The Form 1040-ES, provided by the Department of the Treasury Internal Revenue Service, is an essential tool for individuals to calculate and pay their estimated taxes for the year 2022. Designed for income not subject to withholding, such as earnings...

The Form 1088, known as the Fannie Mae Comparative Income Analysis, plays a critical role for lenders by enabling them to assess a self-employed borrower's business performance across multiple years. Through detailed calculations of gross income, expenses, and taxable income,...

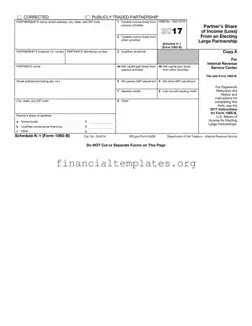

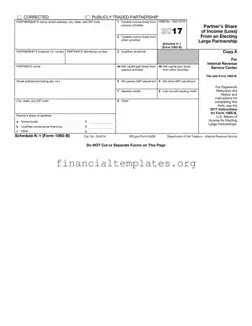

The 2016 IRS K-1 Form is a tax document used by partnerships to provide partners with information on their share of the partnership's income, deductions, credits, etc. This crucial form details a partner's share of taxable income from both passive...

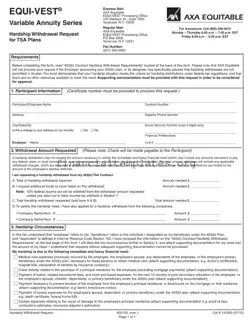

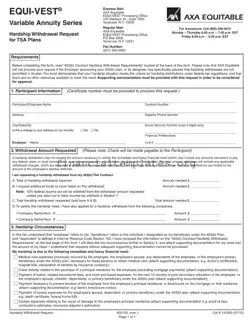

The 403B Loan Axa Hardship form is a crucial document for individuals participating in TSA Plans through AXA Equitable seeking a hardship withdrawal from their 403(b) accounts. It outlines the necessary steps and documentation required to demonstrate a financial hardship...

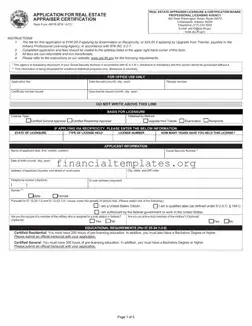

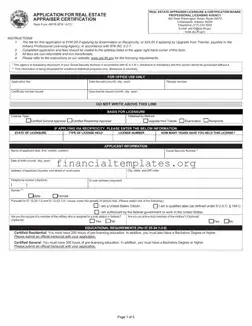

The 45016 Tax Form, officially titled the Application for Real Estate Appraiser Certification, plays a crucial role in the certification process for aspiring real estate appraisers. Approved by the State Board of Accounts in 2008, this form necessitates comprehensive information...

The Form No. 5196 serves as an essential document for individuals seeking a loan against their life insurance policies with the Life Insurance Corporation of India, specifically for policies issued before June 1, 1969. It outlines the process for applying...

The Form 601 serves as an application for those looking to become sales tax practitioners in Gujarat, under the Gujarat Value Added Tax Act, 2003. It is specifically addressed to the Commissioner of Commercial Tax in Gujarat State, Ahmedabad. This...

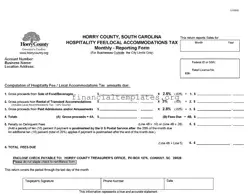

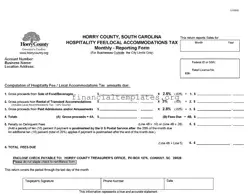

The Accommodations Tax form, as outlined for Horry County, South Carolina, serves as a monthly reporting mechanism for businesses outside city limits dealing with hospitality services. It systematically captures revenues generated from the sale of food, beverages, rental of transient...

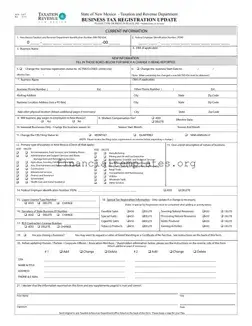

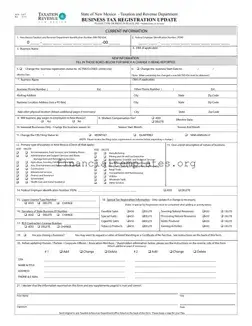

The ACD-31075 Tax Registration Update form serves as a crucial document for businesses in New Mexico looking to update their tax registration details with the State's Taxation and Revenue Department. This form allows for changes in business registration status, ownership...

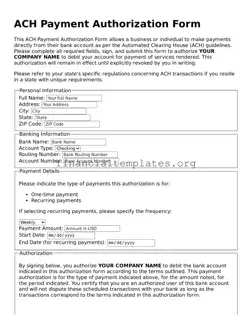

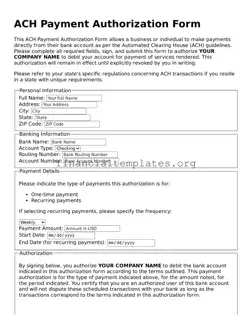

An ACH Payment Authorization Form is a crucial document that gives a company the green light to electronically withdraw funds from an individual’s bank account for payment purposes. This form serves as a formal agreement between the individual and the...

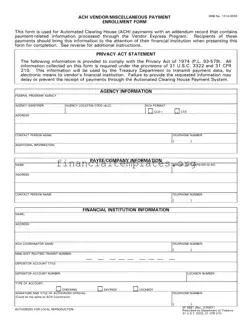

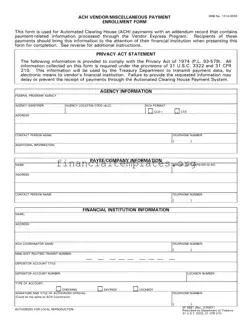

The ACH Vendor/Miscellaneous Payment Enrollment Form serves as a crucial document for entities seeking to receive payments through the Automated Clearing House (ACH) system, complete with an addendum record for payment-related details as part of the Vendor Express Program. It...

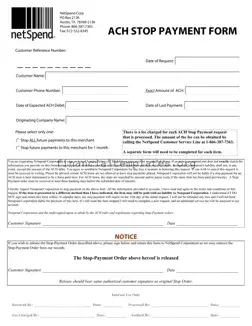

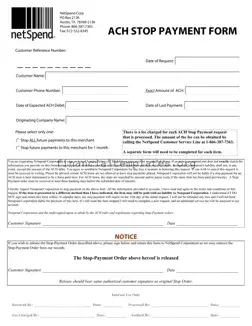

The ACH Stop Payment form is a document used by individuals to request the NetSpend Corporation to halt an Automated Clearing House (ACH) debit transaction specified on their account. It outlines the conditions under which a customer can declare a...