Get 1088 Tax Form

Understanding the nuances and complexities of tax forms is essential for the diligent taxpayer, especially for those involved in the nuanced world of business and self-employment. Among these myriad forms, the Fannie Mae Form 1088 stands out as a critical instrument designed to offer a comparative income analysis for borrowers. This form allows lenders to meticulously compare the fiscal health of a borrower's business across several years, providing a comprehensive overview of vital financial indicators such as gross income, expenses, and taxable income. Specifically, it involves detailed calculations designed to unravel the percentage changes in gross income, expense ratios in relation to gross income, and fluctuations in taxable income over time. Meant for a variety of business structures, including sole proprietorships, partnerships, S corporations, and corporations, the Form 1088 delves into the heart of the business's financial trajectory by employing data from IRS Form 1040, Schedule C, IRS Form 1065, IRS Form 1120(S), and IRS Form 1120. The implications of these analyses are profound since they aid lenders in determining the viability and sustainability of a business, effectively influencing decisions on borrowings and financial support. As such, this form embodies an indispensable tool in the financial assessment repertoire, encapsulating a blend of meticulous fiscal evaluation and forward-looking financial planning.

1088 Tax Example

@) Fannie Mae

Comparative Income Analysis

Borrower Name

Company Name

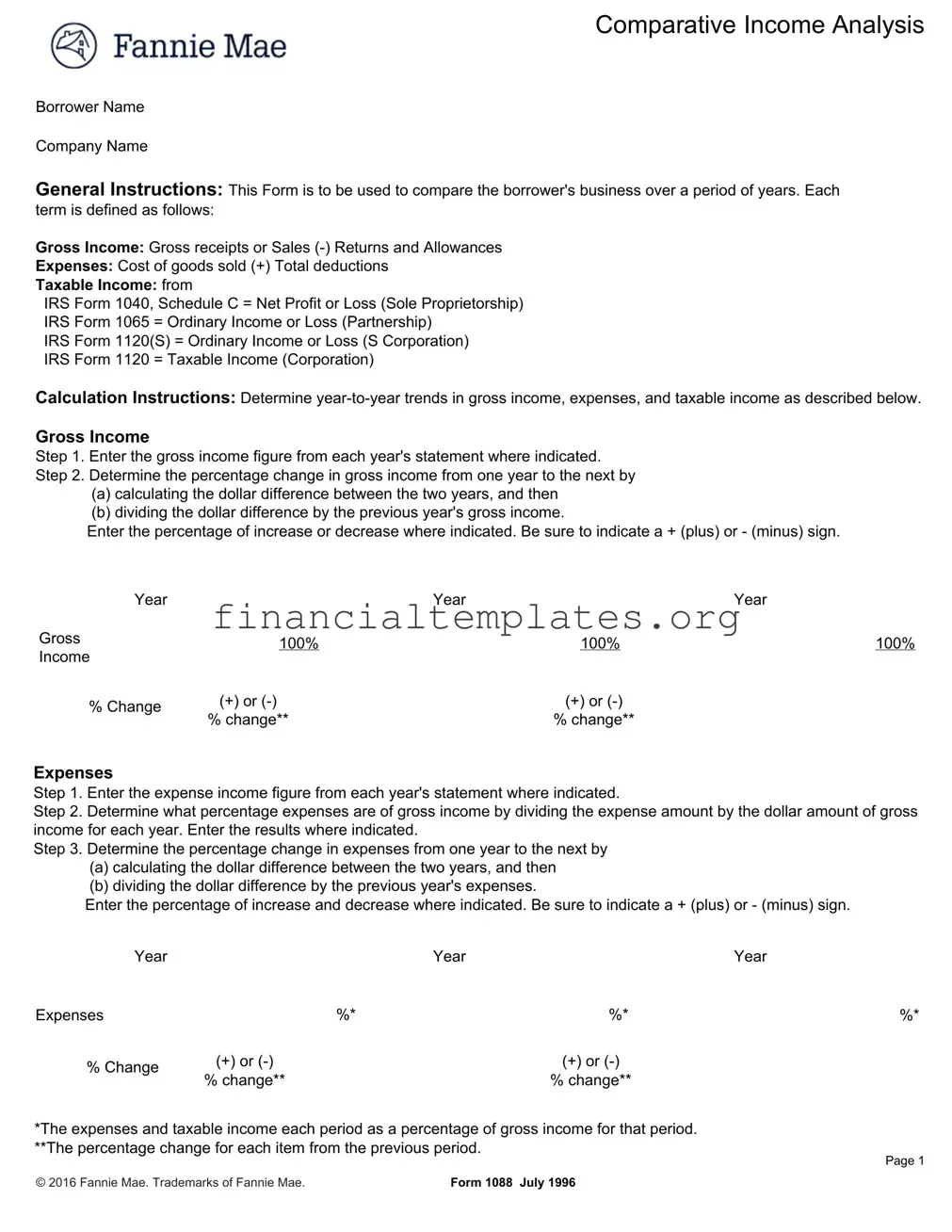

General Instructions: This Form is to be used to compare the borrower's business over a period of years. Each

term is defined as follows:

Gross Income: Gross receipts or Sales

Expenses: Cost of goods sold (+) Total deductions

Taxable Income: from

IRS Form 1040, Schedule C = Net Profit or Loss (Sole Proprietorship)

IRS Form 1065 = Ordinary Income or Loss (Partnership)

IRS Form 1120(S) = Ordinary Income or Loss (S Corporation)

IRS Form 1120 = Taxable Income (Corporation)

Calculation Instructions: Determine

Gross Income

Step 1. Enter the gross income figure from each year's statement where indicated.

Step 2. Determine the percentage change in gross income from one year to the next by

(a)calculating the dollar difference between the two years, and then

(b)dividing the dollar difference by the previous year's gross income.

Enter the percentage of increase or decrease where indicated. Be sure to indicate a + (plus) or - (minus) sign.

|

Year |

|

Year |

Year |

Gross |

|

100% |

100% |

100% |

|

|

|||

|

% Change |

(+) or |

(+) or |

. |

|

% change** I |

% change** |

|

|

|

|

|

||

Expenses

Step 1. Enter the expense income figure from each year's statement where indicated.

Step 2. Determine what percentage expenses are of gross income by dividing the expense amount by the dollar amount of gross income for each year. Enter the results where indicated.

Step 3. Determine the percentage change in expenses from one year to the next by

(a)calculating the dollar difference between the two years, and then

(b)dividing the dollar difference by the previous year's expenses.

Enter the percentage of increase and decrease where indicated. Be sure to indicate a + (plus) or - (minus) sign.

Year ~I |

Year |

I |

Year I I |

||

%* |

|||||

% Change |

(+) or |

(+) or |

|

||

% change** I |

% change** I |

I |

|||

|

|||||

*The expenses and taxable income each period as a percentage of gross income for that period. **The percentage change for each item from the previous period.

Page 1

© 2016 Fannie Mae. Trademarks of Fannie Mae. |

Form 1088 July 1996 |

Taxable Income

Step 1. Enter the taxable income figure from each year's statement where indicated.

Step 2. Determine what percentage taxable income is of gross income by dividing the dollar amount of taxable income by the dollar amount of gross income. Enter the results where indicated.

Step 3. Determine the percentage change in taxable income from one year to the next by

(a)calculating the dollar difference between the two years, and then

(b)dividing the dollar difference by the previous year's taxable income.

Enter the percentage of increase or decrease where indicated. Be sure to indicate a + (plus) or - (minus) sign.

Year ~I |

Year |

I

Year

Taxable |

|

~~I□ |

|

||||

Income |

|

|

|

%* |

|

%* |

%* |

|

|

|

~1- |

|

|

||

|

% Change |

(+) or |

(+) or |

|

|||

|

|

|

|

|

|

||

|

|

|

% change** |

|

|

% change** |

|

The Taxable Income Trend is

*The expenses and taxable income each period as a percentage of gross income for that period. **The percentage change for each item from the previous period.

Page 2

© 2016 Fannie Mae. Trademarks of Fannie Mae. |

Form 1088 July 1996 |

Instructions

Comparative Income Analysis

The lender uses this form to compare the performance of a

Copies

Original

Printing Instructions

This form must be printed on letter size paper, using portrait format. When printing this form, you may need to use the "shrink to fit" option in the Adobe Acrobat print dialogue box.

Instructions

The lender should calculate the percentage change for the borrower's gross income, expenses, and taxable income from one period to the next, covering at least a

Gross Income equals

Gross receipts (or sales) less Returns and allowances.

Expenses equal

Cost of goods sold plus Total deductions.

Taxable Income

is taken from one of the following IRS Forms:

IRS Form 1040, Schedule C = for the Net Profit or Loss for a Sole Proprietorship IRS Form 1065 = for Ordinary Income or Loss for a Partnership

IRS Form 1120(S) = for Ordinary Income or Loss for an S Corporation (a small,

Page 3

© 2016 Fannie Mae. Trademarks of Fannie Mae. |

Form 1088 July 1996 |

Document Specifics

| Fact | Detail |

|---|---|

| Purpose | Form 1088 is used for comparative income analysis of a self-employed borrower's business over multiple years. |

| Key Components | Includes Gross Income, Expenses, and Taxable Income sections for a detailed financial overview. |

| Calculation of Income Trends | Involves calculating year-to-year percentage changes in gross income, expenses, and taxable income. |

| Usage of IRS Forms | Taxable income figures are derived from IRS Form 1040 Schedule C, IRS Form 1065, IRS Form 1120(S), or IRS Form 1120. |

| Printing Instructions | Must be printed on letter size paper in portrait format, possibly using "shrink to fit" setting. |

| Yearly Analysis | Designed to assess the financial health and trends of a business by reviewing at least a two-year period. |

| Ownership | The form is a document of Fannie Mae and carries its trademarks. |

Guide to Writing 1088 Tax

Filling out the Form 1088, also known as the Fannie Mae Comparative Income Analysis, is an essential process for lenders evaluating the financial viability of a self-employed borrower's business across different years. This analysis aims to review the business's performance by comparing changes in gross income, expenses, and taxable income. Here are the steps necessary to complete this form correctly, ensuring accuracy in the representation of the borrower's financial standing.

- General Information: Begin by entering the borrower's name and company name in the designated fields at the top of the form.

- Gross Income Calculation:

- For each year under review, enter the gross income figures in the provided spaces. These figures include gross receipts or sales minus returns and allowances.

- Calculate the percentage change in gross income year-to-year by subtracting the previous year’s gross income from the current year's gross income, dividing the result by the previous year's gross income, and then multiplying by 100 to convert to a percentage. Record this percentage change next to each year, marking it with either a plus (+) or minus (-) sign to indicate an increase or decrease.

- Expenses Calculation:

- Input the expense figures for each year, which include the cost of goods sold plus total deductions.

- To find what percentage of gross income the expenses represent, divide the total expenses by the gross income for the same year and enter the result in the provided space.

- Similar to gross income, determine the percentage change in expenses from one year to the next. This involves calculating the dollar difference between the two years’ expenses, dividing by the previous year's expenses, and converting to a percentage. Note the percentage change indicating an increase or decrease with a plus or minus sign accordingly.

- Taxable Income Calculation:

- Enter the taxable income figure for each year, taken from the relevant IRS form (IRS Form 1040, Schedule C for Sole Proprietorship; IRS Form 1065 for Partnership; IRS Form 1120(S) for S Corporation; IRS Form 1120 for Corporation).

- Determine what percentage of gross income is represented by taxable income each year by dividing the taxable income by gross income and entering the result.

- Calculate the percentage change in taxable income from one year to the next by using the same method as for gross income and expenses. Document the percentage of increase or decrease, clearly marking it with a plus or minus sign.

After completing the calculations, you'll have a detailed year-to-year trend analysis of the borrower’s business income. This information is crucial for lenders to assess the business's financial health over time, making informed decisions based on the performance trends indicated. Properly filling out and understanding the nuances of Form 1088 can make a significant difference in the lending process, especially when working with self-employed borrowers.

Understanding 1088 Tax

What is Form 1088?

Form 1088, also known as the Fannie Mae Comparative Income Analysis, is a document used by lenders to analyze and compare the performance of a self-employed borrower's business across multiple years. This form evaluates the borrower's gross income, expenses, and taxable income, providing insights into the business's financial trends and viability.

Who should use Form 1088?

This form is primarily intended for lenders examining the financial health of a business owned by a self-employed borrower. It can play a crucial role in determining the borrower's ability to repay loans by analyzing the business's income trends.

What types of income are analyzed in Form 1088?

Form 1088 focuses on three main categories: Gross Income, Expenses, and Taxable Income. It considers gross receipts or sales minus returns and allowances, the total cost of goods sold along with deductions, and the taxable income as reported on various IRS forms depending on the business type.

Which IRS forms are relevant to Form 1088?

- IRS Form 1040, Schedule C for Sole Proprietorships

- IRS Form 1065 for Partnerships

- IRS Form 1120(S) for S Corporations

- IRS Form 1120 for Corporations

How is the percentage change in income and expenses calculated?

The form involves calculating the dollar difference between two years for either income or expenses and then dividing this difference by the figure from the previous year, resulting in a percentage increase or decrease. This helps in identifying trends over the years.

What are the printing instructions for Form 1088?

Form 1088 should be printed on letter-size paper in portrait format. It may be necessary to select the "shrink to fit" option in the print dialogue box of Adobe Acrobat to ensure proper formatting.

Why is the comparison of year-to-year financial trends important?

Comparing financial performance across multiple years helps lenders understand the growth, stability, or decline of a borrower's business, which is crucial in assessing loan repayment capabilities.

Can Form 1088 be used for businesses of all sizes?

Yes, Form 1088 is versatile and can be used to analyze businesses of varying sizes, from small sole proprietorships to larger corporations, as long as they're owned by a self-employed individual seeking a loan.

What happens if there is a negative trend observed in Form 1088?

A negative trend in Form 1088 may raise concerns for lenders about the business's financial health and could impact the decision on a loan application. However, it also allows the borrower to provide explanations or demonstrate plans for turnaround.

Is there any specific software required to fill out Form 1088?

While Form 1088 can be filled out by hand, using Adobe Acrobat or a similar PDF reader can make the process easier and ensure accuracy. Advanced financial software is not required but may be helpful in gathering the necessary financial data.

Common mistakes

Filling out the Form 1088, the Fannie Mae Comparative Income Analysis, requires careful attention to detail. Common mistakes can hinder the accurate comparison of a borrower's business performance over time. Understanding these errors can significantly improve the accuracy of the form's completion.

Incorrect gross income entries: People often miscalculate the gross income by failing to correctly subtract returns and allowances from gross receipts or sales. This fundamental error skews all subsequent calculations, leading to an inaccurate representation of business trends.

Mishandling expenses: Another common mistake lies in inaccurately entering expenses. Neglecting to sum the cost of goods sold with total deductions results in incorrect expense figures. Since the analysis compares expenses to gross income, this misstep impacts the understanding of the business's financial health.

Erroneous reporting of taxable income: Taxable income is often reported inaccurately because individuals fail to correctly derive figures from the relevant IRS forms (1040 Schedule C for Sole Proprietorships, 1065 for Partnerships, 1120(S) for S Corporations, and 1120 for Corporations). This miscalculation directly affects the assessment of year-to-year taxable income trends.

Inaccurate percentage change calculations: People frequently err in calculating the percentage change in gross income, expenses, and taxable income. Mistakes in the basic arithmetic of determining dollar differences and in applying these to calculate percentage changes can mislead lenders about the business’s growth or decline.

Misinterpretation of instructions: Despite the form's guidance, users often misinterpret the instructions for entering data and calculating percentages. This mistake is particularly common in determining what percentage expenses and taxable income are of gross income. Understanding the instructions is crucial for accurate analysis.

Omission of signs in percentage changes: Failing to indicate whether the change in gross income, expenses, and taxable income is an increase (+) or a decrease (-) is a seemingly minor but impactful oversight. This omission can lead to confusion about the business’s financial trajectory.

Steering clear of these common pitfalls ensures a more accurate and meaningful financial analysis on the Form 1088, aiding lenders in making informed decisions regarding a borrower's business viability.

Documents used along the form

Understanding the full scope of paperwork required during tax season can be a daunting task, especially when dealing with complex financial situations such as those of self-employed individuals or business owners. The 1088 Tax Form, notably used in the comprehensive analysis of a borrower's business performance over several years, is just the tip of the iceberg. Here's a look at other forms and documents commonly paired with the 1088 Tax Form, each serving its unique purpose in painting a complete picture of one's fiscal health.

- IRS Form 1040, Schedule C: This document is essential for sole proprietors and single-member LLCs. It details the profit or loss from a business, helping to determine the taxable income after accounting for business expenses.

- IRS Form 1065: Utilized by partnerships, this form helps report the business's income, gains, losses, deductions, and credits to the IRS. It is instrumental in showing the financial standings of the partnership.

- IRS Form 1120(S): Required for S corporations, this form reports the corporation's income, gains, losses, deductions, credits, and taxes. It aids in calculating the taxable income that flows through to shareholders.

- IRS Form 1120: Corporations use this form to report their income, gains, losses, deductions, and credits. It plays a crucial role in determining the corporate taxable income.

- IRS Form 1099-MISC: This document is critical for reporting any payments made to non-employees, such as independent contractors, during the tax year. It ensures all income is accounted for.

- IRS Form 4562: Form 4562 is used for reporting depreciation and amortization. Businesses that purchase assets during the year that are used for long-term use can deduct part of the cost each year.

- IRS Form 8829: Exclusive to home office deductions, this form calculates the expenses associated with business use of a home, allowing for a proportionate deduction based on the size and usage of the home office space.

- IRS Schedule K-1 (Form 1065): This schedule is a must-have for partnerships because it reports the share of income, deductions, and credits attributable to each partner, enabling accurate reporting on individual tax returns.

- IRS Form 940: Employers use this form to report annual Federal Unemployment Tax Act (FUTA) tax. This tax is used to fund state workforce agencies and must be filed by employers who pay wages to employees.

Together, these forms and documents complement the 1088 Tax Form in providing a detailed fiscal overview necessary for various tax obligations and financial assessments. Whether it's a detailed report of business income for a partnership or the depreciation of assets for a corporation, each document plays its role in ensuring the accuracy of tax reporting and financial analysis. Navigating through these forms can be complex, but a clear understanding of their purposes helps streamline the tax preparation process, ensuring a comprehensive fiscal snapshot.

Similar forms

The 1088 Form is quite similar to the IRS Form 1040, Schedule C, primarily used by sole proprietors to report their profit or loss from a business. Both forms aim to calculate taxable income, but the 1088 Form is more focused on comparative analysis over several years, specifically for evaluating the financial health of a borrower's business by lenders. Schedule C, on the other hand, is focused on annually documenting the income, expenses, and net profit or loss of an individual sole proprietorship for tax reporting purposes.

Similar to the 1088 Form, IRS Form 1065 is used by partnerships for tax filing, detailing their income, gains, losses, deductions, and credits to determine the partnership's taxable income. This form shares the objective of calculating yearly taxable income but differs as it's designed for partnerships, requiring distribution schedules for each partner's share of income or loss. The 1088 Form utilizes part of the data structure seen in Form 1065, but it aims at a broader analysis, comparing trends over time to assess business performance.

IRS Form 1120S, used by S Corporations, is another document akin to the 1088 Form. It reports income, losses, deductions, and credits of the corporation, similarly aiming to calculate taxable income. However, the 1120S is unique for S Corporations as it considers the pass-through taxation aspect, where the income or loss is reported by the shareholders. The 1088 Form, while analyzing similar financial metrics, has its unique purpose of multi-year comparison, not limited to a single corporate entity type or tax year.

The IRS Form 1120, which corporations use to report their income, gains, losses, deductions, and credits, serves a purpose similar to the 1088 Form in terms of calculating the corporation's taxable income. Narratively, both forms focus on measuring and documenting financial performance. However, the 1088 Form differentiates itself by enabling a comparative analysis over different years, as opposed to the 1120's annual snapshot focused solely on corporations.

The Schedule E (Form 1040) complements the functionalities found in the 1088 Form by reporting income or loss from real estate, royalties, partnerships, S corporations, trusts, and more. While Schedule E addresses the personal income tax implications of these income types, the 1088 extends a broader view, allowing lenders to assess business trends and financial health over time regardless of the specific entity type.

The IRS Form 4562, used for reporting depreciation and amortization, shares similarities with the 1088 Form because both involve detailed calculations related to business assets and expenses. Form 4562 impacts the determination of taxable income by providing a mechanism to deduct depreciation, which is a significant expense for many businesses. The 1088 Form takes a more holistic view by incorporating these deductions into the overall expense analysis over several years, not just focusing on depreciation.

Lastly, the 1088 Form parallels the intentions behind the IRS Form 8825, utilized by real estate rental activities of partnerships and S Corporations. While Form 8825 captures income and expenses specific to rental real estate, aiming at calculating net profit or loss for tax purposes, the 1088 Form encompasses these and other income types in its comprehensive analysis to evaluate the ongoing viability of a business. Both forms ultimately serve to illuminate different facets of business performance for taxation and lending considerations.

Dos and Don'ts

When completing the 1088 Tax Form, it's crucial to follow specific guidelines to ensure accuracy and compliance. Here are lists of things you should and shouldn't do.

Do:- Verify the accuracy of your financial statements before you start. The figures from these documents will be the basis of the calculations you need to perform.

- Use the correct IRS form to report taxable income, depending on your business structure. Sole proprietorships, partnerships, S corporations, and corporations each have their respective forms.

- Calculate percentage changes in gross income, expenses, and taxable income accurately, following the specific instructions for each calculation.

- Ensure all percentages are correctly indicated with a + sign for increases and a - sign for decreases.

- Double-check your math, especially the percentage changes year over year, to avoid errors.

- Fill out the form on letter-sized paper in portrait format, adhering to the original printing instructions.

- Keep copies of the completed form for your records and future reference.

- Rush through filling out the form without thoroughly reading the general and calculation instructions.

- Use estimated figures or guesses. All numbers reported should be based on actual financial statements.

- Forget to indicate whether percentage changes are increases or decreases with the appropriate sign.

- Omit any required details, such as the correct taxable income figure based on your business structure.

- Overlook the printing format. The form must be printed on letter-sized paper in portrait orientation, possibly using the "shrink to fit" option.

- Disregard the importance of keeping a printed copy for your records after submission. It's crucial to have a physical copy for future reference or in case of audit.

- Assume the form is complete without double-checking all calculations and data entered. A second review can prevent many common mistakes.

Misconceptions

Misunderstandings about financial documentation can lead to significant issues, especially when it involves the Form 1088, known as the Fannie Mae Comparative Income Analysis. This form plays a critical role for lenders in assessing the viability of a self-employed borrower's business by comparing its performance over a period of years. However, several misconceptions have arisen regarding its purpose, use, and implications. Here are eight common misconceptions clarified:

- Misconception 1: Form 1088 is only for large businesses. In reality, this form is designed for any self-employed borrower, regardless of the size of their business. It is equally applicable to small and large enterprises.

- Misconception 2: The form is overly complicated and unnecessary. While Form 1088 requires detailed financial information, its structured analysis of a business's performance over time is invaluable for lenders in making informed decisions.

- Misconception 3: Gross income is the only important figure on the form. Although gross income is crucial, the form also emphasizes the importance of understanding expenses, taxable income trends, and year-to-year changes in these figures.

- Misconception 4: It's sufficient to complete this form based on estimates. Accuracy is key. Estimates can lead to inaccurate trend analyses and potentially mislead lenders about the business's health and viability.

- Misconception 5: Form 1088 replaces the need for other financial documents. This form complements, rather than replaces, other required documentation such as IRS Form 1040, Schedule C, and others, providing a comprehensive view of the borrower's financial situation.

- Misconception 6: The form is only concerned with past performance. Although historical data is vital, the analysis aims to gauge the business's future viability by examining trends in income, expenses, and taxable income.

- Misconception 7: Only the borrower can complete Form 1088. While the borrower provides the necessary financial data, it's often a collaborative effort with the lender, who calculates the critical percentage changes and trends.

- Misconception 8: A negative trend on Form 1088 immediately disqualifies a borrower. Lenders use this form as part of a broader assessment. While negative trends are concerning, they do not automatically disqualify a borrower, especially if justified by context or offset by other positive factors.

Understanding the real purpose and requirements of Form 1088 can alleviate much of the stress and misconception surrounding its completion. It is a tool designed to ensure lenders have a clear, accurate understanding of a self-employed borrower's business health over time, thereby facilitating informed lending decisions. Clearing up these misconceptions is crucial for borrowers and lenders alike to navigate the complexities of business assessment and lending with confidence.

Key takeaways

When approaching the Fannie Mae 1088 Tax Form, also known as the "Comparative Income Analysis," it is essential to understand its primary function. This form is utilized to analyze a self-employed borrower's business income over multiple years, helping lenders assess the viability of the business. To effectively complete and leverage this form, consider the following key takeaways:

- Understanding the purpose: The 1088 Form is designed for lenders to evaluate the financial health and trends of a borrower's self-employed business. This is achieved by comparing the business's gross income, expenses, and taxable income across different years.

- Knowing which sections to complete: The form requires detailed information about the gross income, expenses, and taxable income for each year under review. Accurate entries in these sections are crucial for a thorough analysis.

- Accurately calculating percentage changes: For each category (gross income, expenses, and taxable income), you must not only provide the dollar figures but also calculate the percentage change from year to year. This involves subtracting the previous year's figures from the current year's, dividing by the previous year's figures, and then multiplying by 100 to get the percentage change.

- Identifying the source of taxable income: The form accommodates different sources of taxable income, based on the entity type of the business. This includes Schedule C of IRS Form 1040 for sole proprietorships, IRS Form 1065 for partnerships, IRS Form 1120(S) for S corporations, and IRS Form 1120 for corporations.

- Printing instructions: The form should be printed on letter-size paper in portrait format. When printing, you may need to adjust your print settings to "shrink to fit" to ensure the entire form is properly formatted on the page.

- Significance of comparing multiple years: Analyzing more than one year is critical to identifying trends, such as growth or decline in various income and expense categories. This multi-year perspective provides lenders with a better understanding of the business's financial trajectory.

By meticulously filling out the Fannie Mae 1088 Tax Form following these guidelines, borrowers and lenders can gain insights into the financial trends of a self-employed business, aiding in the decision-making process related to lending and borrowing.

Popular PDF Documents

IRS Schedule K-1 1041 - It also highlights the allocation of charitable contributions made by the estate or trust, which can affect a beneficiary's individual tax return.

Control De Maryland - This form must be filed with the IRS for the authorization to be recognized and effective.