of your application.

- Your Social Security number is required for processing the application in accordance with I.C. 4-1-8-1. Disclosure of your Social Security number is mandatory for this form.

- Clearly indicate the type of certification you are applying for: Certified Residential Appraiser or Certified General Appraiser, to ensure your application is processed correctly for the desired certification.

- For educational requirements, certified residential applicants must have at least 200 hours of pre-licensing education and an Associate Degree or higher, or a minimum of twenty-one (21) semester hours covering specified courses. Certified general applicants must have 300 hours of pre-licensing education and a Bachelor’s Degree or higher, or at least thirty (30) semester hours covering specified courses.

- Submission of an official, unopened transcript is required to verify college requirements. Select the appropriate checkbox that corresponds with your educational background and attach your transcript.

- Record your pre-licensing education accurately, including the course title, sponsor, number of hours, and the month and year completed. It’s important to ensure that the total hours meet the requirement for the type of certification you are applying for.

- Disclose any professional licenses held in Indiana or other states. If you have or had any professional license or certification, include the type, state, license number, date issued, and status.

By following these key points, you can streamline the application process for obtaining a Real Estate Appraiser Certification in Indiana. Ensure all information provided is accurate and complete to avoid potential setbacks.

Popular PDF Documents

Waverly City Tax R - Achieve financial transparency by declaring all pertinent income and deductions as required on the City of Waverly's official tax document.

Moneygram Refund Form - Reliable and speedy payment processing for bills and card loading starts with completing your details here.

IRS 8949 - It is a critical document for accurately reporting the exercise and sale of stock options, a common form of employee compensation.