Get 1040 Es Payment Voucher Form

In recent times, the Form 1040-ES has become a crucial tool for individuals who earn income not subject to traditional withholding taxes. This form facilitates the calculation and payment of estimated taxes on diverse sources of income such as self-employment earnings, interest, dividends, rents, and alimony, among others. It is particularly pertinent for those who do not have taxes automatically withheld or who choose not to have their Social Security benefits and unemployment compensation taxed upfront. The IRS has outlined specific rules and exceptions for different groups of taxpayers, including farmers, fishermen, and those with higher incomes, adjusting the threshold percentages for prepayment to avoid penalties. Moreover, changes to one's address or election on withholding options necessitate updates through Form 8822 or a new W-4 form, respectively, ensuring tax obligations are met accurately. With payment due dates spread throughout the year, taxpayers have the flexibility to plan their finances accordingly. However, failing to adhere to these deadlines can lead to penalties, underscoring the importance of understanding and utilizing Form 1040-ES effectively. Additionally, the introduction of increased standard deduction amounts and adjustments for certain credits for the 2022 tax year offer potential tax relief and require consideration in the estimated tax calculation process. As tax laws continue to evolve, staying informed about these changes is pivotal for compliance and financial planning.

1040 Es Payment Voucher Example

2022

Form

Department of the Treasury

Internal Revenue Service

Estimated Tax for Individuals

Purpose of This Package |

Note. These percentages may be different if you are a |

|||||||||

Use Form |

farmer, fisherman, or higher income taxpayer. See |

|||||||||

Special Rules, later. |

||||||||||

for 2022. |

Exception. You don’t have to pay estimated tax for 2022 |

|||||||||

|

Estimated tax is the method used to pay tax on income |

|||||||||

|

if you were a U.S. citizen or resident alien for all of 2021 |

|||||||||

that isn’t subject to withholding (for example, earnings |

and you had no tax liability for the full |

|||||||||

from |

year. You had no tax liability for 2021 if your total tax was |

|||||||||

etc.). In addition, if you don’t elect voluntary withholding, |

zero or you didn’t have to file an income tax return. |

|||||||||

you should make estimated tax payments on other |

Special Rules |

|||||||||

taxable income, such as unemployment compensation |

||||||||||

and the taxable part of your social security benefits. |

There are special rules for farmers, fishermen, certain |

|||||||||

Change of address. If your address has changed, file |

household employers, and certain higher income |

|||||||||

Form 8822, to update your record. |

taxpayers. |

|||||||||

Future developments. For the latest information about |

Farmers and fishermen. If at least |

|||||||||

developments related to Form |

gross income for 2021 or 2022 is from farming or fishing, |

|||||||||

instructions, such as legislation enacted after they were |

substitute 662/3% for 90% in (2a) under General Rule. |

|||||||||

published, go to |

IRS.gov/Form1040ES |

. |

|

Household employers. When estimating the tax on your |

||||||

|

|

|||||||||

Who Must Make Estimated Tax |

taxes if either of the following applies. |

|||||||||

Payments |

2022 tax return, include your household employment |

|||||||||

• You will have federal income tax withheld from wages, |

||||||||||

The estimated tax rules apply to: |

pensions, annuities, gambling winnings, or other income. |

|||||||||

• |

U.S. citizens and resident aliens; |

• You would be required to make estimated tax payments |

||||||||

• |

Residents of Puerto Rico, the U.S. Virgin Islands, |

to avoid a penalty even if you didn’t include household |

||||||||

Guam, the Commonwealth of the Northern Mariana |

employment taxes when figuring your estimated tax. |

|||||||||

Islands, and American Samoa; and |

Higher income taxpayers. If your adjusted gross |

|||||||||

• |

Nonresident aliens (use Form |

income (AGI) for 2021 was more than $150,000 ($75,000 |

||||||||

|

! |

If you filed a Schedule H or Schedule SE with your |

if your filing status for 2022 is married filing separately), |

|||||||

|

Form 1040 or |

substitute 110% for 100% in (2b) under General Rule, |

||||||||

CAUTION some of the household employment and/or |

earlier. This rule doesn’t apply to farmers or fishermen. |

|||||||||

Increase Your Withholding |

||||||||||

use Form |

||||||||||

this payment separate from other payments and apply the |

If you also receive salaries and wages, you may be able to |

|||||||||

payment to the 2020 tax year where the payment was |

avoid having to make estimated tax payments on your |

|||||||||

deferred. You can use Direct Pay, available only on |

other income by asking your employer to take more tax |

|||||||||

IRS.gov, to make the payment. Select the "balance due" |

out of your earnings. To do this, file a new Form |

|||||||||

reason for payment or, if paying with a debit or credit card, |

Employee's Withholding Certificate, with your employer. |

|||||||||

select “installment agreement.” Go to IRS.gov/Payments |

Generally, if you receive a pension or annuity you can |

|||||||||

to see all your payment options. |

|

|

||||||||

use Form |

||||||||||

General Rule |

Pension or Annuity Payments, to start or change your |

|||||||||

withholding from these payments. |

||||||||||

In most cases, you must pay estimated tax for 2022 if both |

You can also choose to have federal income tax |

|||||||||

of the following apply. |

||||||||||

withheld from certain government payments (see Form |

||||||||||

|

1. You expect to owe at least $1,000 in tax for 2022, |

|||||||||

|

||||||||||

after subtracting your withholding and refundable credits. |

nonperiodic payments and eligible rollover distributions |

|||||||||

|

2. You expect your withholding and refundable credits |

(see Form |

||||||||

to be less than the smaller of: |

Payments and Eligible Rollover Distributions). |

|||||||||

or |

a. |

90% of the tax to be shown on your 2022 tax return, |

|

You can use the Tax Withholding Estimator at |

||||||

b. 100% of the tax shown on your 2021 tax return. |

TIP |

IRS.gov/W4App to determine whether you need |

||||||||

|

|

|

|

|||||||

|

|

to have your withholding increased or decreased. |

||||||||

Your 2021 tax return must cover all 12 months. |

|

|

|

|||||||

Jan 24, 2022 |

Cat. No. 11340T |

Additional Information You May Need

You can find most of the information you will need in Pub. 505, Tax Withholding and Estimated Tax, and in the instructions for the 2021 Form 1040 and

For details on how to get forms and publications, see the 2021 Instructions for Form 1040.

What's New

In figuring your 2022 estimated tax, be sure to consider the following.

Standard deduction amount increased. For 2022, the standard deduction amount has been increased for all filers. If you don't itemize your deductions, you can take the 2022 standard deduction listed in the following chart for your filing status.

IF your 2022 filing status is... |

THEN your standard |

|

deduction is... |

||

|

||

Married filing jointly or |

$25,900 |

|

Qualifying widow(er) |

||

|

||

Head of household |

$19,400 |

|

Single or Married filing separately |

$12,950 |

|

|

|

|

However, if you can be claimed as a dependent on |

|

another person's 2022 return, your standard deduction is |

||

the greater of: |

|

|

• |

$1,150, or |

|

• |

Your earned income plus $400 (up to the standard |

|

deduction amount). |

|

|

|

Your standard deduction is increased by the following |

|

amount if, at the end of 2022, you are: |

|

|

• |

An unmarried individual (single or head of household) |

|

and are: |

|

|

65 or older or blind |

$1,750 |

|

65 or older and blind |

$3,500 |

|

•A married individual (filing jointly or separately) or a qualifying widow(er) and are:

65 or older or blind |

$1,400 |

|

65 or older and blind |

$2,800 |

|

Both spouses 65 or older |

$2,800* |

|

Both spouses 65 or older and blind |

$5,600* |

|

*Only if married filing jointly. If married filing separately, these |

|

|

amounts do not apply. |

|

|

! |

Your standard deduction is zero if (a) your spouse |

|

itemizes on a separate return, or (b) you were a |

||

CAUTION |

||

as a resident alien for 2022. |

|

|

Social security tax. For 2022, the maximum amount of earned income (wages and net earnings from

Adoption credit or exclusion. For 2022, the maximum adoption credit or exclusion for

adoption benefits has increased to $14,890. In order to claim either the credit or exclusion, your modified adjusted gross income must be less than $263,410.

Reminders

Individual taxpayer identification number (ITIN) re- newal. If you were assigned an ITIN before January 1, 2013, or if you have an ITIN that you haven’t included on a tax return in the last 3 consecutive years, you may need to renew it. For more information, see the Instructions for Form

Advance payments of the premium tax credit. If you buy health care insurance through the Health Insurance Marketplace, you may be eligible for advance payments of the premium tax credit to help pay for your insurance coverage. Receiving too little or too much in advance will affect your refund or balance due. Promptly report changes in your income or family size to your Marketplace. See Form 8962 and its instructions for more information.

Access Your Online Account (Individual Taxpayers Only)

Go to IRS.gov/Account to securely access information about your federal tax account.

• View the amount you owe and a breakdown by tax year.

• See payment plan details or apply for a new payment plan.

• Make a payment, view 5 years of payment history and any pending or scheduled payments.

• Access your tax records, including key data from your most recent tax return, your economic impact payment amounts, and transcripts.

• View digital copies of select notices from the IRS.

• Approve or reject authorization requests from tax professionals.

• Update your address or manage your communication preferences.

How To Figure Your Estimated Tax

You will need:

• The 2022 Estimated Tax Worksheet,

• The Instructions for the 2022 Estimated Tax Worksheet,

• The 2022 Tax Rate Schedules, and

• Your 2021 tax return and instructions to use as a guide to figuring your income, deductions, and credits (but be sure to consider the items listed under What's New, earlier).

Matching estimated tax payments to income. If you receive your income unevenly throughout the year (for example, because you operate your business on a seasonal basis or you have a large capital gain late in the year), you may be able to lower or eliminate the amount of your required estimated tax payment for one or more periods by using the annualized income installment method. See chapter 2 of Pub. 505 for details.

Changing your estimated tax. To amend or correct your estimated tax, see How To Amend Estimated Tax Payments, later.

Form |

You can’t make joint estimated tax payments if ! you or your spouse is a nonresident alien, you are

CAUTION separated under a decree of divorce or separate maintenance, or you and your spouse have different tax years.

Additionally, individuals who are in registered domestic partnerships, civil unions, or other similar formal relationships that aren’t marriages under state law cannot make joint estimated tax payments. These individuals can take credit only for the estimated tax payments that they made.

Payment Due Dates

You can pay all of your estimated tax by April 18, 2022, or in four equal amounts by the dates shown below.

1st payment |

April 18, 2022 |

2nd payment |

June 15, 2022 |

3rd payment |

Sept. 15, 2022 |

4th payment |

Jan. 17, 2023* |

*You don’t have to make the payment due January 17, 2023, if you file your 2022 tax return by January 31, 2023, and pay the entire balance due with your return.

If you mail your payment and it is postmarked by the due date, the date of the U.S. postmark is considered the date of payment. If your payments are late or you didn’t pay enough, you may be charged a penalty for underpaying your tax. See When a Penalty Is Applied, later.

You can make more than four estimated tax TIP payments. To do so, make a copy of one of your

unused estimated tax payment vouchers, fill it in, and mail it with your payment. If you make more than four payments, to avoid a penalty, make sure the total of the amounts you pay during a payment period is at least as much as the amount required to be paid by the due date for that period. For other payment methods, see How To Pay Estimated Tax, later.

No income subject to estimated tax during first pay- ment period. If, after March 31, 2022, you have a large change in income, deductions, additional taxes, or credits that requires you to start making estimated tax payments, you should figure the amount of your estimated tax payments by using the annualized income installment method, explained in chapter 2 of Pub. 505. If you use the annualized income installment method, file Form 2210, including Schedule AI, with your 2022 tax return even if no penalty is owed.

Farmers and fishermen. If at least

• Pay all of your estimated tax by January 17, 2023.

• File your 2022 Form 1040 or

the 1st month of the following fiscal year. If any payment date falls on a Saturday, Sunday, or legal holiday, use the next business day. See Pub. 509, Tax Calendars, for a list of all legal holidays.

Name Change

If you changed your name because of marriage, divorce, etc., and you made estimated tax payments using your former name, attach a statement to the front of your 2022 paper tax return. On the statement, show all of the estimated tax payments you (and your spouse, if filing jointly) made for 2022 and the name(s) and SSN(s) under which you made the payments.

Be sure to report the change to your local Social Security Administration office before filing your 2022 tax return. This prevents delays in processing your return and issuing refunds. It also safeguards your future social security benefits. For more details, call the Social Security Administration at

How To Amend Estimated Tax Payments

To change or amend your estimated tax payments, refigure your total estimated tax payments due (see the 2022 Estimated Tax Worksheet). Then, to figure the payment due for each remaining payment period, see Amended estimated tax in chapter 2 of Pub. 505. If an estimated tax payment for a previous period is less than

When a Penalty Is Applied

In some cases, you may owe a penalty when you file your return. The penalty is imposed on each underpayment for the number of days it remains unpaid. A penalty may be applied if you didn’t pay enough estimated tax for the year or you didn’t make the payments on time or in the required amount. A penalty may apply even if you have an overpayment on your tax return.

The penalty may be waived under certain conditions. See the Instructions for Form 2210 for details.

How To Pay Estimated Tax

Pay Online

Paying online is convenient and secure and helps make sure we get your payments on time. To pay your taxes online or for more information, go to IRS.gov/Payments.

Once you are issued a social security number (SSN), use it when paying your estimated taxes online. Use your SSN even if your SSN does not authorize employment or if you have been issued an SSN that authorizes employment and you lose your employment authorization. An ITIN will not be issued to you once you have been issued an SSN. If you received your SSN after previously using an ITIN, stop using your ITIN. Use your SSN instead.

You can pay using any of the following methods.

• Your Online Account. You can now make tax payments through your online account, including balance

Form |

payments, estimated tax payments, or other types. You can also see your payment history and other tax records there. Go to IRS.gov/Account.

• IRS Direct Pay. For online transfers directly from your checking or savings account at no cost to you, go to IRS.gov/Payments.

• Pay by Card. To pay by debit or credit card, go to IRS.gov/Payments. A convenience fee is charged by these service providers.

• Electronic Fund Withdrawal (EFW) is an integrated

• Online Payment Agreement. If you can’t pay in full by the due date of your tax return, you can apply for an online monthly installment agreement at IRS.gov/Payments.

Once you complete the online process, you will receive immediate notification of whether your agreement has been approved. A user fee is charged.

Pay by Phone

Paying by phone is another safe and secure method of paying electronically. Use one of the following methods:

(1) call one of the debit or credit card service providers, or

(2) the Electronic Federal Tax Payment System (EFTPS). Debit or credit card. Call one of our service providers. Each charges a fee that varies by provider, card type, and payment amount.

Link2Gov Corporation

WorldPay US, Inc.

ACI Payments, Inc.

EFTPS. To use EFTPS, you must be enrolled either online or have an enrollment form mailed to you. To make a payment using EFTPS, call

Mobile Device

To pay through your mobile device, download the IRS2Go app.

Pay by Cash

Cash is an

Pay by Check or Money Order Using the Estimated Tax Payment Voucher

Before submitting a payment through the mail using the estimated tax payment voucher, please consider alternative methods. One of our safe, quick, and easy online payment options might be right for you.

If you choose to mail in your payment, there is a separate estimated tax payment voucher for each due date. The due date is shown in the upper right corner. Complete and send in the voucher only if you are making a payment by check or money order. If you and your spouse plan to file separate returns, file separate vouchers instead of a joint voucher.

To complete the voucher, do the following.

• Print or type your name, address, and SSN in the space provided on the estimated tax payment voucher. Enter your SSN even if your SSN does not authorize employment or if you have been issued an SSN that authorizes employment and you lose your employment authorization. If you have an ITIN, enter it wherever your SSN is requested. An ITIN will not be issued to you once you have been issued an SSN. If you received your SSN after previously using an ITIN, stop using your ITIN. Use your SSN instead. If filing a joint voucher, also enter your spouse's name and SSN. List the names and SSNs in the same order on the joint voucher as you will list them on your joint return.

• Enter in the box provided on the estimated tax payment voucher only the amount you are sending in by check or money order. When making payments of estimated tax, be sure to take into account any 2021 overpayment that you choose to credit against your 2022 tax, but don’t include the overpayment amount in this box.

• Make your check or money order payable to “United States Treasury.” Don’t send cash. To help process your payment accurately, enter the amount on the right side of the check like this: $ XXX.XX. Don’t use dashes or lines (for example, don’t enter “$

• Enter “2022 Form

• Enclose, but don’t staple or attach, your payment with the estimated tax payment voucher.

Notice to taxpayers presenting checks. When you provide a check as payment, you authorize us either to use information from your check to make a

No checks of $100 million or more accepted. The IRS can’t accept a single check (including a cashier’s check) for amounts of $100,000,000 ($100 million) or more. If you are sending $100 million or more by check, you will need to spread the payment over 2 or more checks with each check made out for an amount less than $100 million. This limit doesn’t apply to other methods of payment (such as electronic payments). Please consider

Form |

a method of payment other than check if the amount of the payment is over $100 million.

Where To File Your Estimated Tax Payment Voucher if Paying by Check or Money Order

Mail your estimated tax payment voucher and check or money order to the address |

A foreign country, American Samoa, |

Internal Revenue Service |

|

shown below for the place where you live. Do not mail your tax return to this address or |

or Puerto Rico (or are excluding |

P.O. Box 1303 |

|

send an estimated tax payment without a payment voucher. Also, do not mail your |

income under Internal Revenue Code |

Charlotte, NC |

|

estimated tax payments to the address shown in the Form 1040 instructions. If you |

933), or use an APO or FPO address, |

|

|

need more payment vouchers, you can make a copy of one of your unused vouchers. |

or file Form 2555 or 4563, or are a |

|

|

|

|

|

|

|

|

resident of Guam or the U.S. Virgin |

|

|

|

Islands |

|

Caution: For proper delivery of your estimated tax payment to a P.O. box, you must |

Guam: |

Department of |

|

include the box number in the address. Also, note that only the U.S. Postal Service can |

Bona fide residents* |

Revenue and Taxation |

|

deliver to P.O. boxes. Therefore, you cannot use a private delivery service to make |

|

Government of Guam |

|

estimated tax payments required to be sent to a P.O. box. |

|

|

P.O. Box 23607 |

|

|

|

GMF, GU 96921 |

IF you live in . . . |

THEN send it to . . . |

U.S. Virgin Islands: |

Virgin Islands Bureau |

|

|

Bona fide residents* |

of Internal Revenue |

|

|

|

6115 Estate Smith Bay |

|

|

|

Suite 225 |

|

|

|

St. Thomas, VI 00802 |

Alabama, Arizona, Florida, Georgia, |

Internal Revenue Service |

|

|

Louisiana, Mississippi, New Mexico, |

P.O. Box 1300 |

|

|

North Carolina, South Carolina, |

Charlotte, NC |

|

|

Tennessee, Texas |

|

|

|

Arkansas, Connecticut, Delaware, |

Internal Revenue Service |

|

|

District of Columbia, Illinois, Indiana, |

P.O. Box 931100 |

|

|

Iowa, Kentucky, Maine, Maryland, |

Louisville, KY |

|

|

Massachusetts, Minnesota, Missouri, |

|

|

|

New Hampshire, New Jersey, New |

|

|

|

York, Oklahoma, Rhode Island, |

|

|

|

Vermont, Virginia, West Virginia, |

|

|

|

Wisconsin |

|

|

|

Alaska, California, Colorado, Hawaii, |

Internal Revenue Service |

|

|

Idaho, Kansas, Michigan, Montana, |

P.O. Box 802502 |

|

|

Nebraska, Nevada, Ohio, Oregon, |

Cincinnati, OH |

|

|

North Dakota, Pennsylvania, South |

|

|

|

Dakota, Utah, Washington, Wyoming |

|

|

|

*Bona fide residents must prepare separate vouchers for estimated income tax and

Instructions for the 2022 Estimated Tax Worksheet

Line 1. Adjusted gross income. When figuring the adjusted gross income you expect in 2022, be sure to consider the items listed under What’s New, earlier. For more details on figuring your AGI, see Expected

If you are

Line 7. Credits. See the 2021 Form 1040 or

Line 9.

for each of you separately. Enter the total on line 9. When estimating your 2022 net earnings from

Line 10. Other taxes. Use the 2021 Instructions for Form 1040 to determine if you expect to owe, for 2022, any of the taxes that would have been entered on your 2021 Schedule 2 (Form 1040), line 8 through 12 and 14 through 17z (see Exception 2, later). On line 10, enter the total of those taxes, subject to the following two exceptions.

Exception 1. Include household employment taxes from Schedule 2 (Form 1040), line 9, on this line only if:

• You will have federal income tax withheld from wages, pensions, annuities, gambling winnings, or other income; or

• You would be required to make estimated tax payments (to avoid a penalty) even if you didn’t include household employment taxes when figuring your estimated tax.

If you meet either of the above, include the total of your household employment taxes on line 10.

Form |

2022 |

Keep for Your Records |

Lines 1 and 9 of the Estimated Tax Worksheet |

1a. Enter your expected income and profits subject to |

1a. |

b.If you will have farm income and also receive social security retirement or disability benefits, enter your expected Conservation Reserve Program payments that will be

|

included on Schedule F (Form 1040) or listed on Schedule |

b. |

|

2. |

. . . . . . . . . .Subtract line 1b from line 1a |

2. |

|

3. |

. . . . . . . . . .Multiply line 2 by 92.35% (0.9235) |

3. |

|

4. |

. . . . . . . . . . . . .Multiply line 3 by 2.9% (0.029) |

. . . . . . . . . . . . . . . . . |

|

5. |

Social security tax maximum income |

5. |

$147,000 |

6.Enter your expected wages (if subject to social security tax or the 6.2% portion of

|

tier 1 railroad retirement tax) |

6. |

7. |

Subtract line 6 from line 5 |

7. |

|

Note. If line 7 is zero or less, enter |

|

8. |

Enter the smaller of line 3 or line 7 |

8. |

9. |

Multiply line 8 by 12.4% (0.124) |

. . . . . . . . . . . . . . . . . . |

10. |

Add lines 4 and 9. Enter the result here and on line 9 of your 2022 Estimated Tax Worksheet |

. . . . . . . . . . . . . . . . . |

11. |

Multiply line 10 by 50% (0.50). This is your expected deduction for |

|

|

Schedule 1 (Form 1040), line 15. Subtract this amount when figuring your expected AGI on |

11. |

|

line 1 of your 2022 Estimated Tax Worksheet |

4.

9.

10.

*Your net profit from

Exception 2. Because the following taxes are not required to be paid until the due date of your income tax (not including extensions), do not include them on line 10.

• Uncollected social security and Medicare or RRTA tax on tips or

• Recapture of federal mortgage subsidy (Schedule 2, line 17b),

• Excise tax on excess golden parachute payments (Schedule 2, line 17k),

• Excise tax on insider stock compensation from an expatriated corporation (Schedule 2, line 17m), and

•

Additional Medicare Tax. For information about the Additional Medicare Tax, see the Instructions for Form 8959.

Net Investment Income Tax (NIIT). For information about the Net Investment Income Tax, see the Instructions for Form 8960.

Repayment of

For details about repaying the

Line 12b. Prior year's tax. Enter the 2021 tax you figure according to the instructions in Figuring your 2021 tax unless you meet one of the following exceptions.

• If the AGI shown on your 2021 return is more than $150,000 ($75,000 if married filing separately for 2022), enter 110% of your 2021 tax as figured next.

Note. This doesn’t apply to farmers or fishermen.

• If you will file a joint return for 2022 but you didn’t file a joint return for 2021, add the tax shown on your 2021

return to the tax shown on your spouse's 2021 return and enter the total on line 12b.

• If you filed a joint return for 2021 but you will not file a joint return for 2022, first figure the tax both you and your spouse would have paid had you filed separate returns for 2021 using the same filing status as for 2022. Then multiply the tax on the joint return by a fraction, the numerator being the tax you would have paid had you filed a separate return, over the total tax you and your spouse would have paid had you filed separate returns. Enter this amount on line 12b.

• If you didn’t file a return for 2021 or your 2021 tax year was less than 12 full months, don’t complete line 12b. Instead, enter the amount from line 12a on line 12c.

Figuring your 2021 tax. Use the following instructions to figure your 2021 tax.

The tax shown on your 2021 Form 1040 or

1.Unreported social security and Medicare tax or RRTA tax from Schedule 2 (Form 1040), lines 5 and 6;

2.Any tax included on Schedule 2 (Form 1040), line 8, on excess contributions to an IRA, Archer MSA, Coverdell education savings account, health savings account, ABLE account, or on excess accumulations in qualified retirement plans;

3.Amounts on Schedule 2 (Form 1040) as listed under Exception 2, earlier; and

4.Any refundable credit amounts on Form 1040 or

Form |

2022 Tax Rate Schedules

Caution. Don’t use these Tax Rate Schedules to figure your 2021 taxes. Use only to figure your 2022 estimated taxes.

Schedule |

|

Schedule |

|

|

|||||||

Single |

|

|

|

|

|

Head of household |

|

|

|

|

|

If line 3 |

|

The tax is: |

|

|

|

If line 3 |

|

The tax is: |

|

|

|

is: |

|

|

|

of the |

is: |

|

|

|

of the |

||

|

But not |

|

|

|

|

But not |

|

|

|

||

Over— |

|

|

|

amount |

Over— |

|

|

|

amount |

||

over— |

|

|

|

over— |

over— |

|

|

|

over— |

||

$0 |

$10,275 |

+ |

10% |

$0 |

$0 |

$14,650 |

+ |

10% |

$0 |

||

10,275 |

41,775 |

+ |

12% |

10,275 |

14,650 |

55,900 |

+ |

12% |

14,650 |

||

41,775 |

89,075 |

4,807.50 |

+ |

22% |

41,775 |

55,900 |

89,050 |

6,415.00 |

+ |

22% |

55,900 |

89,075 |

170,050 |

15,213.50 |

+ |

24% |

89,075 |

89,050 |

170,050 |

13,708.00 |

+ |

24% |

89,050 |

170,050 |

215,950 |

34,647.50 |

+ |

32% |

170,050 |

170,050 |

215,950 |

33,148.00 |

+ |

32% |

170,050 |

215,950 |

539,900 |

49,335.50 |

+ |

35% |

215,950 |

215,950 |

539,900 |

47,836.00 |

+ |

35% |

215,950 |

539,900 |

162,718.00 |

+ |

37% |

539,900 |

539,900 |

161,218.50 |

+ |

37% |

539,900 |

||

Schedule |

|

Schedule |

|

||||||||

Married filing jointly or Qualifying widow(er) |

|

Married filing separately |

|

|

|

|

|||||

If line 3 |

|

The tax is: |

|

|

|

If line 3 |

|

The tax is: |

|

|

|

is: |

|

|

|

|

of the |

is: |

|

|

|

|

of the |

|

But not |

|

|

|

|

But not |

|

|

|

||

Over— |

|

|

|

amount |

Over— |

|

|

|

amount |

||

over— |

|

|

|

over— |

over— |

|

|

|

over— |

||

$0 |

$20,550 |

+ |

10% |

$0 |

$0 |

$10,275 |

+ |

10% |

$0 |

||

20,550 |

83,550 |

+ |

12% |

20,550 |

10,275 |

41,775 |

+ |

12% |

10,275 |

||

83,550 |

178,150 |

9,615.00 |

+ |

22% |

83,550 |

41,775 |

89,075 |

4,807.50 |

+ |

22% |

41,775 |

178,150 |

340,100 |

30,427.00 |

+ |

24% |

178,150 |

89,075 |

170,050 |

15,213.50 |

+ |

24% |

89,075 |

340,100 |

431,900 |

69,295.00 |

+ |

32% |

340,100 |

170,050 |

215,950 |

34,647.50 |

+ |

32% |

170,050 |

431,900 |

647,850 |

98,671.00 |

+ |

35% |

431,900 |

215,950 |

323,925 |

49,335.50 |

+ |

35% |

215,950 |

647,850 |

174,253.50 |

+ |

37% |

647,850 |

323,925 |

87,126.75 |

+ |

37% |

323,925 |

||

Form |

2022 Estimated Tax Worksheet |

Keep for Your Records |

|||

1 |

Adjusted gross income you expect in 2022 (see instructions) |

. . . . |

1 |

|

2a |

Deductions |

. . . . |

2a |

|

|

• If you plan to itemize deductions, enter the estimated total of your itemized deductions. |

} |

|

|

|

|

|

||

|

• If you don’t plan to itemize deductions, enter your standard deduction. |

|

|

|

b If you can take the qualified business income deduction, enter the estimated amount of the deduction |

2b |

|||

c |

Add lines 2a and 2b |

. . . ▶ |

2c |

|

3 |

Subtract line 2c from line 1 |

. . . . |

3 |

|

4 |

Tax. Figure your tax on the amount on line 3 by using the 2022 Tax Rate Schedules. |

|

|

|

|

Caution: If you will have qualified dividends or a net capital gain, or expect to exclude or deduct foreign |

|

|

|

|

earned income or housing, see Worksheets |

. . . . |

4 |

|

5 |

Alternative minimum tax from Form 6251 |

. . . . |

5 |

|

6Add lines 4 and 5. Add to this amount any other taxes you expect to include in the total on Form 1040

|

or |

6 |

7 |

Credits (see instructions). Do not include any income tax withholding on this line |

7 |

8 |

Subtract line 7 from line 6. If zero or less, enter |

8 |

9 |

9 |

|

10 |

Other taxes (see instructions) |

10 |

11a |

Add lines 8 through 10 |

11a |

bEarned income credit, refundable child tax credit* or additional child tax credit, fuel tax credit, net premium tax credit, refundable American opportunity credit, section 1341 credit, and refundable

|

credit from Form 8885* |

11b |

||||||

c |

Total 2022 estimated tax. Subtract line 11b from line 11a. If zero or less, enter |

. |

. ▶ |

11c |

||||

12a |

Multiply line 11c by 90% (662/3% for farmers and fishermen) |

|

12a |

|

|

|

|

|

|

|

|

|

|

|

|||

b |

Required annual payment based on prior year’s tax (see instructions) . . . |

|

12b |

|

|

|

|

|

c |

Required annual payment to avoid a penalty. Enter the smaller of line 12a or 12b . . . |

. |

. ▶ |

12c |

||||

Caution: Generally, if you do not prepay (through income tax withholding and estimated tax payments) at least the amount on line 12c, you may owe a penalty for not paying enough estimated tax. To avoid a penalty, make sure your estimate on line 11c is as accurate as possible. Even if you pay the required annual payment, you may still owe tax when you file your return. If you prefer, you can pay the amount shown on line 11c. For details, see chapter 2 of Pub. 505.

13Income tax withheld and estimated to be withheld during 2022 (including income tax withholding on

|

pensions, annuities, certain deferred income, etc.) |

. . . . . . . . |

13 |

|||

|

|

|

|

|

|

|

14a |

Subtract line 13 from line 12c |

|

14a |

|

|

|

|

Is the result zero or less? |

|

|

|

|

|

|

Yes. Stop here. You are not required to make estimated tax payments. |

|

|

|

|

|

|

No. Go to line 14b. |

|

|

|

|

|

b |

Subtract line 13 from line 11c |

|

14b |

|

|

|

|

Is the result less than $1,000? |

|

|

|

|

|

|

Yes. Stop here. You are not required to make estimated tax payments. |

|

|

|

|

|

|

No. Go to line 15 to figure your required payment. |

|

|

|

|

|

15If the first payment you are required to make is due April 18, 2022, enter ¼ of line 14a (minus any 2021 overpayment that you are applying to this installment) here, and on your estimated tax payment

voucher(s) if you are paying by check or money order |

15 |

* If applicable.

Form |

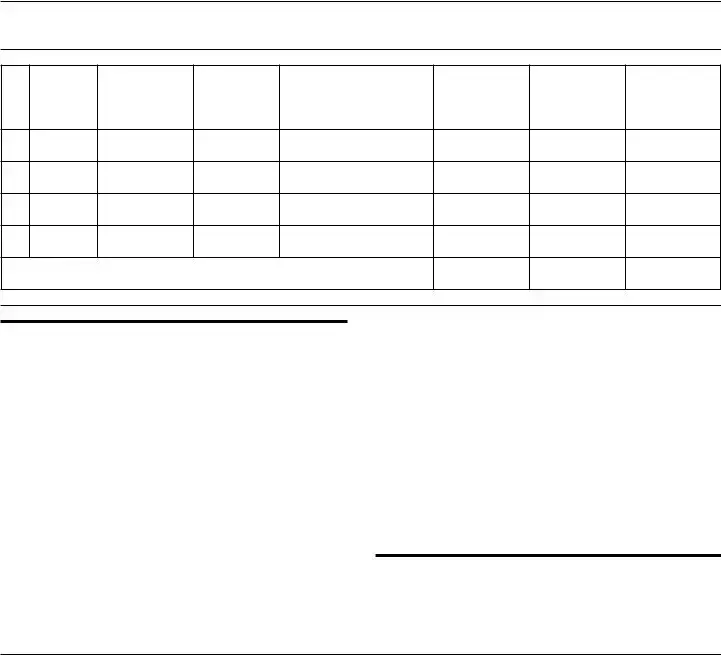

Record of Estimated Tax Payments (Farmers, fishermen, and fiscal year taxpayers, see Payment Due Dates.)

Keep for Your Records

Payment number |

date |

|

|

(c) Check or |

any convenience fee) |

credit applied |

(add (d) and (e)) |

|

|

confirmation number |

|||||

|

Payment |

(a) Amount |

(b) Date |

money order number, or |

(d) Amount paid |

(e) 2021 |

(f) Total amount |

|

due |

due |

paid |

credit or debit card |

(do not include |

overpayment |

paid and credited |

|

|

|

|

|

14/18/2022

26/15/2022

39/15/2022

41/17/2023*

Total |

. . . . . . . . . . . . . . . . . . . . . . . ▶ |

* You do not have to make this payment if you file your 2022 tax return by January 31, 2023, and pay the entire balance due with your return.

Privacy Act and Paperwork Reduction Act Notice. We ask for this information to carry out the tax laws of the United States. We need it to figure and collect the right amount of tax. Our legal right to ask for this information is Internal Revenue Code section 6654, which requires that you pay your taxes in a specified manner to avoid being penalized. Additionally, sections 6001, 6011, and 6012(a) and their regulations require you to file a return or statement for any tax for which you are liable; section 6109 requires you to provide your identifying number. Failure to provide this information, or providing false or fraudulent information, may subject you to penalties.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as stated in Code section 6103.

We may disclose the information to the Department of Justice for civil and criminal litigation and to other federal agencies, as provided by law.

We may disclose it to cities, states, the District of Columbia, and U.S. commonwealths or possessions to carry out their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

If you do not file a return, do not give the information asked for, or give fraudulent information, you may be charged penalties and be subject to criminal prosecution.

Please keep this notice with your records. It may help you if we ask you for other information. If you have any questions about the rules for filing and giving information, please call or visit any Internal Revenue Service office.

The average time and expenses required to complete and file this form will vary depending on individual circumstances. For the estimated averages, see the instructions for your income tax return.

If you have suggestions for making this package simpler, we would be happy to hear from you. See the instructions for your income tax return.

Tear off here

Pay online at www.irs.gov/ etpay

Simple.

Fast.

Secure.

Form |

|

|

2022 Estimated Tax |

Payment |

4 |

OMB No. |

|||||

|

|||||||||||

Internal Revenue Service |

|

|

Voucher |

|

|||||||

|

Department of the Treasury |

|

|

|

|

|

|

|

|

|

|

File only if you are making a payment of estimated tax by check or money order. Mail this |

Calendar |

||||||||||

|

|

|

|

|

|

||||||

voucher with your check or money order payable to “United States Treasury.” Write your |

Amount of estimated tax you are paying |

||||||||||

social security number and “2022 Form |

by check or |

|

|

|

|

||||||

cash. Enclose, but do not staple or attach, your payment with this voucher. |

money order. |

|

|

|

|||||||

|

|

|

|

|

|

|

|

||||

|

Your first name and middle initial |

Your last name |

|

|

Your social security number |

||||||

|

|

|

|

|

|

|

|

|

|||

|

If joint payment, complete for spouse |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||||

or type |

Spouse’s first name and middle initial |

Spouse’s last name |

|

|

Spouse’s social security number |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Address (number, street, and apt. no.) |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

City, town, or post office. If you have a foreign address, also complete spaces below. |

State |

|

|

|

ZIP code |

||||||

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

||||

|

Foreign country name |

|

Foreign province/county |

|

|

Foreign postal code |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

For Privacy Act and Paperwork Reduction Act Notice, see instructions. |

Form |

THIS PAGE INTENTIONALLY LEFT BLANK

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | Form 1040-ES is used to figure and pay estimated tax for individuals with income not subject to withholding. |

| Who Must Make Payments | U.S. citizens and resident aliens, along with residents of Puerto Rico, U.S. Virgin Islands, Guam, Commonwealth of the Northern Mariana Islands, American Samoa, and nonresident aliens (with a different form). |

| Special Rules for Specific Groups | There are special payment guidelines for farmers, fishermen, certain household employers, and higher income taxpayers. |

| General Rule for Payments | To avoid underpayment penalty, taxpayers usually need to pay the smaller of 90% of the tax to be shown on the current year's tax return or 100% of the tax shown on the previous year's return. |

| Payment Due Dates | Generally divided into four equal amounts to be paid by April 18, June 15, September 15, and January 17 (of the following year), with specific conditions for farmers and fishermen. |

| Change of Estimated Tax | To amend or correct estimated tax payments, taxpayers need to refigure the total estimated tax due and adjust remaining payments accordingly. |

Guide to Writing 1040 Es Payment Voucher

When preparing to make estimated tax payments, the 1040-ES Payment Voucher form is an important tool for those who have income not subject to withholding. This might include earnings from self-employment, interests, dividends, and more. The process of filling out this form is straightforward and can help ensure that you meet your tax obligations throughout the year, avoiding any potential penalties for underpayment.

- Begin by locating your personal information, including your Social Security Number (SSN), address, and the tax year for which you are making the payment.

- On the Payment Voucher, write your full name (and spouse’s if filing jointly) and full address clearly to avoid any processing issues.

- Enter your SSN on the voucher. If you are filing jointly, include your spouse's SSN right after yours.

- Specify the amount you are paying with this voucher. Only include the amount being paid at this time, not the total estimated tax for the year.

- Make your check or money order payable to "United States Treasury." Ensure the payment amount matches what you've indicated on the voucher.

- Write “2022 Form 1040-ES” followed by your SSN on your check or money order. If filing jointly, use the SSN shown first on your joint return.

- Attach the check or money order to the voucher, but do not staple or otherwise attach the payment directly to the voucher.

- Lastly, verify the mailing address for the IRS that corresponds to your location and the form's instructions. Addresses can differ based on your place of residence and the specifics of your tax situation. Mail your voucher and payment to the correct IRS address.

After mailing your 1040-ES Payment Voucher and payment, you've successfully completed a crucial step in managing your estimated taxes. Keep a copy of the voucher and your check or money order for your records. If throughout the year your income changes significantly, remember that you might need to adjust your estimated payments accordingly to avoid any penalties. For those with uneven income throughout the year, consider using the annualized income installment method described in Publication 505 to potentially lower or eliminate certain payments.

Understanding 1040 Es Payment Voucher

- Who needs to fill out the 1040-ES Form?

U.S. citizens and resident aliens, residents of Puerto Rico, the U.S. Virgin Islands, Guam, the Commonwealth of the Northern Mariana Islands, and American Samoa need to fill out the form. Nonresident aliens should use Form 1040-ES (NR). This applies to individuals who owe $1,000 or more in taxes for 2022, after subtracting withholdings and credits, and expect their withholdings and credits to be less than the smaller of 90% of the tax to be shown on their 2022 tax return, or 100% of the tax shown on their 2021 tax return.

- How can one pay their estimated tax?

- Online through IRS Direct Pay, for free from a checking or savings account.

- By debit or credit card through an IRS-approved processor (fees apply).

- Via electronic funds withdrawal when e-filing.

- Through the Electronic Federal Tax Payment System (EFTPS).

- By phone using one of the IRS-approved electronic payment options.

- By cash at a retail partner (maximum of $1,000 per day; registration required).

- By check or money order using the estimated tax payment voucher.

- What if you also receive wages?

If you receive salaries and wages, you can avoid making estimated tax payments by asking your employer to withhold more tax from your earnings. To do this, file a new Form W-4, Employee's Withholding Certificate, with your employer.

- Are there special rules for farmers and fishermen?

Yes, if at least two-thirds of your gross income is from farming or fishing, you can choose to either pay all of your estimated tax by January 17, 2023, or file your 2022 Form 1040 or 1040-SR by March 1, 2023, and pay the total tax due. In these cases, 2022 estimated tax payments aren’t required to avoid a penalty.

- What are the payment due dates for 1040-ES?

- 1st payment: April 18, 2022

- 2nd payment: June 15, 2022

- 3rd payment: September 15, 2022

- 4th payment: January 17, 2023

You are not required to make the payment due on January 17, 2023, if you file your 2022 tax return by January 31, 2023, and pay the entire balance due with your return.

- What happens if your income changes during the year?

If you have a large change in income, deductions, additional taxes, or credits, after March 31, you can adjust your estimated tax payments using the annualized income installment method. This method can lower or eliminate the amount of your required estimated tax payment for one or more periods.

- How can you amend estimated tax payments?

To amend your estimated tax payments, recalculate your total estimated tax due for the year. Then, redistribute your payments for the remaining periods according to the new calculation. If an earlier payment was underpaid, you might owe a penalty when you file your return.

- When is a penalty applied?

A penalty may be applied if you didn't pay enough tax throughout the year, either through withholding or by making estimated tax payments, or if the payments were late. A penalty may apply even if you're due a refund when you file your tax return.

- How do you pay if you've moved?

If your address has changed, you should update your record with the IRS by filing Form 8822. This ensures you will receive all IRS correspondence and avoids delays in processing your payments or returns.

- Can joint payments be made if one spouse is a nonresident alien?

No, you can't make joint estimated tax payments if one spouse is a nonresident alien, you are separated under a decree of divorce or separate maintenance, or if you and your spouse have different tax years.

Common mistakes

-

Not Updating Personal Information: One common mistake is when individuals forget to update their personal details, such as their address, on the 1040-ES form. Any changes in address should be reported using Form 8822. Failing to update this information can lead to missed IRS correspondence, potentially resulting in missed deadlines or additional penalties.

-

Incorrect Calculation of Estimated Tax: Many forget to accurately calculate their estimated tax. This can result from not including all sources of income like dividends, rents, or alimony. It's crucial that every source of income, not subject to withholding, is accounted for to avoid underpayment penalties.

-

Overlooking Special Rules: Special rules for farmers, fishermen, and high-income taxpayers are often overlooked. For instance, farmers and fishermen can substitute 66 2/3% for 90% in certain calculations, and high-income taxpayers may need to adjust their payments to 110% of the prior year's tax if their adjusted gross income exceeds a certain threshold.

-

Omitting Household Employment Taxes: Those employing household help and paying wages may need to include household employment taxes in their estimated tax calculations. Failure to do so, if required, can lead to an underestimation of taxes due.

-

Failure to Make Adjustments for Deferred Payments: If any payments for household employment or self-employment taxes were deferred from a previous year, individuals must ensure these amounts are properly addressed and not mistakenly included or omitted in the current year’s estimated tax payments.

-

Not Utilizing Increased Withholding: Instead of making estimated tax payments, some might benefit from simply requesting their employers to withhold more tax from their earnings. This mistake often results from not being aware of or misunderstanding how withholding adjustments can be used to cover the estimated tax on other income.

-

Incorrect Use of Payment Vouchers: A frequent error is the incorrect use of the 1040-ES vouchers, including mixing up the vouchers for different payment periods, not including necessary personal details like Social Security numbers, or failing to attach a check or money order when mailing them. Individuals need to ensure each voucher is filled out correctly and corresponds with the appropriate payment period.

In avoiding these mistakes, taxpayers can help ensure their estimated taxes are paid accurately and on time, potentially saving themselves from unnecessary stress, penalties, and interest charges.

Documents used along the form

When preparing your taxes, especially if you're making estimated tax payments using Form 1040-ES, it's common to encounter other forms and documents that may need to be filled out or referenced. Understanding these forms can simplify your tax preparation process.

- Form 8822: This form is used to notify the IRS of a change in address. It's important to keep your address current with the IRS to ensure you receive any refunds or correspondence promptly.

- Form W-4: The Employee's Withholding Certificate allows you to adjust your withholding with your employer. This may be necessary if you need to increase or decrease the federal tax withheld from your paycheck, potentially affecting whether you owe or receive a refund at tax time.

- Form W-4P: Similar to Form W-4, this Withholding Certificate is for Pension or Annuity Payments. It's used by recipients of these payments to determine the correct amount of federal taxes to be withheld.

- Form W-4V: The Voluntary Withholding Request form allows you to request federal tax withholding from unemployment compensation and certain federal benefits that aren't subject to mandatory withholding.

- Form W-4R: This withholding certificate is for Nonperiodic Payments and Eligible Rollover Distributions related to retirement plans, allowing recipients to specify the amount of tax to be withheld.

- Schedule H: Used for reporting Household Employment Taxes, Schedule H is essential if you employ someone to do household work and that employment impacts your federal taxes.

- Form W-7: This form is used to apply for an IRS Individual Taxpayer Identification Number (ITIN), necessary for taxpayers who don't have a Social Security number but are required to file a federal tax return.

- Form 8962: The Premium Tax Credit form is used to reconcile any health insurance marketplace premium tax credits you may have received, potentially affecting your overall tax calculation or refund.

Each of these documents plays a role in ensuring your taxes are correctly calculated and comprehensively reported. Whether it's adjusting your withholdings, reporting additional income, or claiming credits, familiarizing yourself with these forms can help make tax season smoother. Remember, the specific forms you'll need can vary depending on your individual tax situation.

Similar forms

Similar to the 1040-ES Payment Voucher, the Form W-4, Employee's Withholding Certificate, allows individuals to determine the amount of taxes that should be withheld from their paychecks. The Form W-4 is specifically designed for employees to communicate their tax situation to their employers so the correct federal income tax is withheld from earnings. This process helps in managing tax obligations proactively, akin to making estimated tax payments through 1040-ES for income not subject to withholding. Both forms serve the purpose of adjusting tax payments in alignment with the taxpayer's current financial situation, thereby minimizing either a significant tax bill or a substantial refund during the tax season.

The Form W-4P, Withholding Certificate for Pension or Annuity Payments, is another document that resonates with the purpose of the 1040-ES Voucher in managing tax withholding for specific types of income. This form is used by recipients of pensions, annuities, and other deferred compensation to request the withholding of tax from each payment, directly influencing the tax obligations similar to how an individual would estimate and adjust their payments when using the 1040-ES for non-wage income. Both aim to streamline tax payments across different income sources, ensuring taxpayers remain in compliance with their annual tax liabilities.

Form 8822, Change of Address, serves a logistical purpose that indirectly supports the process of paying estimated taxes through the 1040-ES Payment Voucher by ensuring that all correspondence related to tax payment or refunds reaches the taxpayer. Keeping the address information current with the IRS is crucial for receiving notices pertaining to estimated tax payments or any necessary adjustments. This process emphasizes the importance of accurate and timely information in managing tax affairs, parallel to the attentiveness required in estimating taxes due through the 1040-ES.

The Form 1040-ES (NR) for Nonresident Aliens mirrors the domestic version by providing a means for those not residing within the United States to calculate and pay estimated taxes on income effectively exempt from withholding. This adherence to estimated tax payments highlights the IRS's inclusive approach to tax collection from all individuals earning income within the U.S., ensuring fairness and compliance across a diverse taxpayer base.

The Form W-4V, Voluntary Withholding Request, allows taxpayers receiving government payments, such as unemployment compensation, to have federal income tax withheld from their payments. This preemptive approach to tax obligations runs parallel to the 1040-ES Voucher's concept of managing tax dues in advance, thereby mitigating substantial year-end tax liabilities. Both documents empower taxpayers to take control of their fiscal responsibilities, optimizing their tax situations.

Similar in intent to the 1040-ES, the Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts, comes into play when taxpayers haven't adequately covered their tax liability through withholding or estimated tax payments. While 1040-ES helps in making estimated payments to avoid underpayment, Form 2210 is used to calculate the penalty for failing to do so. These forms complement each other within the tax process, ensuring individuals can navigate through their tax responsibilities effectively while minimizing penalties.

Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, although distinct in its primary function of extending the filing deadline, shares an underlying connection with the 1040-ES Voucher. It provides taxpayers additional time to gather information necessary for accurate tax reporting and, if needed, to make estimated tax payments. This extension can be particularly beneficial for those needing more time to accurately compute their estimated taxes or adjust their payments, demonstrating the flexibility within the tax system to accommodate various taxpayer needs.

Lastly, Schedule H (Form 1040), Household Employment Taxes, relates to 1040-ES as it involves calculating and reporting taxes not typically withheld by employers, similar to self-employment or investment income. Householders employing nannies, housekeepers, or other domestic workers must compute and pay these employment taxes, paralleling the act of making estimated payments for other forms of income not subject to withholding. Both the 1040-ES Payment Voucher and Schedule H emphasize the taxpayer’s responsibility to assess and remit taxes due on less conventional income sources.

Dos and Don'ts

When dealing with the 1040-ES Payment Voucher form, there are specific actions you should take to ensure accuracy and compliance, as well as actions you should avoid to prevent common errors. Below are the dos and don'ts to consider:

Things You Should Do:

- Review the Special Rules section if you are a farmer, fisherman, or higher income taxpayer to understand how the rules may differ for you.

- Use your correct Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) to avoid processing issues.

- Update your address with Form 8822 if it has changed, to ensure you receive all communication from the IRS.

- Consider your filing status and income changes when estimating your tax to avoid underpayment or overpayment.

- Make estimated payments if you expect to owe at least $1,000 in tax for the year after subtracting your withholding and refundable credits.

- File and pay electronically through Direct Pay or EFTPS for convenience and security.

- Adjust your estimated tax payments if your income changes significantly during the year.

Things You Shouldn't Do:

- Don't ignore the payment due dates to avoid penalties for underpayment.

- Don't overlook the option to increase your withholding if you also receive salaries and wages, which could help avoid the need for estimated tax payments.

- Don't use the form to make payment if you deferred household employment and/or self-employment tax payments from the previous year.

- Don't make joint estimated tax payments if it's not applicable to your marital status or residency status as highlighted in the form’s instructions.

- Don't forget to include household employment taxes in your estimated tax if applicable.

- Don't send cash payments through the mail when submitting your payment voucher.

- Don't neglect the annualized income installment method if you receive income unevenly throughout the year, as this could lower your required estimated tax payment for certain periods.

Misconceptions

Understanding the 1040-ES Payment Voucher form is crucial for taxpayers, yet there are several misconceptions that can lead to confusion. This list aims to clarify some of the most common misunderstandings:

It's only for self-employed individuals: The 1040-ES is for anyone with income not subject to withholding, including self-employment, interest, dividends, alimony, and more, not just the self-employed.

If you expect a refund, you don't need to file: Even if anticipating a refund, you may need to file 1040-ES vouchers if you have significant non-withheld income to avoid penalties.

Only U.S. citizens need to file: U.S. citizens, resident aliens, and nonresident aliens may have to make estimated tax payments, making this form relevant to a wider audience than assumed.

You must pay the same amount each quarter: If your income varies, the amount may also change. The form allows for adjustments using the annualized income installment method.

Higher income taxpayers follow the same rules as everyone else: Higher income earners may be subject to different rules, such as having to cover 110% of their previous year's tax through withholding and estimated payments.

Estimated tax calculations are based solely on the current year's income: You must also take into account all available deductions, credits, and applicable taxes from the previous year.

Overpayment credits affect your estimated tax payment calculation: If you're applying an overpayment from last year’s taxes towards this year's, it impacts your estimated tax calculations but should not be added directly into the voucher amount.

Payment methods are limited: Estimated taxes can be paid online, by phone, via mobile device, or through traditional mail, offering flexibility in payment methods.

Estimated taxes don’t apply to household employers: Household employers may need to include estimated payments for their employment taxes if they do not meet certain criteria.

Penalties are rare: Failing to make estimated payments or underpaying can lead to penalties, contrary to beliefs that penalties are not commonly applied.

By clearing up these misconceptions, taxpayers can navigate their obligations with a clearer understanding, ensuring compliance and avoiding unnecessary penalties.

Key takeaways

Here are 7 key takeaways about filling out and using the 1040-ES Payment Voucher form:

- Who Needs to File: Individuals who earn income not subject to withholding, such as self-employment income, interest, dividends, rents, and alimony, are required to make estimated tax payments using Form 1040-ES.

- Figuring Your Estimated Tax: To accurately calculate your estimated tax, you'll need your 2021 tax return, the 2022 Estimated Tax Worksheet, the Instructions for the 2022 Estimated Tax Worksheet, and the 2022 Tax Rate Schedules.

- Payment Periods: Estimated tax payments are due in four equal amounts by the deadlines of April 18, June 15, September 15 of the current year, and January 17 of the following year.

- Special Rules: Different rules may apply if you are a farmer, fisherman, certain household employers, or fall into the category of higher income taxpayers. These special rules adjust the percentages used in calculating whether you should pay estimated tax.

- Changing Your Estimated Tax: If there are changes in your income, deductions, additional taxes, or credits, you may need to adjust your estimated tax payments. Use Pub. 505 and the amended estimate section for guidance.

- Penalties for Underpayment: If you do not pay enough tax through withholding or estimated tax payments, or if your payments are late, you may be charged a penalty. However, there are circumstances under which penalties may be waived.

- Payment Methods: You can pay your estimated taxes online, by phone, mobile device, or by mailing a check or money order with the 1040-ES payment voucher. Online payments via Direct Pay, the Electronic Federal Tax Payment System (EFTPS), or by credit/debit card are recommended for their convenience and security.

For the most current information and for any legislative changes affecting Form 1040-ES, consult the IRS website or the latest version of Pub. 505, Tax Withholding and Estimated Tax.

Popular PDF Documents

Deed Tax - Accurately calculating the amount of transfer tax due ensures compliance with Illinois state laws and regulations.

Ifta Oregon - Detailed documentation required for reporting vehicle miles on Oregon highways for tax purposes.